(Bloomberg) -- OPEC may be about to succeed by accident, again.

Unplanned supply losses from members Iran and Venezuela could effectively double the intended cutback of 800,000 barrels a day the cartel pledged last week, according to the International Energy Agency.

There’s a precedent for this: It was the Latin American country’s collapsing oil industry that accelerated OPEC’s effort to clear a supply glut in 2017. This time, U.S. sanctions on the Persian Gulf nation could amplify that effect.

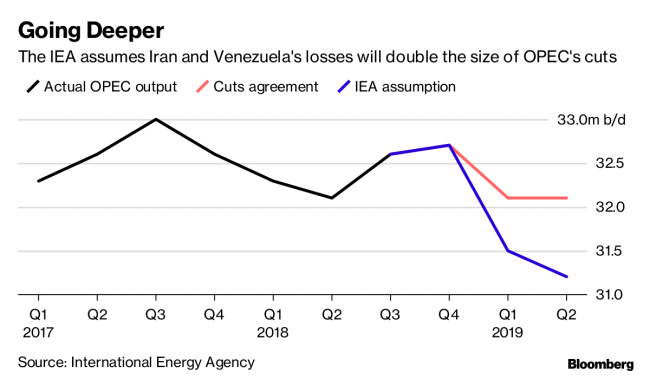

OPEC production may decline by 1.4 million barrels a day from October levels to 31.5 million a day during the first quarter and then slip further to 31.2 million in the second, according to the IEA’s monthly oil market report.

The reduction, which the agency says is an assumption rather than a forecast, includes both the planned OPEC cutback of 800,000 barrels a day, plus involuntary losses of 600,000 barrels day in the first quarter from Iran and Venezuela -- both of whom are exempt from making voluntary cuts. In the second quarter, the pair’s reduction will rise to 900,000 barrels a day, the IEA said.

If the agency’s assumptions are correct, global oil inventories could shrink substantially in the second quarter, a phenomenon that’s often accompanied by rising prices.