(Bloomberg) -- The OPEC buzz has once again sent oil surging, but hedge funds are playing it cool.

They reduced their bullish stance on crude for a second week as they brace for OPEC’s market swings -- where prices rally too much before a high-profile meeting of the group, only to slump on an announcement that fails to surprise.

“There has been a considerable run-up in prices already,” said Tamar Essner, an energy analyst at Nasdaq Inc. “Even if OPEC does exactly what they say they’re going to do, the market wants more shock and awe.”

Both the West Texas Intermediate and Brent crude benchmarks are trading near their highest in two years as the Organization of Petroleum Exporting Countries and its allies, meeting in Vienna on Nov. 30, are expected to prolong their output curbs. The group and Russia have crafted the outline of a deal to extend the cuts to the end of next year, although both sides are still hammering out crucial details, according to people involved in the conversations.

Money managers are taking a lesson from the May OPEC meeting. In the weeks leading up to that gathering, futures climbed 10 percent on speculation that the group would extend cuts. But once OPEC did that, and nothing else, oil slipped back. That’s giving hedge funds a bit of deja vu.

“Hopes went so high last time that, when OPEC did what they said they were going to do, people were disappointed,” said Ashley Petersen, lead oil-market analyst at Stratas Advisors in New York. “Now it’s a little bit of wait-and-see until the OPEC meeting.”

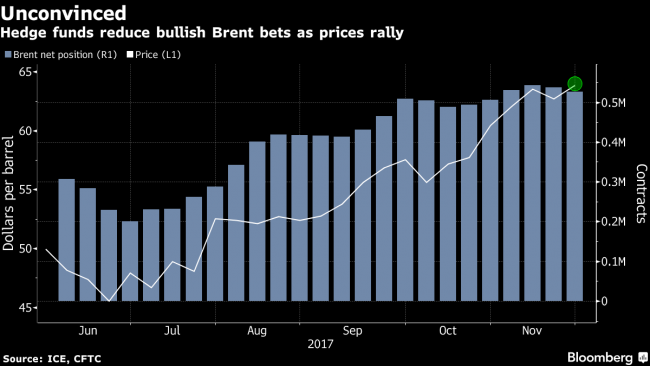

Hedge funds cut their Brent net-long position -- the difference between bets on a price increase and wagers on a drop -- by 2.1 percent to 526,240 contracts in the week ended Nov. 21, according to data from ICE Futures Europe. Shorts fell 4.2 percent, while longs declined 2.3 percent.

Bullish bets on WTI, the U.S. benchmark, were also reduced. Money managers lowered their net-long position on WTI by 1.7 percent to 343,840 contracts over the same period, according to the U.S. Commodity Futures Trading Commission. Traders who are not money managers, a category called “other reportables” by the CFTC that has boosted its net-bullish position on WTI by almost 40 percent this year, pared it by 0.7 percent to 270,137 contracts.

WTI closed at $58.95 a barrel on Friday, its highest since June 2015, while Brent closed at a two-year high of $64.27 on Nov. 6. Both crudes fell on Monday as it remains uncertain how much of the curbs will be extended by OPEC and its allies, as well as what their exit strategy will be. WTI closed 1.4 percent lower at $58.11, and Brent fell less than 1 percent to $63.84.

As for fuels, money managers’ the net-longs on benchmark U.S. gasoline fell 6.9 percent, while the position on diesel was unchanged.

Still, optimism is growing that Thursday’s meeting will yield a continuation of output cuts aimed at trimming the global supply glut. Whether that persuades money managers to bet on rising prices is another matter.

“What I want to see more of is what the exit strategy is,” said Nasdaq’s Essner. “Do we just go back to a free-for-all?”