By Olivia Oran

(Reuters) - Goldman Sachs Group Inc (N:GS) and other U.S. banks are looking at ways to slash expenses further this year as market turmoil, declining oil prices and concerns about Germany's Deutsche Bank AG (DE:DBKGn) have sent the sector's shares down sharply.

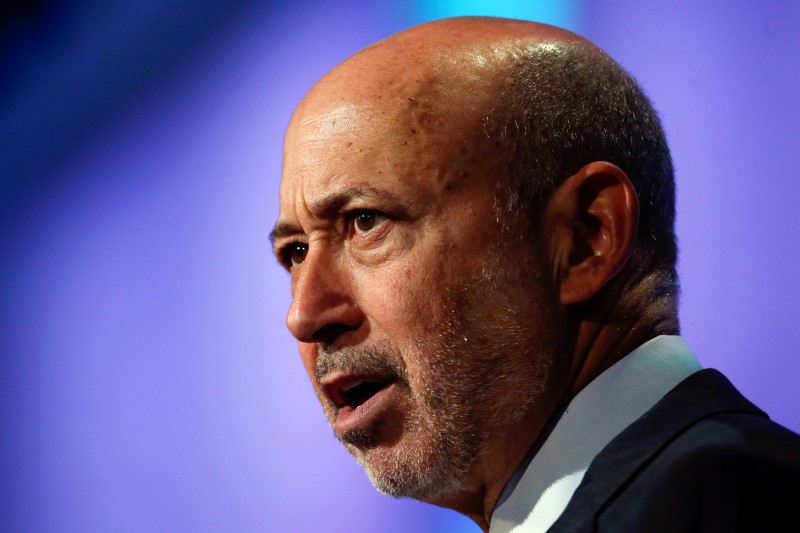

"We can absolutely do a lot more on the cost side if we have to, especially now, when you have to deliver a return," Goldman Chief Executive Officer Lloyd Blankfein said on Tuesday at the Credit Suisse (VX:CSGN) financial services forum in Miami.

"We take a particular and energetic look at continued cost cuts when revenues are stalled," he said. " ... Necessity is the mother of invention."

U.S. Bancorp Chief Financial Officer Kathy Rogers echoed Blankfein's comments at a separate panel, saying her bank would keep cutting costs this year. She cited a smaller chance that interest rates would rise, which would have indicated a stronger economy and more revenue for the bank.

BB&T Corp (N:BBT) CEO Kelly King said the bank has rejected broad-based layoffs so far and remains focused on managing expenses in a way that will not hurt business in the long-term.

"Cutting expenses with a butcher's knife and a bad attitude is not going to produce good results," he said.

As executives were speaking at the conference, Deutsche Bank shares hit a record low, following their 9.5 percent plunge on Monday.

Although the bank has said it has sufficient reserves, investors have worried that it will not be able to repay some bonds that are coming due. The bonds, called AT1 securities, convert into equity in times of market stress.

Deutsche Bank's woes reflect broader concerns about the health and profitability of euro zone banks. Last week, Sanford Bernstein analyst Chirantan Barua said Barclays (L:BARC) Plc should spin off its investment bank in an effort to revive its core UK retail and commercial business.

Major Wall Street banks have also had a brutal start to 2016, with the KBW Nasdaq Bank index down 18 percent on concerns about profitability.

Most of the large U.S. banks ended trading on Tuesday with shares flat, while Morgan Stanley (N:MS) closed up 1.2 percent.

Since demand for U.S. bank shares began to weaken in late November, the sector's top five stocks have lost 20 percent of their market capitalization, or around $120 billion. Almost 70 percent of the banks deemed globally significant are trading below their tangible book values, or what they would be worth if liquidated. Analysts say if this continues, banks may have to restructure more drastically to cut costs. Investors said bank executives would need to look at other ways to boost profitability now that hopes for further interest rate hikes have faded. "They're going to have to come up with other levers to pull, whether it is investing in technology or reducing headcount," said John Fox, chief investment officer at Feinmore Asset Management, which invests in financials. "There will be more pressure on expenses because of the interest rate environment."

NOT SINGING "KUMBAYA"

Banks have already engaged in major cost-cutting over the last several years, as low interest rates and strict regulations have crimped profits in areas like fixed income trading.

At Goldman, headcount in its troubled fixed-income trading business has already declined 10 percent since 2012, Blankfein said. The bank has transferred many jobs to lower-cost locations like Bengaluru, India, Salt Lake City and Dallas, where 25 percent of its employees are now based.

Goldman is also looking for ways to reduce payments to outside vendors.

Other U.S. banks have been taking similar steps.

Morgan Stanley said in January it planned to cut another $1 billion in costs by 2017 by leaning more on technology and increased outsourcing. Last year, it eliminated about 25 percent of jobs in its fixed income division as it tries to lift its profitably to 10 percent. JPMorgan Chase (N:JPM) & Co's investment bank is in the middle of a $2.8 billion expense-reduction program.

Bank of America Corp (N:BAC) is looking to keep quarterly core expenses below $13 billion, which it has accomplished five out of the last six quarters, Chief Financial Officer Paul Donofrio said last month. That target comes after years of cost reductions.

Offering his outlook on Tuesday, Blankfein said he believed global markets would improve, "but we aren't holding hands and singing 'Kumbaya' to get better."