By Michelle Price and Melanie Burton

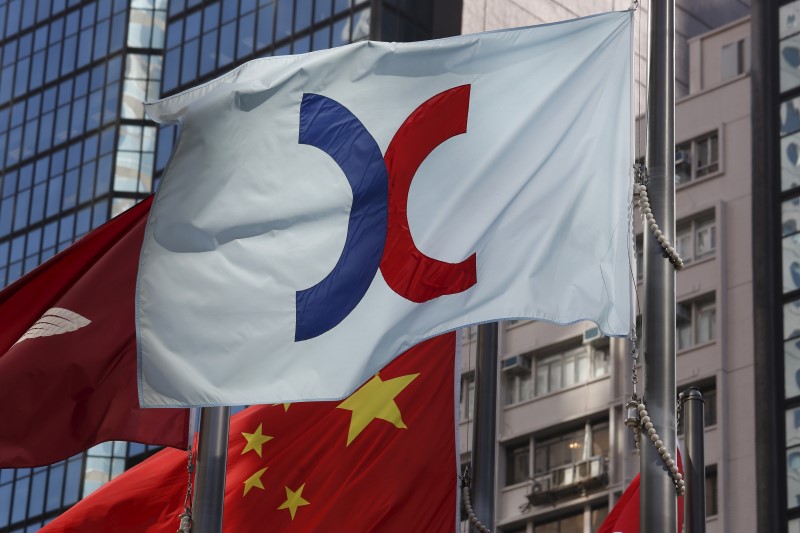

(Reuters) - Hong Kong Exchanges and Clearing Ltd (HKEx) (HK:0388) said it isn't actively looking for acquisition targets, even as it is keeping a close eye on a proposed bid for London Stock Exchange (LSE) (L:LSE) by Deutsche Boerse (DE:DB1Gn).

HKEx is "pretty busy" with its China strategy and organic growth, but will look at potential opportunities if they come up, Charles Li, chief executive of the Asian bourse operator, told a news conference to comment on the exchange's results on Wednesday.

The company owns the London Metal Exchange (LME), which posted a 36 percent jump in revenue for 2015 and was a key contributor to its record earnings last year.

"We have a pretty solid portfolio of organic growth. However, if there are opportunities that present themselves that add value...we will look at them," Li said. "We are not actively looking for something."

Still, HKEx is watching closely how the bid for the LSE will develop, as global exchanges look to consolidate amid weaker volumes and shrinking margins. New York Stock Exchange owner ICE (N:ICE) said on Tuesday it may make a rival bid for the LSE, raising the prospect of a battle with Deutsche Boerse.

"I'm not saying we're doing anything and I'm not saying we are not doing anything. HKEx will be maintaining a lot of conversations to stay on top of the game," Li said. "It is obviously a pretty major transaction and we will be watching it closely."

Li also refused to confirm or deny if the LME had made an informal approach to buy the Baltic Exchange global shipping hub late last year.

EARNINGS

The LME, the world's biggest metals exchange by volume, posted a 36 percent jump in revenue for 2015 to HK1.735 billion ($223.15 million), as higher trading fees and tariffs helped it offset a drop in volumes.

The revenue gains at its London unit was a key contributor to HKEx's net profit last year, showing the payback has begun from its $2.2 billion buyout of the 139-year old metals bourse near the height of the commodities boom in 2012.

But trading volumes on the LME shrank 4.3 percent in 2015, dented by slowing growth in Chinese demand for commodities, data from the bourse showed in January.

HKEx reported a 2015 net profit of HK$7.96 billion ($1.02 billion), slightly above analysts' expectations of HK$7.913 billion, according to Thomson Reuters data.

($1 = 7.7751 Hong Kong dollars)