Using the Elliott Wave Principle, I found the S&P 500 two weeks ago:

“The index should now be in a multi-day corrective pattern into late November, ideally targeting the black W-b box at $3,735-3,875.”

Since then, the index dropped to as low as $3,906 and rallied as high as $4,034. Thus, it had been stuck in a 130p range until yesterday, when it broke higher. Thus, we indeed got a multi-day corrective pattern. But was that sideways range for two weeks all we got for the anticipated b-wave lower? And now, is the “more significant black W-c back up to ideally $4,350-4,500” under way?

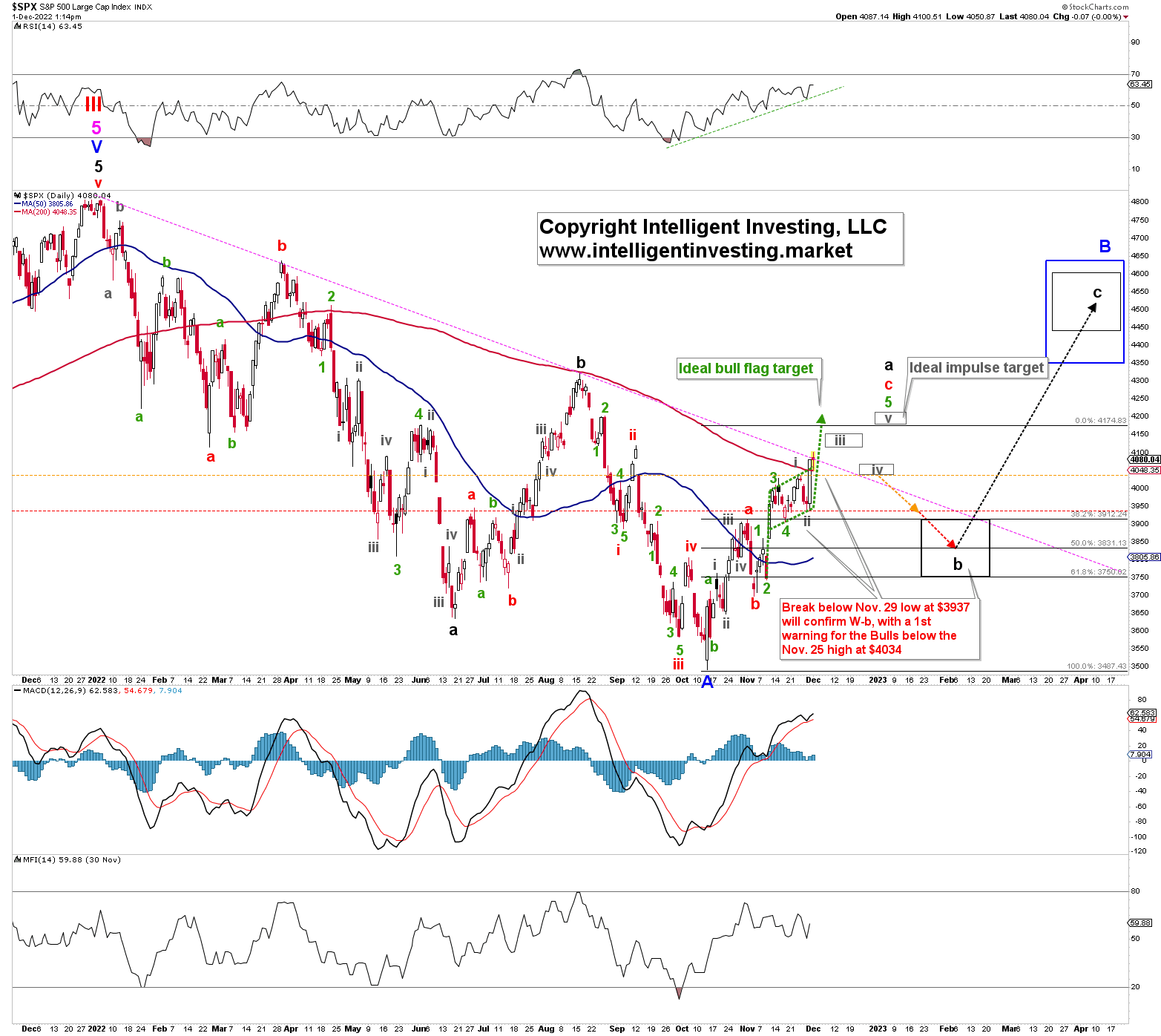

Let’s assess the index’s daily chart, starting with figure 1 below.

Figure 1:

The two-week sideways price action fell 31p (0.8%), short of the upper end of the ideal target zone for W-b: $3,906 vs. $3,735-3,875. Thus, technically, the Nov. 17 low at $3,906 could have been enough. However, the price action over the last two weeks looks more bullish than bearish, as a potential bull flag formed (dotted green pattern), ideally targeting around $4,225. Besides, this week’s higher low ($3,937 vs. $3,906) and yesterday’s rally suggest the index is in a subdividing green W-5 (grey W-i, ii, iii, iv, v) targeting the grey target zone at $4,200+/-25 ideally. Thus, the ideal Fibonacci-based impulse pattern’s fifth wave target zone matches well with the technical bull flag pattern. That would then complete black W-a. Black W-b can then still start, targeting $3,830+/-80 ideally, before W-c to $4,450-4,600 takes hold.

However, for this option to stay alive, the index should not break below the Nov. 25 high at $4,034 from current levels as that would mean overlap with the potential grey W-i. It should remain above this week’s low at $3,937 at all times. Otherwise, the index will have already topped per the EWP count shown in Figure 2 below.

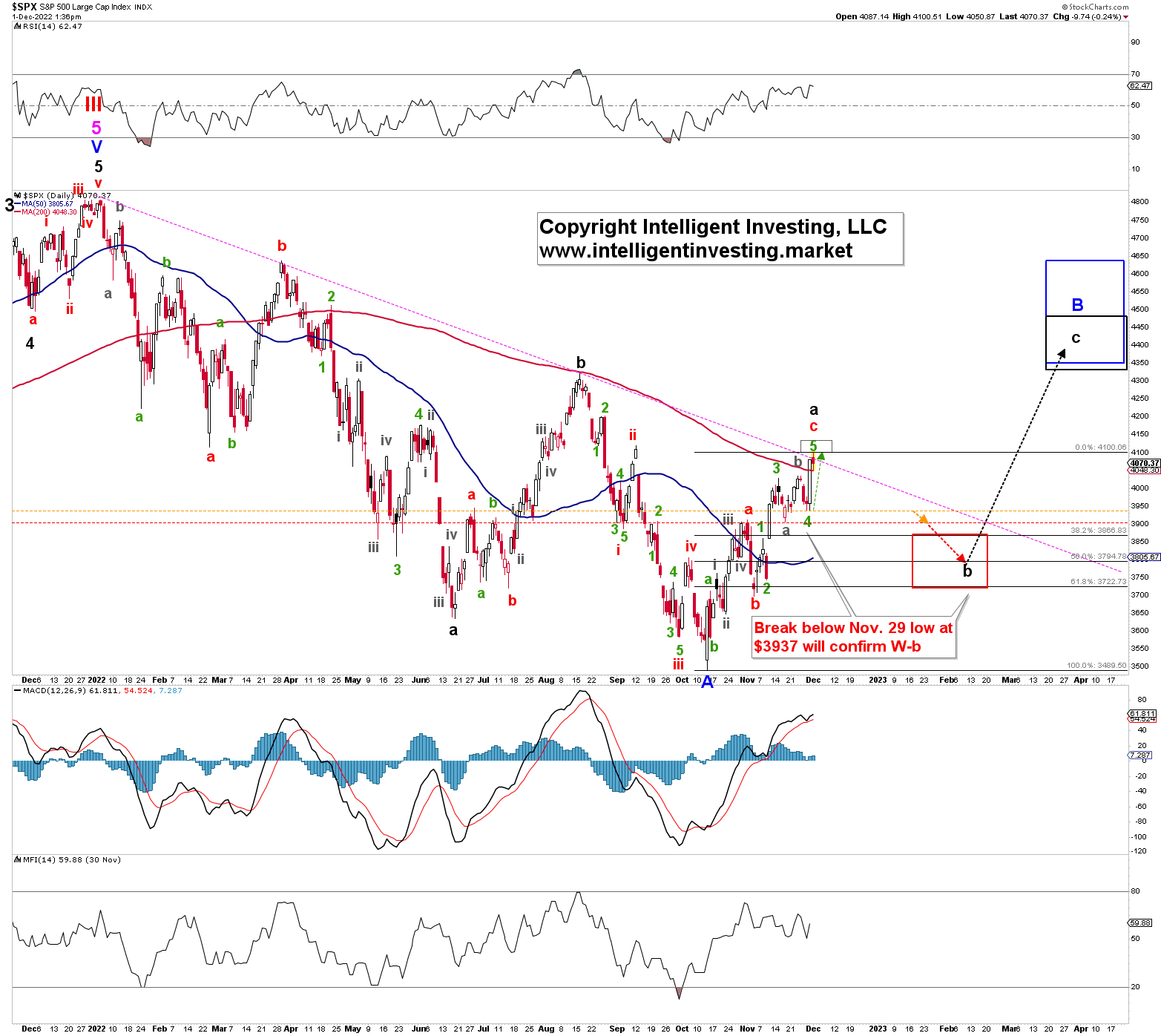

Figure 2:

Sideways price action always leaves things more open to interpretation from an EWP perspective than a trending market, be it up or down. This week’s low, instead of the Nov. 17 low, could have been green W-4. In that case, it was what’s called in the EWP an irregular running flat (see here).

That, in turn, means that yesterday’s rally into today’s open was green W-5: all of the black W-a is close to completion. Today’s high would make for a perfect green W-5 = W-1 relationship (dotted green up arrow). A break below the Nov. 29 low at $3,937, with a first warning for the bulls below $4,034, will confirm this option. I then expect a pullback to $3,795+/-75 for black W-b before the next rally (black W-c) takes place to $4,350-4,475.

In conclusion, the last two weeks’ sideways price action combined with yesterday’s breakout allows for a final push higher, to possibly as high as $4,200+/-25, before the next larger pullback to $3,830+/-80 kicks in. But the bulls will have to hold $4,034 and $3,937 for now because the bears will take the ball and run it down to $3,795+/-75.