Proactive Investors - Bitcoin took a beating against the US dollar on Thursday after this week’s hawkish pause from the US Federal Reserve lent more strength to the greenback.

In total, the BTC/USDT pair fell more than 2%, pushing the world’s largest cryptocurrency below $26,600 by the end of the session.

Though the Fed decided not to hike interest rates yet again, Fed chair Jerome Powell certainly did not take future hikes off the table completely, lending further caution to the risk-on asset classes.

The same can be said of the Bank of England, which implemented its own rate pause on Thursday in favour of a “wait-and-see approach”.

Equities consequently saw a sell-off, with the Nasdaq 100 blue-chip index falling more than 3% since Monday.

Despite bitcoin taking a hit yesterday, it remains in the green when looking across the weekly session as a whole, adding 0.2% to $26,598 at the time of writing.

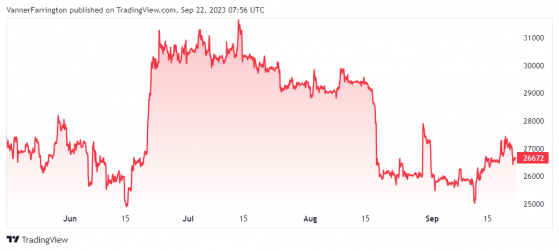

Bitcoin remains 2.9% lower over six months – Source: tradingview.com

Regardless, it is clear that hawkish-to-neutral central bank policy will keep the dollar inflated in the short term, adding to the melange of headwinds impacting the crypto markets.

Ethereum (ETH) lost nearly 2.5% on Thursday, bringing the ETH/USDT pair down to $1,583 by the session’s close.

ETH/USDT has managed to bump 0.4% higher to $1,590 this morning.

In the broader altcoin space, Toncoin (TON) remains over 20% higher on a week-on-week basis, though the Telegram-linked Layer-1 blockchain was kicked back down to 20th spot in place of Solana (SOL).

Most other blue-chip altcoins are in the red week on week, with Sodecoin (DPGE) down 0.3%, BNB down 0.4%, Cardano (ADA) down 2.25% and Tron (TRX) down 0.6%

Following a hefty 1.4% overnight fall, global cryptocurrency market capitalisation currently stands at $1.05 million, with bitcoin dominance at 50.17%.

Read more on Proactive Investors UK