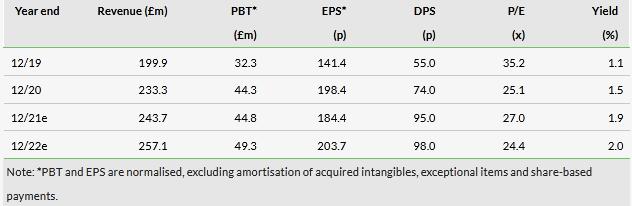

XP Power (LON:XPP) has reported another record quarter for orders as customers in all three sectors seek to secure their requirements in the midst of global supply-chain challenges. Revenue and bookings for the nine months to 30 September (9M21) are ahead of our expectations and we have revised our forecasts to reflect this, with EPS upgrades of 2% in FY21 and 3% in FY22.

Share price performance

Record order intake in Q3

XP reported Q321 order intake of £97.2m, up 73% y-o-y (87% in constant currency, cc) and 16% q-o-q. While the company saw continued strong demand from the semiconductor manufacturing equipment sector, it also benefited from the ongoing recovery in industrial technology and a pick-up in demand from the healthcare sector (where orders were 70% higher than 2019 levels). XP has seen lead times extend due to supply chain issues, which has prompted many customers to seek security of supply, with most recent orders unlikely to be fulfilled until H222. Q321 revenue of £61.6m was down 11% y-o-y or 5% cc, with 9M21 revenue up 4% y-o-y or 12% cc. Q321 book-to-bill was 1.58x and 9M21 was 1.40x. XP closed Q321 with net debt of £25.2m and declared a Q3 dividend of 21p, ahead of our 20p forecast.

Upgrading estimates on strong outlook

The board’s expectations for FY21 are in line with market expectations. Management also sounded a note of caution on the supply chain issues it is facing, including component shortages, COVID-19 restrictions and freight capacity constraints, all of which are putting upward pressure on costs. We have revised up our forecasts to reflect slightly stronger than expected revenue in H221 and a higher order backlog. Our revenue forecasts increase by 1% in FY21 and 2% in FY22 resulting in normalised diluted EPS forecast increases of 2% in FY21 and 3% in FY22. We also tweak up our dividend forecast for FY21 by 1p to 95p.

Valuation: Semiconductor sector drives volatility

The share price rebounded after H1 results were released, reaching 5,630p on 17 August. Since then, the stock has declined 12%, in line with semiconductor equipment stocks, while the FTSE 250 is down 8% from its peak, we believe on inflation and supply chain concerns. On an FY21e P/E basis, XP is trading at a 21% premium to global power-converter companies but a 2% discount to UK electronics companies, with a dividend yield at the upper end of the range. The company generates EBITDA and EBIT margins at the top end of both peer groups.

Click on the PDF below to read the full report: