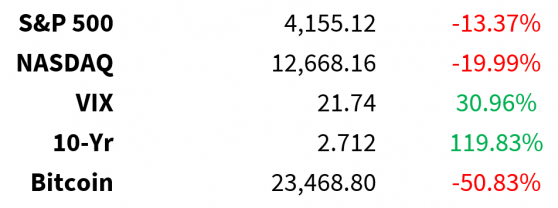

MARKET UPDATE After a 3-week S&P 500 rally, U.S. markets catching Canadian market

-

Year-to-date in Canadian dollars

- S&P 500 -11%

- TSX -8%

- Nasdaq -17%

Large-Cap Technology stocks up 19% off the June lows

10yr 2.7

- Bank of England raises rates by 0.5%, most since 1995

- U.S. job numbers/ initial unemployment claims up 6,000 to 260,000

Crude $91 flat

- Oil prices back to pre-Ukraine/Russia war

Corn prices back to pre-Ukraine/Russia war

Meta (NASDAQ: META) +5% yesterday on Share Buyback rumours

- A no-debt company making its bond market debut

- Investment Grade debt seeking up to $10 billion @ 1.75%-1.8%

- Follows Apple (NASDAQ:AAPL) debt offerings

- Proceeds to be used for general corporate purposes including Capex, share buybacks and M&A

- Will hold investor meetings

- With net cash balance sheet (no debt) and Fiscal 2022 EBITDA of $50 billion, a substantial share buyback possible

Netflix (NASDAQ: NASDAQ:NFLX)

- Wall Street Journal: Reed Hastings, founder and CEO

- Thinks Cost-per-thousand-impressions (CPM) could hit $80

- $80 would allow Netflix to charge nothing for their Ad-supported service at 2 minute/hour Ad-load

- They probably will not do that, but the Ad-supported service will be cheap, offset by Ad revenue

- Netflix shifting from grow-at-all-costs to focus on cash flows

Earnings

eBay (NASDAQ: NASDAQ:EBAY) Q2 beat top and bottom lines

Wayfair (NYSE: W) free cash flow burn $244 million

Paramount (NASDAQ: PARA) Paramount+ streaming subs missed small due to Russia

Costco (NASDAQ: NASDAQ:COST) Solid comp but decelerated, 2 year stack 20.4% to 17.8%

ConocoPhillips (NYSE: NYSE:COP) repurchased $2.3B stock, paid $1B in dividends, ended Q2 with $8.5B cash

Booking (NASDAQ: NASDAQ:BKNG)

MetLife (NYSE: NYSE:MET)

Fortinet (NASDAQ: FTNT)

McKesson (NYSE: MCK)

Eli Lilly (NYSE: NYSE:LLY)

Alibaba (NYSE: NYSE:BABA)

Toyota (NYSE: TM)

Cigna (NYSE: NYSE:CI)

Duke $DUKE

Zoetis (NYSE: ZTS)

Becton, Dickinson (NYSE: BDX)

CRYPTO UPDATE 1-month performance

- Bitcoin (CRYPTO: BTC)

- Ethereum (CRYPTO: ETH)

- Solana (CRYPTO: SOL)

- Cardano (CRYPTO: ADA)

- BNB (CRYPTO: BNB)

- Ripple (CRYPTO: XRP)

Coinbase (NASDAQ:COIN) is partnering with the world’s largest money manager (NASDAQ: COIN)

- BlackRock (NYSE: NYSE:BLK) teaming up with the crypto exchange to make it “easier for institutional investors to manage and trade Bitcoin”

- Wall Street extends push into crypto…

Starbucks (NASDAQ:SBUX) has entered the chat (NASDAQ: SBUX)

- CEO Howard Schultz teased Web3 updates for its popular rewards program

- “Digital third place community”

- Will be unveiled on Investor Day (September 13)

Bitcoin options volume put/call ratio

- On-chain data indicates more calls are being purchased than puts

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga