Proactive Investors - Cathie Wood’s ARK Invest’s monthly bitcoin update for July highlighted a preeminent theme in the state of the world’s largest cryptocurrency in 2023.

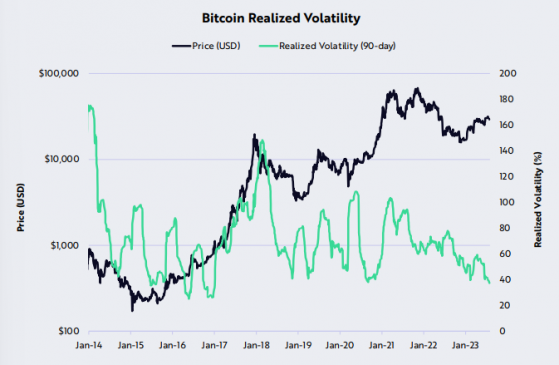

Per the report’s data, bitcoin volatility on a 90-day basis has reduced to levels not seen since 2017.

According to both ARK and empirical evidence, this prolonged bout of non-volatility is setting the stage for a major price movement on the horizon, but it could be either up or down.

“Based on its low level of volatility, we believe the bitcoin price could be setting up to move dramatically in one direction or the other during the next few months,” said ARK.

Let’s not forget that bitcoin’s unprecedented bull run to all-time highs in late-2021 followed a major volatility trough, though that hasn’t always been the reaction to low volatility in the spot markets.

Credit: ARK Invest

ARK’s analysis also suggested a trend towards long-term bitcoin holding among investors. This is contributing to low volatility, while also reducing bearish selling pressure.

However, ARK also noted that the full impact of US Federal Reserve fiscal tightening has yet to take effect, a not insignificant tick for the bear case.

In the meantime, bitcoin’s six-year-low volatility was on display once again on Thursday, with the BTC/USDT pair closing essentially unchanged at US$29,193.

The pair inched slightly lower to US$29,180 in this morning’s Asia trading window, indicating a lack of short-term appetite on the spot markets.

Bitcoin’s six-year-low volatility – Source: currency.com

Bulls are going to struggle to get BTC/USDT over the US$30,000 price point, given the very large sell wall camped out at this resistance point, as evidenced in Binance’s order book.

Support should kick in at around US$28,500.

Moving on to Ethereum (ETH), the world’s second-largest cryptocurrency closed 0.2% lower at US$1,835 yesterday, where it has remained this morning.

In the altcoin space, almost all of the top-20 set are in the red week on week, barring the Shiba Inu (SHIB) meme coin, which is around 8% higher.

Ripple (XRP), Solana (SOL), Polygon (MATIC) and Litecoin (LTC) have all lost more than 5% of their respective market capitalisations.

Bitcoin dominance, which legged recently, is showing signs of improving, having remained above 50% since Wednesday.

Global cryptocurrency market capitalisation currently stands at US$1.16 trillion, having added around 0.1% overnight.

Read more on Proactive Investors UK