Proactive Investors - Bitcoin failed to spark interest over the weekend trading session, with the BTC/USDT pair falling around a quarter of a percent over both days combined.

At the time of writing, the world’s largest cryptocurrency was swapping for $25,800, having dipped another 0.15% in this morning’s Asia trading window.

BTC/USDT is currently down 0.7% week on week and 12.2% down month on month.

Bitcoin prices are likely to remain under pressure in lieu of any notable external catalyst, combined with a general lack of risk appetite among traders- a running theme in 2022.

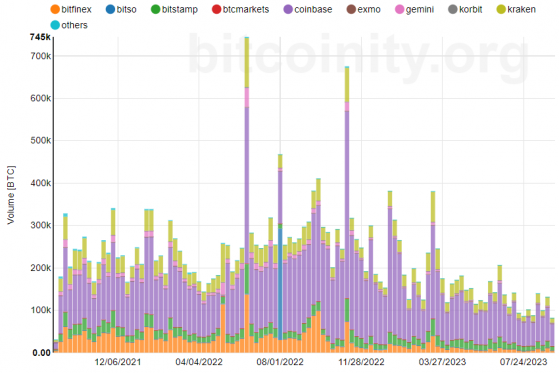

Trading volumes have been on a clear downward trajectory this year, an understandable result of the barrage of controversies that mired crypto in 2022.

Barring a brief spike in March in the midst of the US banking mini-crisis, the amount of bitcoins flowing through the major exchanges has been far below the average seen over the past two years.

Bitcoin volumes are on a steady journey lower

Ethereum (ETH), the world’s second-largest cryptocurrency, fared poorly over the weekend trading session, flat on Saturday before dipping more than 1.1% by the end of Sunday.

The ETH/USDT pair is currently swapping for $1,612 after falling another 0.3% this morning.

Ether has underperformed against bitcoin on a weekly basis, with 1.4% knocked from its spot price. As such, bitcoin dominance has seen a resurgence, recovering from lows of 49.1% to 49.6% today.

In the altcoin space, Toncon (TON)’s rally has come to an end. Initially developed by the team behind encrypted messaging platform Telegram, TON was among the top altcoin performers in August, but has since plummeted 10% in the past seven days.

Solana (SOL) has also underperformed the market, dipping 7.9% week on week, while Ripple (XRP), BNB, Dogecoin (DOGE) and Cardano (ADA) have managed to keep their losses in the low single digits.

Global cryptocurrency market capitalisation currently stands at $1.03 trillion, down from $1.045 trillion this time last week.

Read more on Proactive Investors UK