CAMBRIDGE, MA - Moderna Inc (NASDAQ:MRNA) has received authorization from Health Canada for its updated COVID-19 vaccine, SPIKEVAX®, targeting the KP.2 sub-lineage of SARS-CoV-2. This vaccine is designed to prevent COVID-19 in individuals six months and older, marking it as the first updated vaccine approved in Canada for the 2024-2025 season. The company is set to begin deliveries to the Public Health Agency of Canada to support the upcoming provincial and territorial vaccination campaigns.

Moderna's CEO, Stéphane Bancel, stated that this authorization allows Canadians to have timely access to the latest vaccine, aiding in protection during the fall and winter. The updated vaccine is expected to provide a more robust immune response against the circulating strains of COVID-19, especially for those at higher risk of infection or severe illness.

Health Canada based its approval on a range of data, including manufacturing, pre-clinical, and previous clinical and real-world evidence demonstrating the efficacy and safety of Moderna's mRNA COVID-19 vaccines. Dr. Shehzad Iqbal, Moderna Canada's Country Medical Director, emphasized the importance of staying current with COVID-19 vaccinations and encouraged Canadians to discuss the updated vaccine with their healthcare providers.

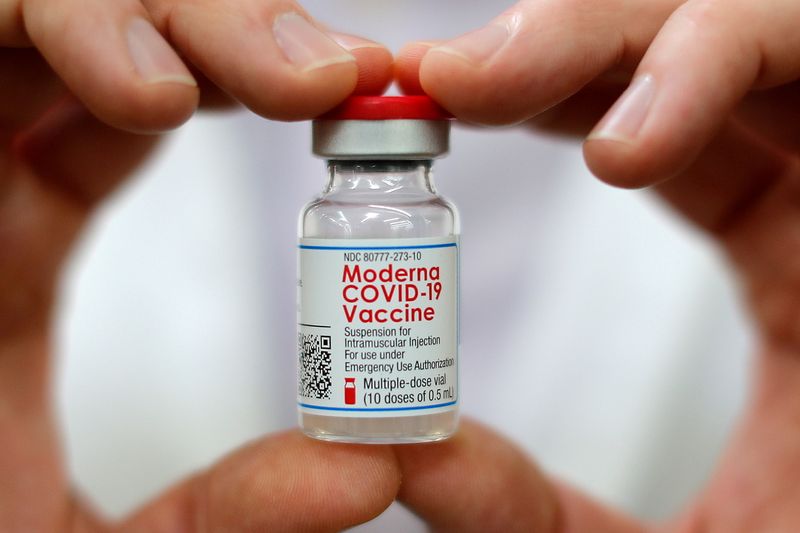

The vaccine will be available in a monovalent KP.2 composition and will come in a multidose vial suitable for both adult and pediatric doses. The National Advisory Committee on Immunization recommends the updated dose for anyone not vaccinated or without a known COVID-19 infection in the past three months, focusing on protecting vulnerable individuals.

Moderna is known for its role in advancing mRNA technology and has developed a range of therapeutics and vaccines for various diseases, including one of the earliest COVID-19 vaccines. The company's forward-looking statements indicate a commitment to supplying the updated COVID-19 vaccine to the Public Health Agency of Canada.

This news is based on a press release statement and is intended to provide factual information regarding Moderna's latest vaccine authorization in Canada.

In other recent news, Moderna has seen adjustments in its stock targets by several analyst firms. Piper Sandler cut the target to $115 from $157, maintaining an Overweight rating. This follows Moderna's R&D Day where it set a goal for 10 mRNA product approvals by 2027 and outlined plans for several vaccines. The company also estimates product sales between $3 billion and $3.5 billion for the current year and $2.5 billion to $3.5 billion in 2025.

Oppenheimer downgraded Moderna stocks to a neutral "Perform" status amid a shift in R&D strategy. This strategic shift aims to diversify late-stage leads and reduce R&D spending by $1.1 billion by 2027. The firm's outlook is cautious about Moderna's ability to bring its non-respiratory assets to market.

RBC Capital reduced its price target for Moderna from $90 to $75 while maintaining a Sector Perform rating. This follows announcements indicating a delay in the company's path to profitability and changes in R&D spending. The firm sees potential in Moderna's pipeline, including a possible interim look at Phase III trials for its cytomegalovirus (CMV) vaccine this year.

Brookline Capital Markets also adjusted its outlook, reducing the price target to $238.00 from $310.00, but maintaining a Buy rating. This revision follows changes in the prioritization and timing of projects, leading to reduced revenue estimates for the years 2025 through 2030.

Lastly, TD Cowen revised its price target for Moderna, reducing it to $60 from $70, while retaining a Hold rating. The firm acknowledged the company's efforts to decrease its research and development expenses and set a more realistic goal for reaching a breakeven point by 2028.

InvestingPro Insights

As Moderna Inc (NASDAQ:MRNA) garners attention with Health Canada's authorization of its updated COVID-19 vaccine, SPIKEVAX®, investors are closely monitoring the company's financial health and stock performance. According to InvestingPro data, Moderna's market capitalization stands at $27.85 billion, reflecting the company's substantial size in the biotechnology industry. Despite the positive news, the stock has experienced significant volatility recently, with a price total return of -13.87% over the last week and -21.37% over the past month.

InvestingPro Tips suggest that Moderna holds more cash than debt on its balance sheet, which could provide financial flexibility in its operations and vaccine distribution efforts. Additionally, the Relative Strength Index (RSI) indicates that the stock is currently in oversold territory, which could potentially signal a buying opportunity for investors considering the company's recent developments and future prospects.

For those interested in a deeper dive into Moderna's financials and stock performance, InvestingPro offers additional insights. There are currently 15 InvestingPro Tips available that provide a comprehensive analysis of the company's financial metrics and market trends. These tips can be accessed at https://www.investing.com/pro/MRNA and may offer valuable information for investors looking to make informed decisions about their investments in Moderna.

It's important to note that while the authorization of Moderna's updated vaccine is a positive development, the company's stock price and financial metrics should be considered within the broader context of its industry and the current economic environment.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.