Benzinga - Good Morning Everyone!

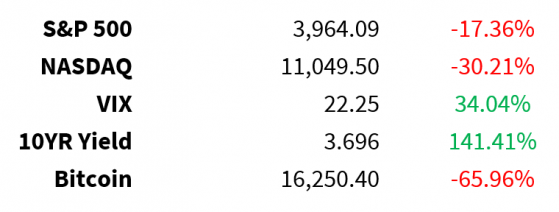

Prices as of 4 pm ET, 11/28/22; % YTD

MARKET UPDATE China said it would bolster vaccination among senior citizens (over age 80)

- China ETF bounced back overnight

Just 23 trading days left in 2022

- Volumes continue to be very low

- Activity continues to be very low

- Small changes in this kind of market creates greater than expected volatility

Yesterday Fed Speak: both New York Fed Williams & St. Louis Fed Bullard hint at 50-point hike on Dec. 14

Today Housing data at 9 a.m., Consumer confidence at 10 a.m.

Tomorrow Jay Powell speaks

Friday November jobs data

Dec. 14 FOMC meeting

Fed Williams expects inflation rate to fall to

- 5% to 5.5% by the end of the year

- 3% to 3.5% by end of 2023

- 2% Fed’s target rate

Crude 78.50 +2%

- Up today on China reversal

- China cases in China fell slightly today to 38,000 from 40,000

Europe still has not agreed to a price cap

- Poland and the Baltic nations are objecting to $65-70 level because this would allow Russia to continue to sell oil to Europe at market prices to fund the war

Apple (NASDAQ: NASDAQ:AAPL)

- Delivery times on the iPhone 14 Pro stretch to a record 37 days due to supply chain disruptions

- Announced most downloaded apps of 2022

- It appears Meta’s (NASDAQ: META) core products are still very much in the game

Disney (NYSE: DIS)

- Shanghai Disneyland to be closed

- It’s the second time this month

- L.A. times reporting CEO Bob Iger not looking to sell company to Apple

- Iger held a townhall yesterday: will focus on profitability not subscribers

- Does that mean he will take down Fiscal 2024 Disney+ subscriber guidance?

U.S. Rails

- Biden called on Congress to pass legislation that would avert a rail shutdown

- 4 railroad unions (115,000 workers) have rejected a proposed contract

Earnings Today None

Earnings tonight

- CrowdStrike (NASDAQ: CRWD) 8% implied move

- Workday (NASDAQ: WDAY) 7% implied move

- Intuit (NASDAQ: NASDAQ:INTU)

CRYPTO UPDATE BlockFi files for Chapter 11 bankruptcy

- Nov 10 - halted withdrawals in wake of FTX fallout

- ~$257 million cash on hand

- +100,000 creditors

- Executive estimate assets and liabilities in range of $1 to $10 billion (LOL)

-

Previously on brink of bankruptcy after Three Arrows Capital (3AC) implosion

- FTX “saved” the day then

- But not really…

Digital asset flows

- Investment products saw $23 million in outflows last week

- Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) outflows totaled $10 and $6 million, respectively

- Altcoins outflows continue

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga