YOC's (DE:YOCG) Q321 results were strong, highlighting the continuing success of its programmatic advertising platform, VIS.X. Both revenue and EBITDA increased by c 20% for the first nine months of the year (9M21), driven by 40% growth in trading volumes. Management now expects FY21 revenue and EBITDA to be at the top end of the guidance it provided in March 2021, representing year-on-year growth of 16% and 20% respectively, and in line with the expectations provided in our October initiation. Seasonal impacts relating to events like Christmas, as well as new partnerships with demand-side platforms, should help catalyse performance in Q421. Revenue and profitability growth could further accelerate in FY22 as VIS.X builds its share of total revenue.

Performing at the top end of expectations

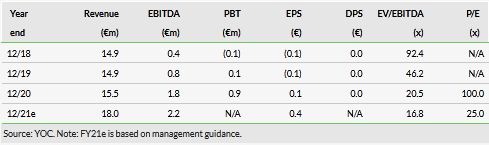

A 40% increase in trading volumes, driven by VIS.X, led to a 19% and 17% y-o-y increase in revenue and EBITDA to €11.7m and €1.2m respectively for 9M21. Investments during the period, including the launch of its unified management interface and VIS.X SDK to monetise mobile applications, resulted in a 1pp q-o-q reduction in EBITDA margin to 10%, but an immediate uplift in trading volumes. Margins should see a recovery in Q421, reflected by management’s expectations that FY21 revenue and EBITDA should be at the top end of the guidance given in March, representing y-o-y growth of 16% and 20% to c €18m and €2.2m respectively. Net income grew by €0.6m to €0.5m, benefiting disproportionately as net income in FY20 was affected by the discontinuation of its Spanish business.

New partnerships to bolster performance

On 11 November, management announced its expanded partnership with demand-side platform (DSP) Adform, resulting in its direct integration onto the VIS.X platform. The partnership increases the volume of inventory available to advertisers, which can be programmatically traded through the open market or via private deals. YOC has existing direct integration partnerships with other notable DSPs, including Xandr, The Trade Desk and Magnite. On 27 October, management announced the integration of Oracle (NYSE:ORCL) Contextual Intelligence into VIS.X, increasing its contextual targeting capabilities and brand safety. This strengthens the company’s position in view of the withdrawal of tracking cookies in 2023.

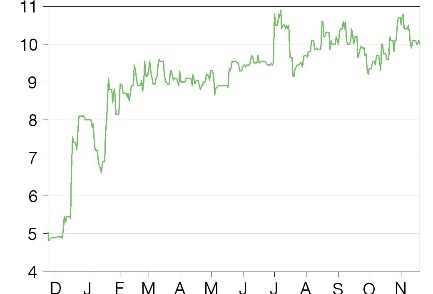

Valuation: Robust share price performance

YOC’s share price has grown by 26% in 2021 to date, 3% ahead of its peer group median. On guided FY21e sales and EBITDA, YOC trades at EV multiples of 2x and 17x, a discount of 74% and 30% respectively to our peer group.

Historic financials and FY21e management estimates

Share price graph

Business description

YOC is a Germany-based technology company that develops software for the global digital advertising market. By using the platform VIS.X® and YOC's proprietary ad formats, advertisers can increase awareness for their brand or products in combination with high-quality advertising inventory. Its supply-side platform VIS.X, launched in 2018, provides a programmatic marketplace for the automatic trading of digital advertising units, allowing for the real-time bidding of advertising budgets. YOC’s key markets include Germany, Austria and Poland.

Bull

- Unique ability for VIS.X to trade YOC’s high-impact ad formats provides a first mover advantage.

- VIS.X has the potential to deliver scalable growth at low fixed costs.

- New partnerships should support future growth, despite potential headwinds such as the withdrawal of cookies.

Bear

- Strong global competition from several large companies.

- Still in a net liabilities position.

- Short track record of VIS.X platform.