There is a popular meme that the government has an incentive to inflate, because the same debt is worth less in real terms at a higher price level. If inflation is high enough, then the government (it is said) can make the debt go away. Inflation is, after all, a tax; doesn’t it then follow that if the government increases that tax quite a bit then it can get itself out of hock in real terms?

It turns out that this is difficult to do, at least over a range of ‘normal’ inflation rates. The reason is that it is hard to get the debt to go away fast enough when the market adjusts interest rates to reflect the level of inflation. I want to try and illustrate the general idea here. I’ve looked at this before, so I know the answer, but I’ve never put this in a blog post before.

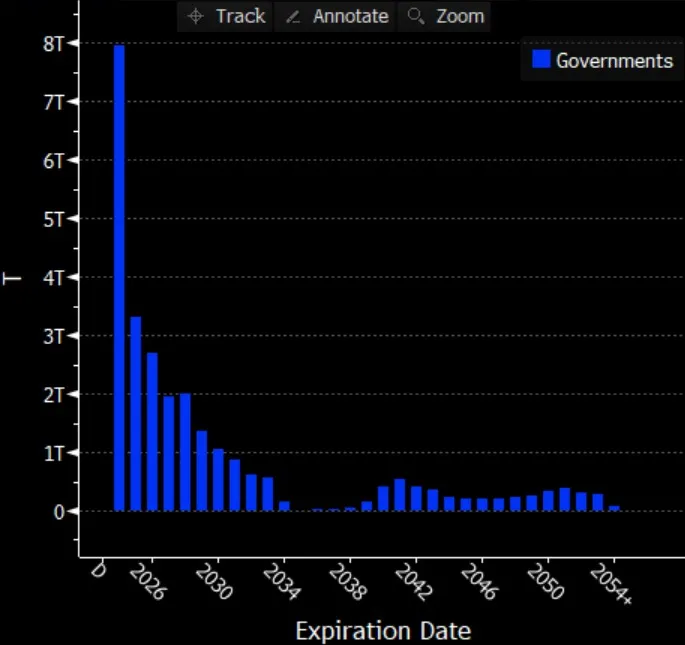

First, let’s start with the current distribution of debt for the US. The chart below is from Bloomberg, showing how many trillions of Treasury bill/note/bond maturities will happen every year. For a host of reasons, prime among them being incompetence, the US did not take advantage of the artificially ultra-low interest rate environment to extend maturities. That makes inflating the debt away even more difficult.

The average interest rate on US debt is 3.21%, about double what it was in early 2022 and the highest it has been since 2009 (and there is a lot more debt outstanding now than there was then, thanks to a decade and a half of massive deficits designed to save the world). Having a lot of debt mature every few years is a great way to increase the sensitivity of your interest expense, and therefore deficit, to short-term inflation and interest rate fluctuations. That’s not feature, it’s a bug!

Starting from the distribution above, let’s model how the debt would grow over time using a couple of simple assumptions and then tweaking those assumptions. We will start with this: assume that the maturing debt, plus the annual Treasury deficit, is rolled into new debt distributed 1/30th to each year.

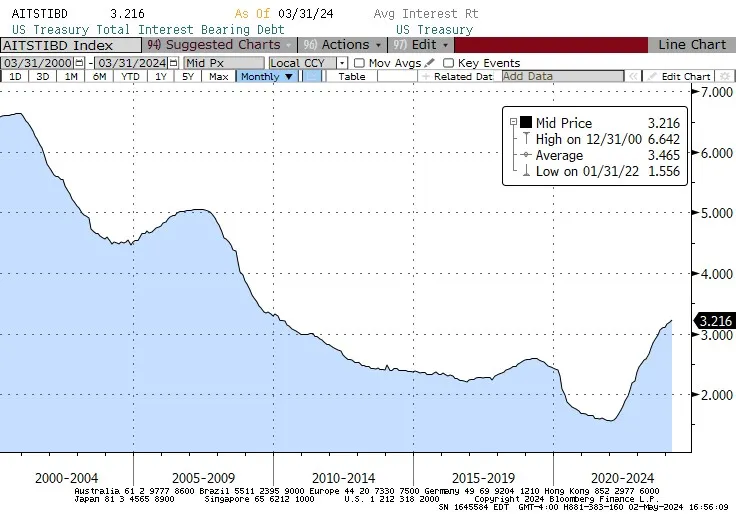

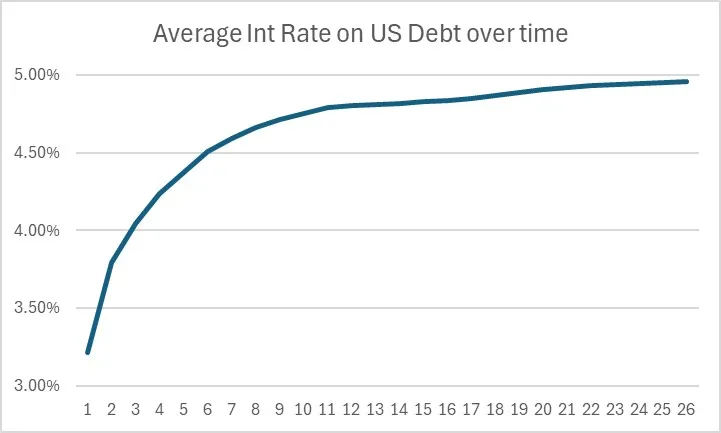

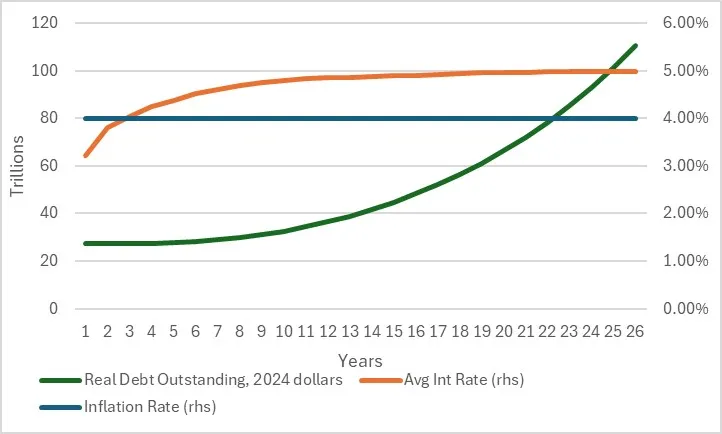

We will assume a 4% inflation rate, and an interest rate of 1% over the inflation rate. Because we are spreading out the maturities, we are explicitly extending the maturity of the debt. The more rapidly the average interest rate reacts to the current interest rate, the harder it is to inflate the debt away. If we started with that 3.22% interest rate and rolled the debt as I have just described, here is how the average nominal interest rate evolves over the next 25 years.

I should note that I am also assuming that the deficit is initially $1 Trillion, and grows by the rate of inflation every year. So, in year 0 it is $1T; in year 1 it is 1.04T, which is the same amount in real terms. Note that this implies that discretionary spending is decreasing rapidly. In year 0, the Treasury would pay interest of about $876 billion ($27.2 trillion in debt * 3.22% interest rate).

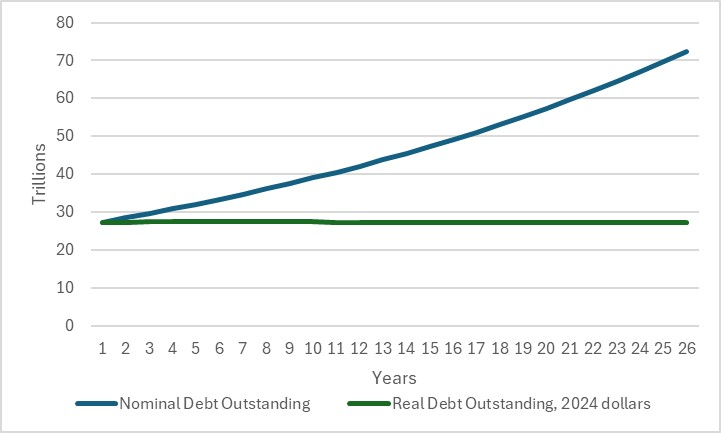

In year 1, the average interest rate rises to 3.80% and the deficit is $1T larger, so the interest paid rises to $1072 billion. Since we assumed that the overall deficit increased by only $40bln, the implication is that discretionary spending fell $156bln ($1072 – $876 – $40). So, the notion that the deficit grows only equally with inflation is not realistic. But even using such magical thinking, the total debt rises from $27.2T to $72.5T over 25 years. The real debt (remember, we’re inflating it away!) stays basically steady at $27.2T in today’s dollars.

So constant inflation actually doesn’t do it. It’s even worse than the picture suggests, as I said. If we instead assume the nominal debt increases by the change in the interest outlays – which means discretionary spending still decreases, but only in real terms – then that chart looks distinctly uglier. The nominal debt in 25 years with these assumptions gets to $294T, and the real debt steadily climbs over $100T.

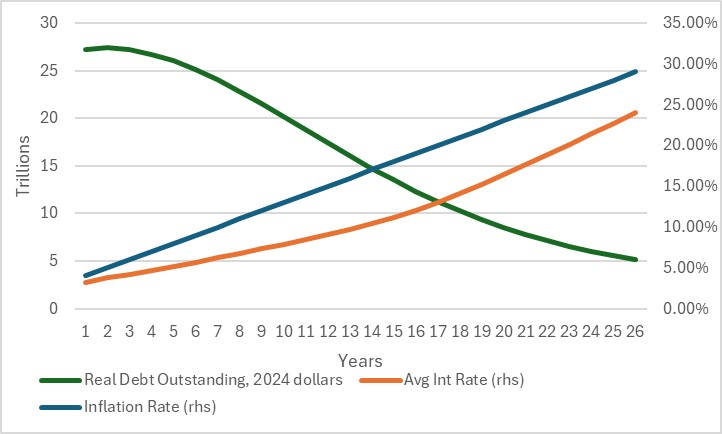

We can see that this is just not going to work unless we decrease discretionary spending. Again, we’re just trying to figure out if there is some way to inflate ourselves out of this mess. So let’s go back to the assumption that the deficit only rises pari passu with inflation, but now let’s get rocking on inflation and increase it 1% every year, from 4% to 30% over the next quarter-century. Assuming that investors still demand a positive 1% real rate on all new debt, we get this picture.

We finally make some headway on the debt! Because so much of it is short-term, though, it takes a good 6-7 years before we see a lot of progress on the real debt because we’re just rolling it over at higher rates too quickly.

By the way, I neglected to mention that Medicare is an off-balance-sheet ‘debt’ that we can’t outgrow in this fashion. And it’s a big item. It is impossible to inflate away Medicare.

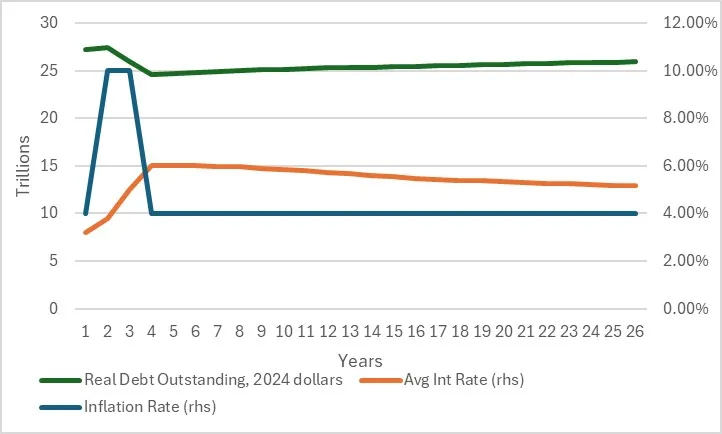

Now, most people who suggest that we can inflate our way out of debt do not imagine a steadily-accelerating inflation rate forever. That’s not what we would call a ‘re-electable outcome’. So let’s instead assume that we spike inflation for two years to 10%, and then drop it back to 4%. You can look at the chart below and see that once again this doesn’t work because the debt is turning over too quickly. There is a quick, small benefit to the real debt, but then it levels off again.

Unless you can spike inflation to, say, 100% for a year or two and then put it right back down to the prior level, you really need accelerating inflation because you need the principal amount of the outstanding debt to fall in real terms more than the interest payments are accumulating.

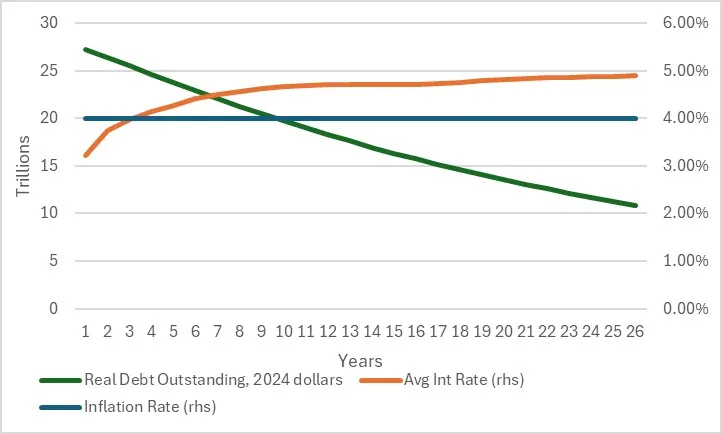

If you can have inflation a bit above the average interest rate on the debt, then you’ll make headway but since the interest rate responds you have to keep doing this for a while. And remember, we are assuming that the government outside of interest payments is steadily shrinking in real terms.

What about if we balanced the budget? Well, then obviously the real debt will tend to decline over time, although more and more of the budget becomes interest payments.

So far, we can find no realistic way to inflate our way out of debt, other than moving toward hyperinflation (and the faster, the better). And even with these simulations, I am making a very unrealistic assumption about how the deficit evolves when the interest costs of the debt blow up.

Hyperinflation, with a balanced budget, is what you need. Good luck with that. The only way that happens is if the dollar collapses and no one will lend us any more money anyway. And there is no one in government today, I feel confident in asserting, who thinks that outcome is a decent tradeoff in order to get out from under the mountainous debt. At least…let’s hope not.

Have a better idea? Let’s hear it!

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI