Summary- GM stock has had an impressive year

- Management has a long-term strategy to capitalize on electric vehicles and autonomous driving

- Despite the bullish long-term outlook, investors should be ready for short-term volatility, with a potential decline toward $56 in the coming weeks.

Investors in General Motors (NYSE:GM) stock have had a great year so far. Shares are is up close to 40% year-to-date.

The Detroit-based car manufacturer will report Q2 earnings on Aug. 4. Although we expect the shares to be volatile until then, long-term investors with two- to three-year time horizons could consider investing in GM stock now. Here’s why.

Long-Term Tailwinds For GM Stock

With a history that goes back to 1908, General Motors has manufactured iconic vehicle brands over many decades. Nevertheless, for GM and its automotive peers, 2020 brought challenges due to the pandemic. The industry has also been battling the recent chip shortage.

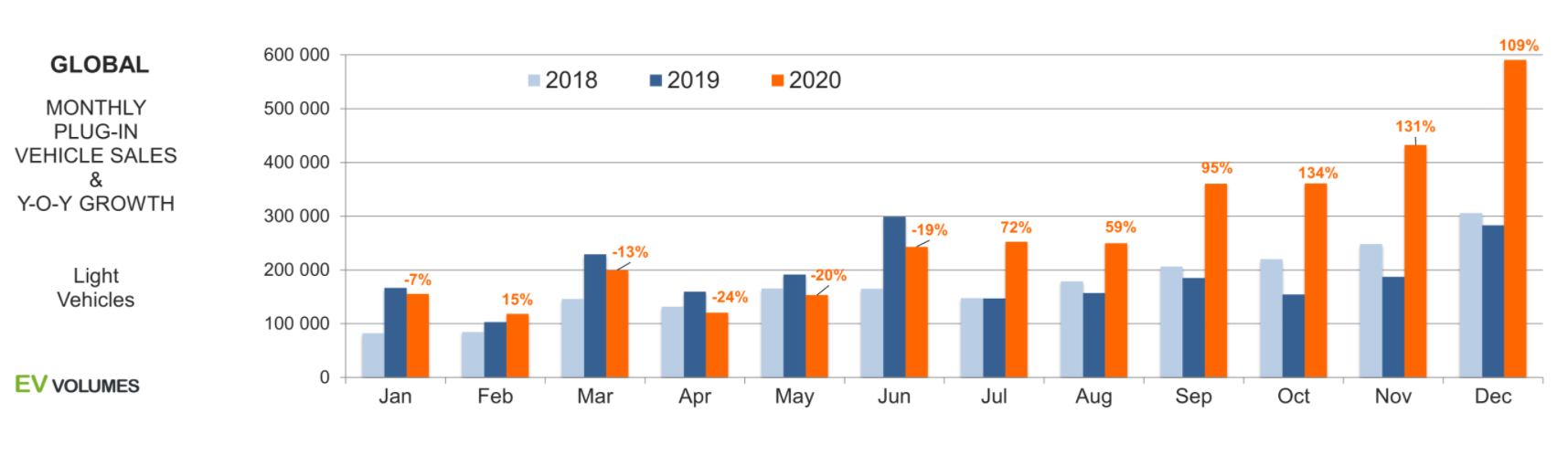

Chart courtesy ev-volumes.com

On the other side of the equation, the past year has seen investor interest in electric vehicles and alternative energy peak. More than 3 million electric vehicles were sold globally in 2020. Most investors regard Tesla (NASDAQ:TSLA) as perhaps the most successful name on the road to automotive electrification.

However, more established car manufacturers such as Ford (NYSE:F) and General Motors have join the EV revolution as well.

General Motors announced Q1 results in early May. Its top line remained almost flat at $32.5 billion. Net income, on the other hand, jumped to $3.0 billion in Q1 2021 from $0.3 billion in Q1 2020. Adjusted diluted EPS came in at $2.25.

Regarding the results, CEO Mary Barra remarked:

“While we will have production downtime in the second quarter, we expect to have a strong first half. We are also reaffirming our guidance for the full year.”

Thus, despite the semiconductor shortage, General Motors reiterated its 2021 full-year guidance. It expects to achieve $6.8 billion-$7.6 billion net income, or adjusted diluted EPS of between $4.50-5.25.

In recent months, management has highlighted that the company will devote considerable resources to EV growth.

Shareholders have been delighted with the direction the company is taking.

Long-term GM investors have also been excited about 'Cruise,' the autonomous driving firm partially owned by General Motors. Other partners in the business include Microsoft (NASDAQ:MSFT), Honda (NYSE:HMC), Softbank (OTC:SFTBY) and Walmart (NYSE:WMT).

Over the past 12 months, GM stock has returned about 115%. The stock closed at $58 on Wednesday.

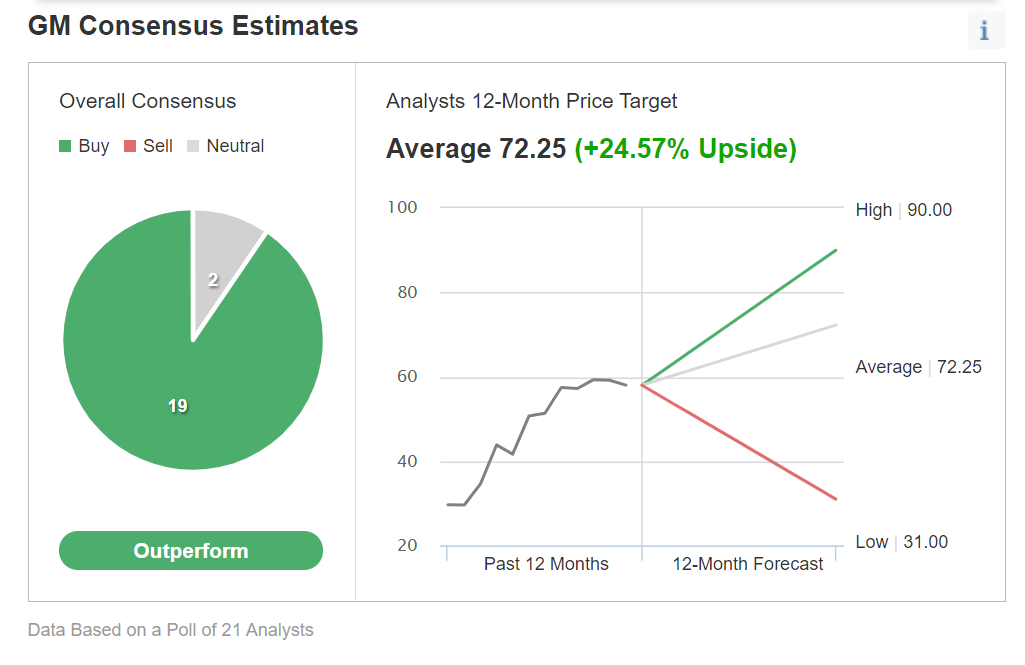

Among 21 analysts polled via Investing.com, it was projected to 'Outperform.' With an average 12-month price target of $72.25, that would represent a return of more than 22%.

The stock's trailing P/E, P/S and P/B ratios stand at 9.5, 0.7 and 1.82, respectively. For comparison, Tesla’s trailing P/E, P/S and P/B ratios are 673.71, 17.92 and 27.97.

In summary, Wall Street is bullish on General Motors. We also believe GM stock looks attractive from a value standpoint. Coupled with management’s position in EVs and autonomous driving, we believe the stock should belong in a long-term portfolio.

Short Term Volatility Likely In General Motors Stock

Despite the bullish outlook on GM shares over the long run, there could be several short-term headwinds for the stock, especially between now and when the company reports earnings on Wednesday, July 28 ahead of the open.

Those investors who watch technical charts might be interested to know that GM stock could possibly trade sideways in the coming weeks, especially between $55 and $60.

Since early June, the shares have lost about 10% of their value, providing a better entry point for buy-and-hold investors. However, there could still be a further pullback toward the $56 level, or even below.

We should also note that the beta (β) of GM is 1.33, a measure of a security's volatility in relation to the overall market.

Thus, a company like GM whose β is greater than 1 is more volatile than the market. With a beta of 1.33, GM has a level of volatility 33% greater than the market average. In other words, we should expect swings in price, especially in the short run.

As part of the short-term sentiment analysis, it would be important to look at the implied volatility levels for GM options. Implied volatility typically shows traders the market's opinion of potential moves in a security, but it does not forecast the direction of the move.

GM’s current IV is 33.2, which is higher than the 20-day moving average of 30.9. In other words, implied volatility is trending higher.

In summary, charts and options markets are urging caution. Given the high beta of GM stock, we can expect swings in price. Our first expectation is for a potential pullback toward $56. In case of such a decline, long-term investors would find better value.

Possible Trades

For readers who are of the opinion that General Motors still has room to run higher, they may want to add GM stock to their long-term portfolios.

Depending on individual portfolio allocations and risk/return profiles, here are three types of trades. These trades are based on GM stock’s intraday price of $58.96 on July 14. Please note that various calculations below exclude trading costs or taxes.

1. Buy GM Stock At Current Level:

Investors who are not concerned with daily moves in price and who do not want to wait for a potential decline of about 5%-7% from the current levels, could consider investing in GM stock now.

Such buy-and-hold investors should expect to hold this long position for several months while GM stock potentially makes another attempt at the all-time high of $64.30 and beyond.

Assuming an investor enters this trade at the current price of $58.96 and exits at $64.30, the return would be slightly more than 9%.

Investors could also consider placing a stop loss at about 3% below their entry point.

2. Buy A LEAPS Option As A ‘Surrogate’ For Owning GM Stock:

Investors who would like to buy 100 shares of GM stock would need to invest $5,896 (current price of $58.96 X 100 shares).

For some investors who are bullish on General Motors, this could be a sizeable investment. Instead, they could consider buying a LEAPS call with a delta of 0.80, such as the GM Jan. 20, 2023, 45-strike call option. This option is currently offered at $17.80.

We covered the mechanics and the risk/return profile of LEAPS here. But in simple terms, the delta rating shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

In this case, if GM stock goes up $1 to $59.96, the current option price of $17.80 would be expected to increase by 80 cents, based on a delta of 0.80. However, the actual change might be slightly more or less, based on several other factors.

The profit-loss profile of this trade will differ constantly as the price of the underlying GM options changes. However, on Jan. 20, it would break even at an underlying price of $62.80. To arrive at this number, one can add the current option premium of $17.80 to the strike price of $45.00, i.e., $62.80.

The maximum return on the upside would be uncapped, depending on where GM stock trades on the day the investor closes the position.

Investors should remember that although the expiry is in January 2023, this long-term option still expires. As the expiration day approaches, an option loses value at an accelerating rate. If GM stock were to tank and close below $45 in January 2023, the maximum loss would be $1,780. Therefore, trade management will be important for those who decide to set up a LEAPS strategy.

3. Sell A Cash-Secured Put Option:

Our third trade involves a cash-secured put strategy. We have recently covered this option in numerous articles. Here is one example.

Traders could now sell a Sept.17 57.50-strike put option, which is currently being offered at $3.18.

Assuming traders would enter this put selling strategy at the current prices, the upside is keeping this premium of $318 as long as GM stock closes above $57.50, when the option expires. Although, $318 would be the maximum return for this trade.

The downside is that if GM stock trades below $57.50 ahead of expiration, traders could be assigned 100 shares for each sold put at a cost of $57.50 per share.

At expiry, this trade would break even at a stock price of $54.32 (i.e.,$57.50-$3.18).

Bottom Line

General Motors is aggressively investing in EV technology, and management is eager to build on the current momentum in the alternative energy market. Therefore, GM stock, which has had a strong year, could continue to offer sizeable gains in the quarters ahead as well. However, there is likely to be volatility ahead before the next bull leg begins.