Benzinga - To gain an edge, this is what you need to know today.

Raise Cash And Hedges Cash and hedges are being raised. Scroll down to the “Protection Band And What To Do Now” section below.

Be forewarned that this decision may need to be quickly reversed depending upon the upcoming inflation data and earnings. If the inflation data comes out better than expected and earnings start coming out better than expected, the market mechanic of year end chase will take over. This market mechanic has the potential to run up the stock market by as much as 10% - 15%. You gain an edge when you understand market mechanics. For those interested in next-level information, listen to the podcast titled “Market Mechanics: Gain An Edge From Year End Chase.” The podcast is available in Arora Ambassador Club.

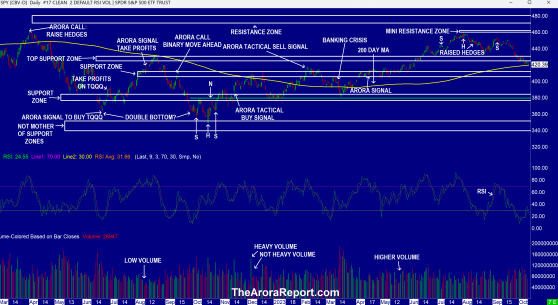

Jobs Report Please click here for a chart of S&P 500 ETF (ARCA:SPY) which represents the benchmark stock market index S&P 500.

Note the following:

- The chart shows that the stock market has fallen below the low band of the top support zone.

- The chart shows that the stock market is now approaching the 200 day moving average. There is nothing special about the 200 day moving average. Why not 180 days or 220 days? However, a legion of people believe in the power of the 200 day moving average, and this average has power because of the blind belief. Expect bulls to make the case that the 200 day moving average is going to act as support and the stock market is going to bounce from here. Expect bears to make the case the stock market is going to break the 200 day moving average and go lower.

- The chart shows the support zone. The stock market can go to the support zone only if the Fed speak is negative and there are rumors about CPI and PPI next week.

- PPI will be released on October 11.

- CPI will be released on October 12.

- The jobs report is extremely strong with the exception of average hourly earnings. Here are the details:

- Non-farm payrolls came at 336K vs. 158K consensus.

- Non-farm private payrolls came at 263K vs. 150K consensus.

- Unemployment rate came at 3.8% vs. 3.7% consensus.

- Average work week came at 34.4 vs. 34.4 consensus.

- Average hourly earnings came at 0.2% vs. 0.3% consensus.

- Investors should note that an increase of 0.2% in average hourly earnings translates to an 2.4% average annual raise. This is at a time when unions are demanding very large raises. The data shows that workers outside of unions are getting raises on the order of about 2%.

- Yesterday, some momo gurus were predicting a 1000 point DJIA rally. In yesterday’s Afternoon Capsule, we wrote:

Start with Arora’s second law: Nobody knows with certainty what is going to happen next in the markets. Momo gurus do not have any special knowledge or information. They are simply doing their job of getting their followers excited to buy stocks.

- What are momo gurus going to do now that they were so wrong? Momo gurus are often wrong, so this is nothing new. They still insist on claiming to know that they know what is going to happen next. Even though their gurus are wrong most of the time, the momo crowd continues to follow them. None of this is going to change. Expect momo gurus to come up with a new narrative around an annualized wage increase of 2.4% to try to run up the stock market.

- Exxon Mobil Corp (NYSE: XOM) is rumored to be in advanced talks to buy Pioneer Natural Resources Co (NYSE: PXD) for $60B. Such a large buyout has the potential to generate excitement in the stock market and run several oil stocks up.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

Magnificent Seven Money Flows In the early trade, money flows are negative in Apple Inc (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), Microsoft Corp (NASDAQ: MSFT), and NVIDIA Corp (NASDAQ: NVDA). Money flows are very negative in Tesla Inc (NASDAQ: TSLA). Tesla is cutting prices again.

In the early trade, money flows are negative in SPDR S&P 500 ETF Trust and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is