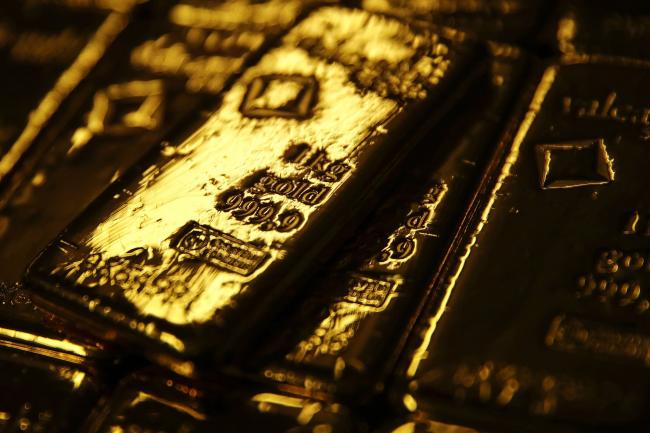

(Bloomberg) -- The biggest bullion-backed exchange-traded fund is suddenly getting a lot of love. Holdings in SPDR Gold Shares (NYSE:GLD) surged by the most in almost three years as the U.S.-China trade war, signs of a slowdown, and speculation the Federal Reserve will cut rates combined to fan demand.

Assets in the SPDR ETF jumped 16.44 metric tons, or 2.2%, on Monday to post the biggest gain since July 2016, while a tally of holdings in all ETFs saw the biggest increase this year. The swing toward the traditional haven came as gold prices surged above $1,300 an ounce to hit the highest since February.

Gold’s had a lackluster year so far even as trade war concerns flared, with Fed policy makers signalling rates were on hold and the dollar gaining ground in the four months to May. Still on Monday, St. Louis Fed President James Bullard weighed in, saying a cut may be warranted soon, and markets are now discounting at least two quarter-point reductions by year-end. Bullion, which doesn’t bear yields, tends to benefit from a low-rate environment.

“Gold is once again trying to reclaim its role as a safe haven amid growing trade tensions and consequent risks to growth,” Joni Teves, a strategist at UBS Group AG, said in a note on Monday. The price “looks like it is getting comfortable above $1,300, with aspirations of testing this year’s highs.”

On Tuesday, there were more signs of macro weakness from across Asia as revised data showed South Korea’s economy shrank 0.4% in the first quarter, the worst performance since the financial crisis, while the purchasing managers index in trade-dependent Singapore dropped below 50.

Spot gold was steady at $1,326.21 an ounce at 7:49 a.m. in London.

(Updates to add year-to-date performance in third paragraph.)