(Bloomberg) -- Sign up for Next China, a weekly email on where the nation stands now and where it's going next.

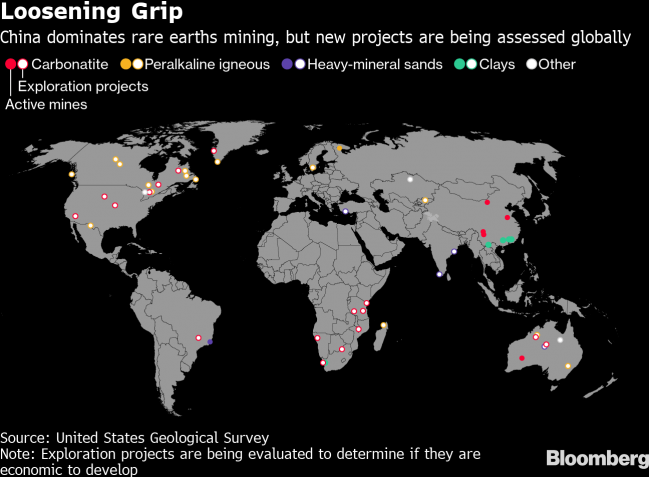

U.S. consumers of rare earths including makers of magnets used in electric vehicles, drones and robots are likely to scramble for supply of the minerals should China curb exports as the trade war deepens. Here’s a list of alternative exporters that American manufacturers may turn to for rare earth supply:

Australia

The largest miner behind China boosted output last year to 20,000 metric tons, from 19,000 tons a year earlier, according to the U.S. Geological Survey. Australia is home to the mine run by Lynas Corp., the largest rare earths producer outside of China. The company said last week it plans to almost double output of the rare earths neodymium and praseodymium by 2025 and will expand its processing capacity. It also plans to help fill the shortfall in the U.S. through a joint venture with Blue Line Corp (NYSE:LN). that will build a plant to process the commodities in Texas.

Estonia

This European country is the second-largest supplier to the U.S., accounting for 6% of the imports of the mineral, according to USGS. It is also host to Neo Performance Materials Inc.’s Silmet facility, which has the capacity to produce 2,500 tons of rare earth products, according to a company filing. The company will likely ship more of the minerals from its operations in Estonia to customers in the U.S., should China decide to curb exports to the North American nation, Scott Fromson, an equity analyst at CIBC, said in a note to clients last week. Still, the company would expect only “a minor and temporary impact,” a spokesman said in an email in response to Bloomberg queries.

Myanmar

The Southeast Asian nation is the largest producer behind China, the U.S. and Australia, according to the USGS. Myanmar produced 5,000 metric tons of rare earths last year, and much of this year’s output will need to find a home after losing its buyer, China. Beijing banned imports of the ore from Myanmar on May 14, SMM Information & Technology Co. said.

India

The South Asian nation holds the fifth largest rare-earth mineral reserves. When China restricted shipments beginning 2007, India was one of the countries that joined the race to increase domestic investment and production, commissioning a monazite processing plant in 2010. Across the globe, prices of the metal soared until China agreed to open trade again.

Brazil and Vietnam

The two countries each have about 22 million tons in rare-earth reserves, according to USGS. They have been slow to develop their mines. While Vietnam doubled its output last year, the total was only 400 tons. Brazil, on the other hand hand, cut its output to 1,000 tons, from 1,700 a year earlier, data show. Other suppliers include Russia, which has 12 million tons still buried in the ground.