September is historically the worst month for equities but 2018 is shaping up to be an exception.

US stocks hit a record high and this was crucial to the recovery of euro, aussie and other major currencies. The big story this month was that investors ignored all of the negative trade headlines, choosing instead to focus on positive data surprises from the US and other parts of the world. The US dollar’s slide last week against all of the major currencies except for the Japanese yen reinforces the risk-on story. The best-performing currency was the New Zealand dollar, which shot higher on the back of strong GDP. Aside from the yen, sterling was the weakest as the UK is no closer to a Brexit deal with the EU. Looking ahead, the question on everyone’s mind is whether the dollar will have a strong or weak end to the quarter. There’s no doubt that the Federal Reserve will raise interest rates by 25bp on Wednesday but how the dollar reacts will depend on their guidance. But that’s not the only factor affecting the greenback because month- and quarter-end flows will also influence FX trade.

US Dollar

Data Review

- Empire Manufacturing 19 vs 23 Expected

- NAHB Housing Market Index 67 vs 66 Expected

- Current Account Balance -$101.5b vs -$103.5b Expected

- Housing Starts 9.2% vs 5.7% Expected

- Building Permits -5.7% vs 0.5% Expected

- Philadelphia Fed Business Outlook 22.9 vs 18 Expected

- Existing Home Sales 0.0% vs 0.5% Expected

- BoJ Keeps Rates Steady at -0.10% as Expected

Data Preview

- FOMC Rate Decision - Fed expected to hike but guidance is key. Not clear if this will be dovish or hawkish hike

- Consumer Confidence - Potential for downside surprise given lower IBD/TIPP

- New Home Sales - Potential for downside surprise given zero change in existing home sales

- Advance Goods Trade Balance, GDP and Durable Goods Orders - Revisions to GDP are hard to predict but if changes are made they can be market moving

- PCE Deflator, Personal Income and Spending - Stronger wage growth offsets weaker retail sales so tough call

- Chicago PMI - Weaker Empire offset by stronger Philly so tough call

- University of Michigan Consumer Sentiment Report - Revisions are difficult to predict but if changes are made they will be market moving

Key Levels

- Support 111.00

- Resistance 113.00

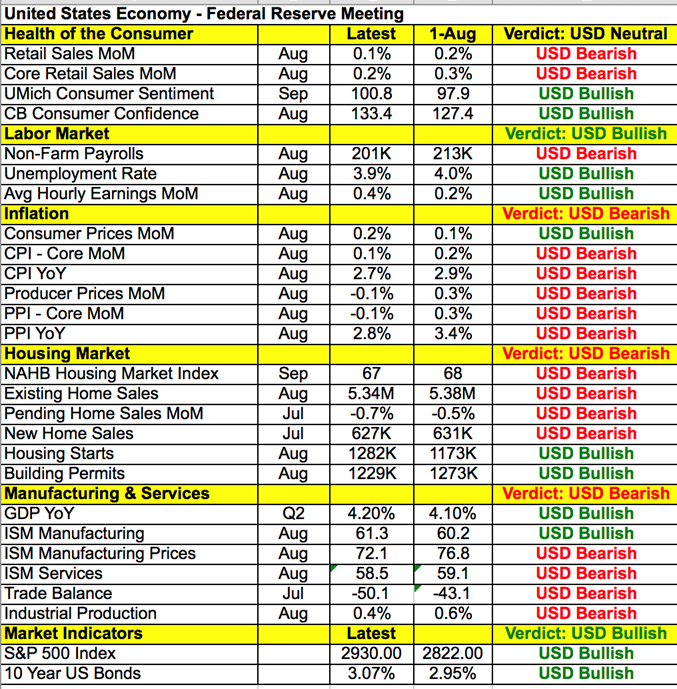

Judging from the recent performance of the US dollar, investors are preparing for a dovish hike. This means that the Federal Reserve will raise interest rates by 25bp on Wednesday and temper expectations for additional tightening this year. The market is pricing in 100% chance of a hike on September 26 and a 75% chance of tightening on December 19, which implies that there’s a still a large subset of investors who anticipate a fourth hike this year. We think the risk of disappointment is greater than a positive surprise because, after 3 rounds of tightening, it would behoove the Fed to take a break, especially given the president’s criticism, trade war uncertainty and mixed data. Since July, there’s been weakness in retail sales, inflation, housing and manufacturing activity. However with strong corporate earnings, record highs in stocks and continued labor-market strength, if the Fed wanted to raise interest rates again, the arguments are there. As a result, we expect the dollar to consolidate with a mild bias to the downside before the FOMC rate decision. There are a handful of other economic reports scheduled for releases such as consumer confidence, personal income, and personal spending but they will be overshadowed by FOMC flows. Portfolio rebalancing flows should also weigh on the dollar but we may have already seen some of those moves last week. USD/JPY, in particular, is vulnerable to a correction back to 111.50.

Euro

Data Review

- EZ CPI 0.2% vs 0.2% Expected

- EZ Current Account Balance 21.3b vs 23.8b Prior

- EZ Consumer Confidence -2.9 vs -2.0 Expected

- GE Manufacturing PMI 53.7 vs 55.7 Expected

- GE Services PMI 56.5 vs 55 Expected

- GE Composite PMI 55.3 vs 55.4 Expected

- EZ Manufacturing PMI 53.3 vs 54.5 Expected

- EZ Services PMI 54.7 vs 54.4 Expected

- EZ Composite PMI 53.3 vs 54.5 Expected

- SNB Keeps Rates at -0.75% as Expected

Data Preview

- FO Report - Potential for downside surprise given stronger ZEW and weaker manufacturing PMI

- Consumer Confidence and ECB Economic Bulletin - Will have to see how IFO fares but ZEW was stronger

- GE CPI - Potential for upside surprise given weaker euro and stronger oil prices, which should drive up CPI

- GE Unemployment Change and Claims - Potential for downside surprise as rate of job creation eased slightly from Aug

- EZ CPI - Will have to see how German and French CPI fares

Key Levels

- Support 1.1600

- Resistance 1.1800

The euro almost exclusively driving the market’s appetite for US dollars and risk-on, risk-off flows. Friday’s Eurozone PMIs were the only pieces of data released and they are mixed with manufacturing activity slowing and service-sector activity accelerating. The composite index declined slightly as a result. There have been widespread signs of slowing in Germany’s manufacturing sector and we think it will affect Monday’s IFO report. EUR/USD hit a 2-month high last week but it is vulnerable to a correction down to 1.1650. The Swiss franc rose to a 5-month high despite the Swiss National Bank’s growing concern about the currency. Although they continue to describe the CHF as highly valued, they said the currency has appreciated noticeably and are therefore prepared to intervene if necessary. They also cut their inflation forecast and said second-half growth could be softer. Diversification out of sterling into the franc is the only reason that we see for the currency’s strength.

British Pound

Data Review

- CPI 0.7% vs 0.5% Expected

- RPI 0.9% vs 0.6% Expected

- PPI Input 0.5% vs 0.5% Expected

- PPI Output 0.1% vs 0.2% Expected

- PPI Output Core 0.1% vs 0.1% Expected

- Retail Sales Ex Auto Fuel 0.3% vs -0.3% Expected

- Retail Sales Inc. Auto Fuel 0.3% vs -0.2% Expected

Data Preview

- Current Account Balance and GDP - Revisions to GDP are hard to predict but if changes are made they can be market moving

Key Levels

- Support 1.2900

- Resistance 1.3200

Sterling’s sensitivity to Brexit headlines was made clear on Friday when the currency lost all of the gains that it had slowly built up during the week. At the start of the month, it appeared that a deal was close but the talks broke down last week when Prime Minister May said they were at an impasse. She said they are far apart on two big issues and the UK expects respect from the EU rather than an outright refusal to accept their proposal. The biggest hangups are their post-Brexit economic relationship and the Irish border. May sees no deal as better than a bad deal, which is bad news for sterling, especially as her own Eurosceptic MPs want her to abandon her Chequers plan. Stronger-than-expected retail sales and consumer price growth were completely overshadowed by Brexit. With no major UK economic reports on the calendar in the coming week, we expect further weakness in sterling. GBP/USD should drop below 1.30 but its greatest weakness may be against the yen and commodity currencies. GBP/JPY in particular could fall below 146.

AUD, NZD, CAD

Data Review

Australia

- RBA Meeting Minutes Show Continued Caution Over Trade Tensions

New Zealand

- PMI Services 53.2 vs 55.1 Prior

- GDT Prices Drop 1.3%

- Consumer Confidence 103.5 vs 108.6 Prior

- BoP Current Account Balance -1.619b vs -1.315b Expected

- GDP 1.0% vs -0.8% Expected

Canada

- Existing Home Sales 0.9% vs 1.9% Prior

- Manufacturing Sales 0.9% vs 0.6% Expected

- Retail Sales 0.3% vs 0.3% Expected

- Retail Sales Ex Auto 0.9% vs 0.6% Expected

- CPI -0.1% vs -0.1% Expected

Data Preview

Australia

- No Data

New Zealand

- Trade Balance - Potential for upside surprise given Stronger manufacturing PMI index, weaker currency

- RBNZ OCR - No changes expected from RBNZ but beware of cautious comments

Canada

- GDP - Potential for upside surprise given significantly better trade balance and retail sales

Key Levels

- Support AUD .7200 NZD .6600 CAD 1.2800

- Resistance AUD .7350 NZD .6750 CAD 1.3200

The Australian and New Zealand dollars were the best-performing currencies. While their rallies have taken them to important resistance levels versus the US dollar, we still expect AUD and NZD to outperform in the week ahead. Data has been better than expected and most importantly these deeply oversold currencies are due for a recovery. It is also very positive that the market was able to look past the latest US tariffs on China and their response. The trade war is still raging but the shots taken by both sides this month were not as powerful as the world may have feared. For the first time, Beijing was not able to match Washington’s tariffs dollar by dollar because they don’t import $200 billion worth of US goods. On the trade front, China is running out of options. If they want to increase pressure on Washington, they’ll need to do so by limiting US business activity, weakening its currency or selling US Treasuries but all of these would have consequences on China’s economy. However, it seems that China still wants to go the diplomatic route and is open to additional talks. No trade news will be good news for the Australian dollar in the coming week.

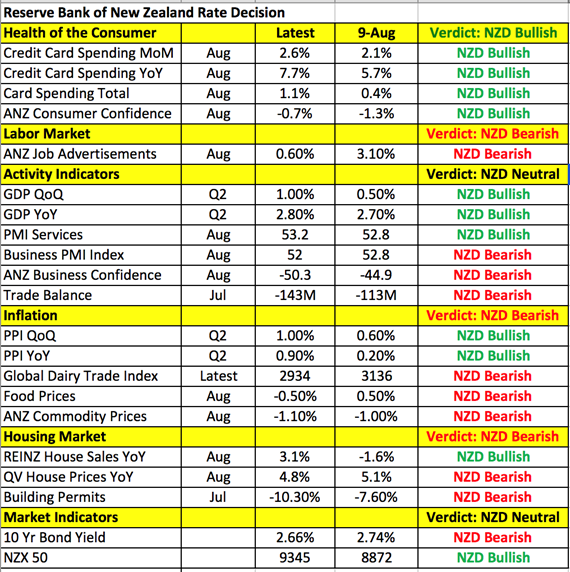

The performance of the New Zealand dollar, on the other hand, will be largely impacted by the Reserve Bank’s monetary policy announcement. When they last met, they sent NZD/USD tumbling to its lowest level in 2.5 years by pushing out their forecast for a rate hike from Q3 of 2019 to Q3 of 2020. This was a significant change at the time that reflected their concern about growth. However, since then, we’ve seen quite a bit of improvement in New Zealand’s economy, especially in consumer spending, GDP and inflation. In the second quarter, the economy expanded at its fastest pace in 2 years. Although weakness elsewhere keeps the central bank neutral, these latest reports reduce the chance of easing by the RBNZ and increases the odds of a slightly brighter outlook by the central bank. If the RBNZ says nothing damaging, NZD/USD could squeeze up to 68 cents; but if they maintain an overly cautious outlook, the pair could slide below 66 cents.

After selling off throughout the month, USD/CAD is due for a recovery. Last week’s economic reports were mixed with retail sales growth rising more than expected and inflation falling. These reports had minimal impact on a currency that is being jockeyed around by trade headlines. Canadian Foreign Minister Freeland came back to the US to continue talks but according to the White House, they are getting very close to a NAFTA deal that involves Mexico and not Canada. Every trade negotiation deadline has been blown and if they don’t reach an agreement by next week, President Trump could choose to move forward with Mexico alone because he wants a deal signed before the current president leaves office. Trade headlines should overshadow next week’s GDP report and the risk of no deal with Canada means USD/CAD could squeeze back to 1.30. Technically, there’s a lot of support for USD/CAD above 1.2850.