Proactive Investors - Gas prices spiked over 40% higher this week following reports of terminal worker strikes in Australia, exposing the continued volatility of the market.

Reports of the potential strike action among Woodside (LON:WDS) and Chevron (NYSE:CVX) liquified natural gas workers prompted fears of supply disruption.

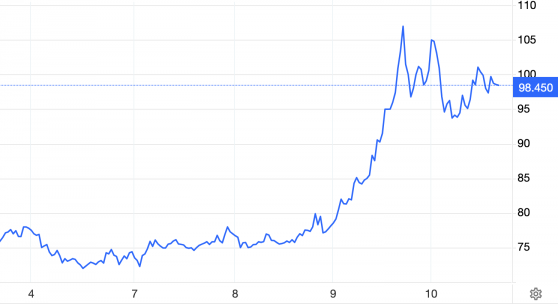

This caused the price of gas to rise by over 40% from 76p per British thermal unit last Thursday to a peak just shy of 107p on Wednesday, according to Trading Economics.

Trading Economics: Natural Gas UK GBP (GBp/thm) week to Thursday

Though reports of talks between unions and the Australian workers saw prices recede back below 100p per therm on Thursday, the spike exposes continued market volatility in the wake of Russia’s invasion of Ukraine in early 2022.

“In reality, the degree of the price spike highlights the underlying global supply [and] demand fragility,” Liberum analyst David Hewitt noted.

Wholesale natural gas effectively determines the price of other sources of energy, meaning sustained highs can translate to higher household bills – as seen over the past year.

Australia is a world leader in the export of liquified natural gas, meaning any threat to supply from the country does indeed threaten to heavily weigh into prices.

According to Hewitt, the threatened strikes at Australia’s gas terminals put a hefty 10% of global supply at risk.

“The next major date is Tuesday next week, where the union is due to make a final decision on strike action,” he added.

Read more on Proactive Investors UK