SHANGHAI (Reuters) - Xu Xiang, the Chinese hedge fund manager detained in the wake of the country's stock market crash in 2015, was sentenced on Monday to 5-1/2 years imprisonment for market manipulation.

Xu, general manager of Shanghai-based Zexi Investment, who earned nicknames like "Hedge Fund Brother No.1" and "China's Carl Icahn" in local media, was detained in November 2015.

Between 2010 and 2015, Xu colluded with 13 listed companies in driving up their share prices, using non-public information, and made huge profit from such illegal activities, Qingdao Intermediate People's Court, in the eastern province of Shandong, said in a statement on its official microblog.

Xu, and two other accomplices, pleaded guilty to manipulating the market, according to the statement.

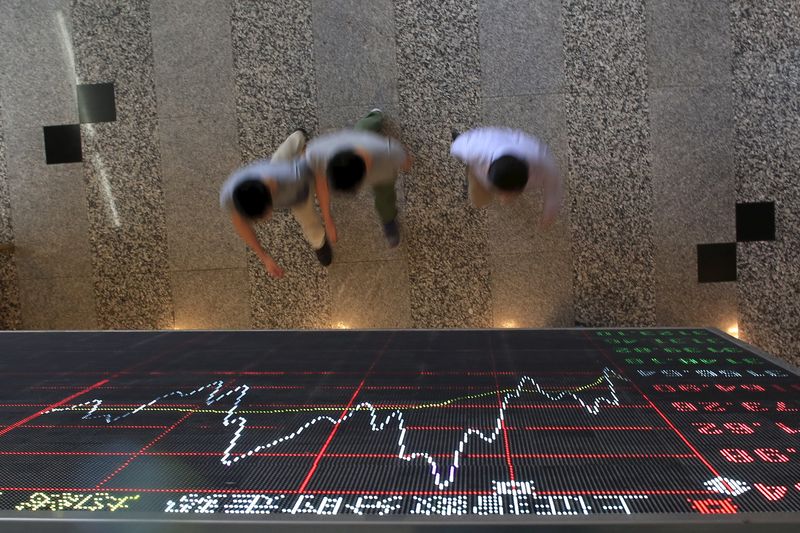

China's stock market tumbled over 40 percent in the summer of 2015, sending shockwaves across global financial markets.

Chinese authorities blamed market manipulation and "malicious" trading in stock futures for stoking share volatility, and launched investigations that netted journalists, senior brokerage executives, foreign and local hedge fund managers and even securities regulators.

The Chinese financial news website Caixin said at the time of his arrest that the low-profile Xu had been respected "as a legendary punter with a knack for successfully timing investment moves according to volatile stock market swings".

It said his funds had scored annual yields of 160 to 323 percent as of October 2015.