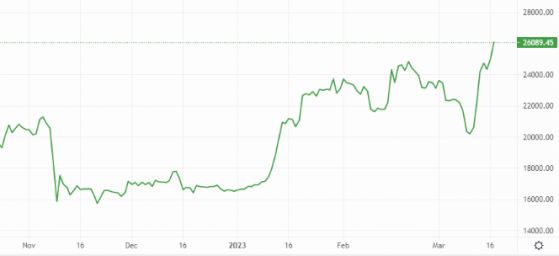

Proactive Investors - Bitcoin (BTC) is still on pump mode adding another 4% this morning to hit US$26,000 for the second time in four days.

The benchmark cryptocurrency has been a true benefactor of the market chaos following Silicon Valley Bank’s collapse- over the seven-day period, BTC/USDT has shot up over 30%

Given its exceptional resilience at the moment, the narrative of bitcoin as a safe haven asset has returned, though its volatility cannot be ignored, nor can the selling pressure inevitably on the way as long-bitcoin traders cash out their profits.

Binance’s order book definitely shows a selling bias on the BTC/USDT pair, particularly at the US$26,300 price point.

Regardless, today’s options expiry is certainly poised to favour the bulls.

Bitcoin (BTC) hits its stride – Source: currency.com

Ethereum (ETH) is trading just above US$1,700, which is significant given how often ETH/USDT gets rejected at the US$1,700 price point.

If the ether bulls stay in charge, it could break through the next resistance point at US$1,730 throughout today’s trading session.

ETH’s price is being helped by the fact that its supply has substantially reduced due to deflationary tokenomics introduced after switching to a proof-of-stake model in September 2022.

All in all, a strong showing from the benchmark cryptoassets, despite the ongoing meltdown in the financial sector and persistent regulatory scrutiny.

Across the week, BTC/USDT is now over 30% higher, while ETH/USDT is up over 20%.

Crypto-adjacent stock are also performing well, particularly Coinbase (NASDAQ:COIN), which after adding 20% in the past five days, is now worth double what it was at the start of the year.

London-listed Argo Blockchain has also doubled in value in 2023, while Nasdaq-listed Marathon Digital Holdings is up a stellar 124%.

In the altcoin space

Performance in the altcoin space has been a bit more of a mixed bag.

Among the top-20 set, the likes of Polygon (MATIC), BNB and Polkadot (DOT) have certainly joined in on the rally, having all added close to 20%.

But the same cannot be said for Ripple (XRP), which has essentially stayed flat across the past seven days, while Cardano (ADA), Shiba Inu (SHIB) have contained gains to the mid-single digits.

Decentralised finance (DeFi) tokens have also been a mixed bag. Derivatives exchange Synthetix (SNX) dipped 5% overnight, though remains 26% higher week on week, while Maker (MKR) is down 7% week on week.

Liquid staking protocol Lido (LDO) sits somewhere in between, having added 10% in the past seven days.

Global cryptocurrency market capitalisation currently stands at US$1.12tn after adding $% overnight, while total value locked in the DeFi space sits at US$47.4bn afte adding 1.5% overnight.

Read more on Proactive Investors UK