XP Power Ltd (LON:XPP) saw another year of strong customer demand, with orders up 33% y-o-y after 20% growth in FY20. FY21 results reflected the challenges of dealing with component shortages, increased freight costs and further COVID-19 restrictions, which constrained H221 revenue and weighed on gross margin. XP enters FY22 with its strongest ever backlog providing good visibility for the year. The company is focused on building further operational and supply chain agility while investing in product development and adding capacity to support future growth.

Share price performance

Business description

XP Power is a developer and designer of power control solutions, with production facilities in China, Vietnam, Germany and the United States and design, service and sales teams across Europe, the United States and Asia.

Strong demand amid supply chain challenges

For FY21 XP reported revenue growth of 3% (10% constant currency), a gross margin of 45.1% and normalised operating profit of £45.1m (18.8% margin), in line with our forecast. Higher than expected tax resulted in normalised diluted EPS 1.5% below our forecast. In H2, supply chain issues and a lockdown in Vietnam constrained revenue as the company was unable to keep pace with customer demand (FY21 orders +33% y-o-y) resulting in a record year-end backlog of £217m.

Good visibility for FY22

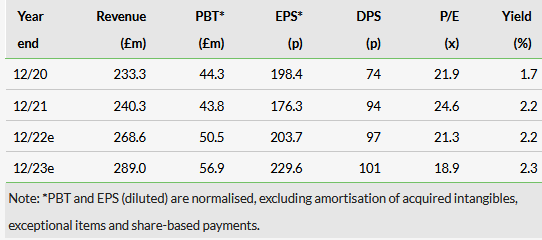

Customer demand remains strong, with continuing demand from semiconductor equipment manufacturers and rebounding activity from industrial technology OEMs. Healthcare customers have reverted to more normal ordering patterns after a very strong FY20, although FY21 order intake exceeded FY19. The order book entering FY22 represents 85% of our pre-German acquisitions revenue forecast for FY22. Factoring in ongoing supply chain issues we have trimmed our revenue forecasts, cutting normalised diluted EPS by 1.7% in FY22 and 1.3% in FY23.

Valuation: Better value

Over the last year, the shares have declined 19% even while our forecasts have increased, reflecting uncertainty around supply chain issues, a shift to value stocks and concern over the Ukraine/Russia conflict. On a P/E basis for FY22, XP is trading in line with global power solution companies and at a discount to UK electronics companies, with a dividend yield at the upper end of the range. The company generates EBITDA and EBIT margins at the top end of both peer groups and has a record order book entering FY22. In our view, acceleration in revenue growth, successful integration of FuG and Guth and evidence that supply chain issues are abating will be key drivers of the share price.

Click on the PDF below to read the full report: