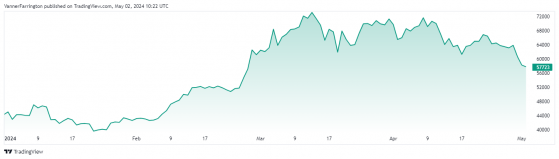

Proactive Investors - Bitcoin (BTC) prices continue to fall in the post-Halving environment, with the world’s largest cryptocurrency plummeting 3.8% against the US dollar on Wednesday following Tuesday’s 5% fall.

The bears remained in control in today’s Asia trading window, with BTC/USD falling another percentage point.

At the time of writing, the pair was swapping for $57,723, nearly 10% lower week on week.

Though not a surprise by any stretch, the Federal Reserve’s decision to keep interest rates unchanged at 5.5% due to lack of further progress in bringing down inflation has kept the dollar in a strong position.

“The committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” Fed officials said in a statement following the conclusion of its two-day meeting.

This is likely to heap further downward pressure on bitcoin in the near term.

Ethereum (ETH), the second-largest cryptocurrency, fell 1.4% on Wednesday and remained bearish this morning. The ETH/USD pair was swapping for $2,948 at the time of writing, or around 4.6% lower week on week.

In the wider altcoin space, BNB, Solana (SOL), Cardano (ADA) and Toncoin (TON) have dipped in the mid to upper single digits, while Dpogecoin (DOGE)’s losses have extended to nearly 13%.

Global cryptocurrency market capitalisation currently stands at $2.17 trillion, with bitcoin dominance at 52.5%.