By Geoffrey Smith

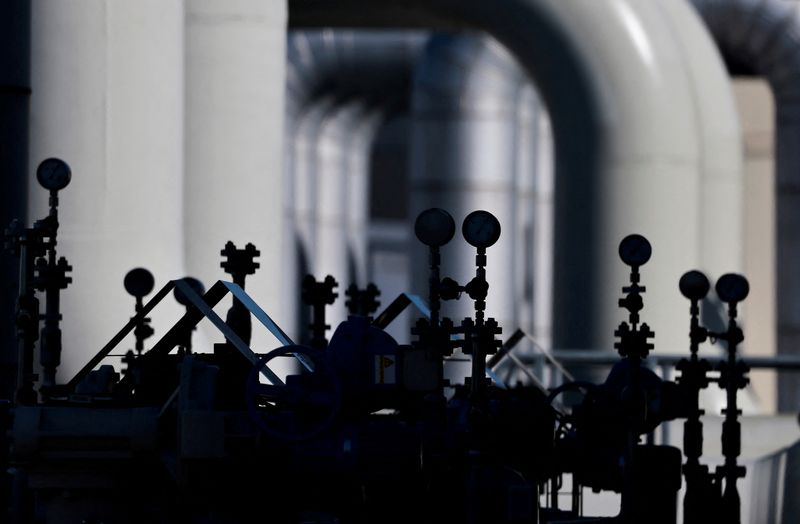

Investing.com -- U.S. natural gas futures fell to a new 10-month low on Wednesday as the combination of warm weather in Europe and ample domestic supplies further eased the pressure on prices.

Henry Hub futures fell below $4 per million British thermal units for the first time since last February, against a backdrop of unseasonably warm weather across much of Europe. That is allowing suppliers to inject gas into storage again, further reducing the risk of a supply shortage and rationing later this winter.

According to data from German network operator Bundesnetzagentur, reserves in Germany's gas storage facilities rose above 90% at the start of the year as the weather reduced heating demand. Germany is continental Europe's biggest gas market. BNA continues to warn, however, that underlying demand - adjusted for temperature fluctuations - continues to run above the level it sees as sustainable.

U.S. inventories, meanwhile, are bang in line with historical averages over the last five years, according to the Energy Information Administration's latest data, leaving export demand for liquefied natural gas as the key swing factor.

Regular LNG imports are now flowing to Germany from the U.S. and elsewhere. On Tuesday, a newly commissioned LNG regasification terminal accepted its first cargo from the U.S., and there are indications that spot market conditions can ease further in the coming weeks: the massive Freeport LNG export terminal on the Gulf of Mexico said just before the Christmas holidays that it expects to resume full operations in the second half of January after a fire in the summer that restricted flows to world markets just as European buyers were scrambling to find alternatives to Russian pipeline gas.

By 09:35 ET (14:35 GMT), U.S. natgas futures had bounced a little from their intraday low to trade at $4.038/mmBtu, still down 9.6% on the day. Benchmark futures for northwest Europe were down 1.2% at €76.25 a megawatt-hour, while U.K. benchmark futures were down 2.7% at 181 pence a therm.