(Bloomberg) -- So you want in on China, the world’s fastest-growing gas market?

It would have been virtually impossible last decade. The only gas seen in China was pumped from its own wells and sold at prices strictly regulated by the government.

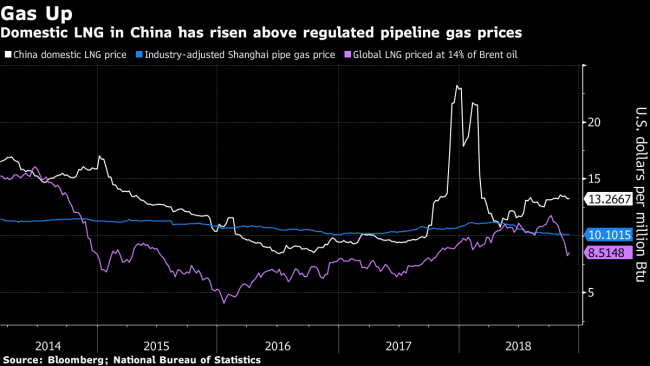

Today, things are vastly different as China has become the world’s biggest importer. Its battle against smog by replacing coal furnaces caused demand for cleaner-burning gas to explode, pushing up prices above state-controlled rates.

Amid the surge in consumption and imports, new trading methods have emerged that reflect supply and demand in ways inconceivable under tight pricing controls that dominated the market. The government has also signaled a willingness to loosen its grip, pushing through policies in recent times that adopt more free-market practices common in the U.S. and Europe.

Here’s a look at some of those initiatives:

Trucks

The future of gas trading in China may evolve from a decidedly primitive mode of transportation: good ol’ trucks. Since the 1990s, China has super-chilled small amounts of domestic gas into liquid form, loaded it on tanker trucks and sent the vehicles off to filling stations to fuel everything from taxis to 18-wheelers.

Those trucks have found a massive new market in recent years as China forced homes and factories to switch from burning coal, boosting gas demand quicker than pipelines can be built to support it. Trucks carried about 19 million tons of liquefied natural gas to customers last year, accounting for 12 percent of China’s total use, Wood Mackenzie Ltd. estimates.

Click here to read about the ‘pipelines on wheels’ market

All that trucked supply is sold outside the government’s regulated pricing scheme. Buyers and sellers negotiate deals on WeChat and other platforms. Exchanges and companies such as ENN Group publish daily prices, adding transparency to this corner of the market.

Trucked LNG sells for about 4,500 yuan ($650) a metric ton. That’s two-thirds higher than the government-set benchmark Shanghai city-gate rates. In the previous winter, trucked LNG prices jumped to 7,400 yuan amid a nationwide gas shortage.

Ships

If a truck of LNG is too small for your needs, consider an ocean-going tanker. The first auction of overseas supply via a Chinese trading platform took place in September, according to the host Chongqing Petroleum & Gas Exchange. The buyer was a unit of China National Petroleum Co., which said spot cargoes traded over the bourse have a price advantage.

What the Chongqing exchange wants to achieve is an active gas marketplace where buyers and sellers can gain the price transparency and liquidity they need for trading. It follows in the footsteps of global companies such as S&P Global (NYSE:SPGI) Platts and GLX, which have created online platforms that allow traders to bid and offer spot cargoes, including shipments into China.

Terminals

What good is a ship full of LNG if there’s no place to unload it? That problem was felt acutely last year, when infrastructure needed for China’s transition from coal to gas wasn’t completed in time, worsening heating shortages in parts of the country.

Most of China’s gas facilities are owned and operated by its state-owned giants: CNPC, Sinopec Group and China National Offshore Oil Corp. Over the years, authorities have urged the trio to share their terminals and pipelines with smaller firms to help ease bottlenecks in the distribution network.

In a first-ever deal this year, CNOOC auctioned off a time slot for its Yuedong station to a Zhenhua Oil-led consortium, allowing them to receive an import cargo during the designated period. It’s since auctioned a second terminal spot on the Shanghai Petroleum & Natural Gas Exchange.

Some companies including ENN, Guanghui Energy Co. and Jovo Energy Co. have built their own terminals so they can access the global LNG market and not be beholden to other operators.

Auctions

The two exchanges in Shanghai and Chongqing have also started allowing companies to auction small quantities of gas and LNG on their platforms. Depending on demand, that will give firms the chance to fetch prices above government-set rates. All three of China’s largest gas suppliers have taken part in such auctions this year.

Policies

It’s not just trading practices that have evolved. National policies have also undergone changes to free up the gas market. The government is considering spinning off pipeline assets of the three state giants into a separate national operator, allowing for fairer access and competition among companies. The plan may be unveiled in the first half of 2019.

Another policy shift is the convergence of China’s residential and non-residential benchmark rates to give markets greater flexibility to determine prices. The nation’s top economic planner said in May that China sourced about 40 percent of its natural gas supplies from overseas last year, and domestic prices were insufficient to cover import or production costs.