This article was written exclusively for Investing.com

- Soft commodities can be highly volatile

- Sugar breaks higher

- Coffee rises from a higher low

- 2008-2011 was a bullish period- 2020 and the coming years could be a repeat performance

Sugar and coffee are each part of the soft commodities sector of the broader commodities market. Brazil is the leading producer of both agricultural commodities. The climate of the South American nation is ideally suited for growing Arabica coffee beans and sugarcane.

Coffee and sugar futures trade on the Intercontinental Exchange, and the US dollar is the pricing mechanism. Since local production costs are in Brazilian real, the foreign exchange relationship between the Brazilian currency and the US dollar impacts the prices of these soft commodities. A rising real and falling dollar tend to be bullish for coffee and sugar, while weakness in the Brazilian currency and strength in the US dollar often weighs on prices.

While currency differentials can impact prices, the supply and demand fundamentals dictate the path of least resistance of pricing. Adverse weather conditions or outbreaks of crop diseases can cause the output to decline. In 2020, the global pandemic could affect production. Brazil faces the second-leading number of coronavirus cases and fatalities in the world.

Sugar and coffee prices fell to what is close to the bottom end of their pricing cycles earlier this year. Coffee was below $1 per pound, and sugar futures reached a low of 9.05 cents in April, the lowest level since 2007. Over the past weeks, the prices of both soft commodities have made impressive comebacks.

Soft commodities can be highly volatile

Soft or tropical commodities have a long history of extreme volatility. The weather, crop diseases, currency fluctuations all contribute to price variance over time.

When it comes to sugar, the price range since the early-1970s has been from 2.29 cents to 66.00 cents per pound. The most recent high came in 2011 at 36.08 cents, and the low this century has been at 4.62 cents per pound on the nearby ICE world sugar futures contract.

Coffee has traded in a range from 41.50 cents to a high of $3.3750 per pound since 1973. From 2000, the low has been at 41.50 cents and the high at $3.0625.

Sugar breaks higher

In late July, sugar broke out above its short-term resistance level at 12.29 cents per pound on the continuous futures contract. Since March, nearby futures had traded below the 12.30 level and reached the lowest price since 2007 in April at 9.05 cents per pound.

Source, all charts: CQG

The weekly chart shows that break to the upside during the final week of January. Last week, October sugar futures traded to a high of 13.00 cents, closing a gap from 12.95 to 12.93 from March. The next target on the upside is the February 2020 high at 15.90 cents per pound.

Price momentum and relative strength indicators were rising towards overbought conditions in the sugar market at the end of last week. At over 38%, weekly historical volatility was above the midpoint for this year.

The total number of open long and short positions moved just over the one-million-contract level as of August 6. The metric reached a peak at over 1.26 million contracts in mid-February when sugar traded to its highest price since 2017. The peak in open interest was a record high for the sugar market. The decline was a function of the risk-off conditions created by the global pandemic.

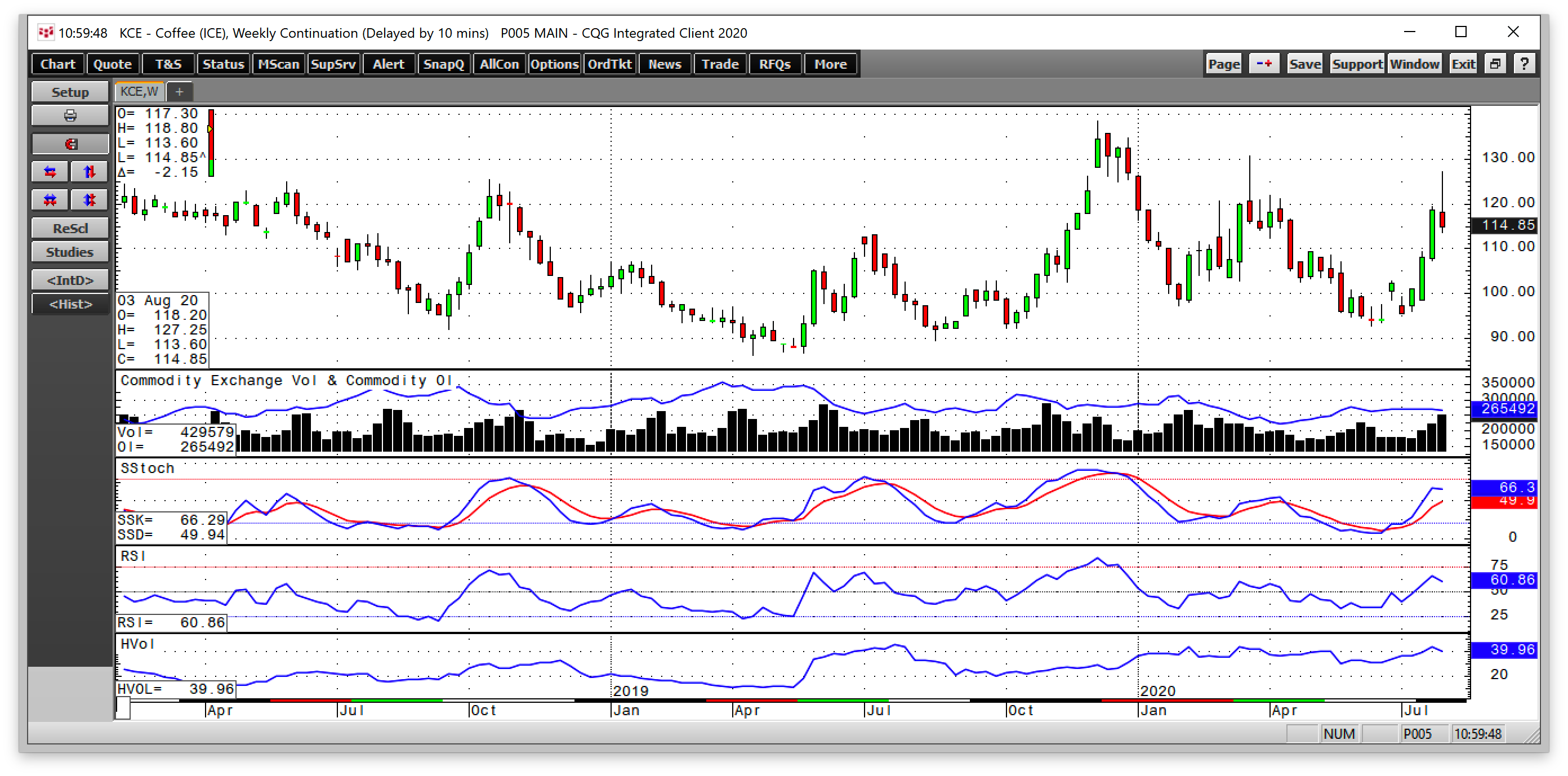

Coffee rises from a higher low

In mid-June, Arabica coffee futures on the Intercontinental Exchange dropped to the lowest level of 2020 when it traded to 92.70 cents per pound. This year’s bottom was a higher low than in 2019 when the soft commodity declined to 86.35 cents, the lowest level since 2005.

The weekly chart illustrates the rebound in the coffee futures market, which took the price to a high of $1.2725 per pound level last week.

Over less than two months, coffee futures rose by 37.3%. Price momentum and relative strength metrics were above neutral territory.

Weekly historical volatility was closer to the high than the low for 2020 at almost 40%. Open interest at just over the 265,000-contract level at the end of last week has been flatlining since mid-June.

The next target on the upside is the late March high at $1.3065, and the December 2019 peak at $1.3840 per pound. The price pulled back at the end of last week and settled at $1.1545 per pound on the September futures contract.

2008-2011 was a bullish period; 2020 and the coming years could see a repeat

Sugar has gotten a lot sweeter over the past months, and coffee has been percolating on the upside since mid-July. A falling US dollar, a rise in the value of the Brazilian real against the greenback, and record levels of government and central bank stimulus have been bullish for the two soft commodities.

Moreover, Brazil has experienced the second-leading number of coronavirus cases and fatalities. The global pandemic could significantly impact production and logistics for the sugar and coffee markets over the coming months. Meanwhile, a shortage of Robusta coffee beans from Vietnam has been lifting the price of Arabica beans.

I believe that the price action in commodity markets from 2008 through 2011 is a model for the coming years. In the wake of the 2008 global financial crisis, central bank stimulus created a flood of liquidity that sparked a rally in the commodity asset class. In 2020, far higher stimulus levels from central banks and governments are likely to do the same.

The quarterly chart shows that the price of nearby sugar futures rose from a low of 9.44 cents in 2008 to a high of 36.08 in 2011, as the sweet commodity almost quadrupled in value.

Coffee moved from a low of $1.0170 per pound in 2008 to a high of $3.0625 in 2011 as the soft commodity more than tripled over the period.

If the span from 2008 through 2011 is a model for 2020, expect sugar to get a lot sweeter and coffee to pop even higher over the coming months and years.