VALUATIONS: We are positive on the resilience of the super-sized US stock market. But its combination of already high profitability and above average valuations limits the upside. These are the only two-levers of stock performance. This means the magnitude of this bull market may be lower than the long-term average of near 150%. And that the relative upside from here is increasingly elsewhere. Much of the rest of the world, and many cyclical sectors, still have a double earnings and valuation upside combo, and clearer rate cut and growth rebound catalyst. Their wider than average valuation discounts offer upside potential and downside protection.

RELATIVE: The US is expensive for a reason. With higher GDP growth, a big tech sector, and strong governance. Tech deserves its high valuation. With huge profitability, balance sheet strength, and outsize growth. Whilst Europe’s valuation is justifiably held back. By higher debt and more cyclical index composition alongside lower growth and profit margins. You cannot compare apples with oranges. The question is the size of the gap. Europe’s Stoxx 600 and FTSE 100 price/earnings discount is now 15pp and 20pp wider than the 10-yr average 20% and 25%. Chinese stocks are 20pp cheaper than the average 35%. Yet not everything has changed. The 2nd largest US financial sector, for example, is still on an average 28% discount to US tech.

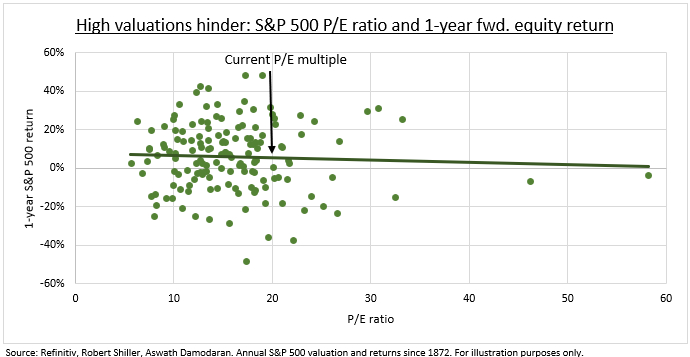

MATTER: Valuations matter, especially over the longer term. Our plot of 150 years of US stock market valuations versus 1-year forward returns (see chart) shows the odds turning against you at current high valuation levels. And this only worsens over time as the correlation between the two significantly increases. Simplistically, lower valuations have more room to rise when times are good. And less room to fall when the fundamentals turn against you. Whilst lower valuations are also a technically positive contrarian sign of stocks being under-owned and out of favour.

- English (USA)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why valuations matter

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.