(Bloomberg) -- Plunging Venezuelan crude production; sanctions disrupting Iranian oil exports; Saudi Arabia pushing for even higher prices; North Korea peace talks -- the coming weeks bring an abundance of risks for the oil market.

The geopolitical premium has already helped lift crude prices to a three-year high. There are several dates coming up which could have a significant impact on global oil supply and demand, or at the very least elevate the risk of a market-moving presidential tweet.

Iran Sanctions

Within five days, U.S. President Donald Trump must choose whether to pull out of the Iran nuclear deal and reimpose restrictions on oil shipments from the Organization of Petroleum Exporting Countries’ third-largest producer. It’s a decision that could remove a big chunk of supply from the market -- about 1 million barrels a day under the previous sanctions regime -- and risk further escalating regional tensions.

In early April, analysts said it was a toss-up whether Trump kills or preserves the deal. Since then, the odds have tilted toward a U.S. pullout. The friendly embrace of French President Emmanuel Macron failed to convince Trump to accept an improved version of the existing deal. Last week, Israel’s Prime Minister Benjamin Netanyahu did his best to convince the U.S. president that the pact was a mistake and Iran couldn’t be trusted.

“In our view President Trump’s decision on the waiver looks likely to be both the largest upside and downside risk to oil prices over the next 11 days," analysts at Standard Chartered (LON:STAN) wrote in a report on May 2.

Venezuelan Election

A collapsing economy has already taken a huge toll on this South American OPEC member’s oil production. Things could get even worse if the U.S. finds cause to question the legitimacy of the presidential election on May 20 and imposes oil sanctions.

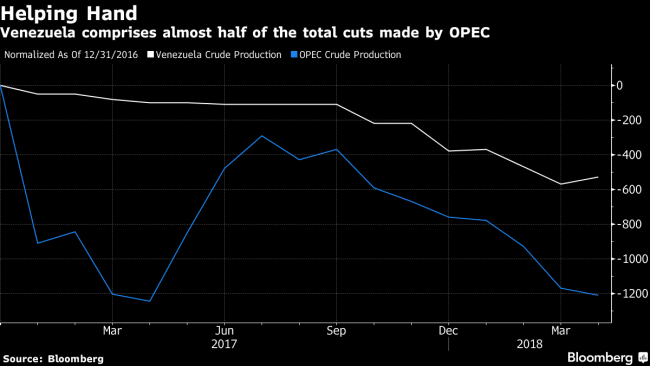

Venezuela’s industry is in a terrible state. Since 2015, daily production has plunged by about a million barrels to 1.55 million, according to data compiled by Bloomberg. It’s output has fallen five times more than required by the OPEC-Russia supply deal, helping the cartel achieve a record level of cuts.

As access to credit dries up and international companies limit their activities or pull out employees, this figure could drop to a 70-year low of about 1.38 million by year-end, according to the International Energy Agency. Former oil minister Rafael Ramirez says the state-owned oil company is on the brink of collapse.

"If you ask me what the biggest geopolitical disruption risk to oil supply between now and December, I would say Venezuela," said Bob McNally, president of the Rapidan Energy Group. Rapidan expects the country’s output to slump to 1.1 million barrels a day by year-end. "In terms of geopolitical risk, Iran is just as important. But are we going to lose 400,000 barrels a day of Iranian production by the end of the year? I don’t think so.”

North Korea Summit

The sudden detente between Trump and North Korean leader Kim Jong-Un doesn’t directly affect the oil market, but the stakes are high for a region that’s still the largest source of demand growth.

There’s little risk priced in currently and the summit between the two leaders planned for early June would only move the market if it’s a spectacular failure, said McNally. If Trump were to walk out saying Kim was being unreasonable and “we are going to have do this the hard way” then it would be bearish for crude, he said. Northeast Asia generates 20 percent of global GDP and a significant amount of oil demand growth.

Such an outcome isn’t likely, said Ole Sloth Hansen, head of commodity strategy at Saxo Bank A/S. "I would imagine that the meeting will be a kiss and hug meeting as the details will have been worked out before," he said. The potential for an escalation in the Syrian conflict involving Israel is more worrying, Hansen said.

A Saudi Squeeze

OPEC and Russia’s production cuts have all but achieved their primary aim of eliminating surplus oil stockpiles. Yet the group’s most important member, Saudi Arabia, says the job isn’t done and is championing a push to further tighten the market and boost prices.

The weeks leading up to the June 22 OPEC meeting could bring more bullish rhetoric from Saudi Minister of Energy and Industry Khalid Al-Falih. The kingdom needs to earn $88 a barrel to balance its national budget this year, according to the International Monetary Fund, an increase of 26 percent since October. Higher prices would also ease the way for Crown Prince Mohammad bin Salman’s ambitious plans to modernize and diversify the kingdom’s economy.

"They increasingly seem determined on raising the price,” said Hansen. This strategy could disrupt the market in two ways -- further accelerating the boom in production from outside OPEC or curbing global demand growth. For the Saudis, neither factor is “high on their focus list at this stage," he said.