Whitbread (LON:WTB) continues to show that the strong get stronger with Premier Inn, much the largest UK hotel chain, materially outperforming the market throughout H1 to August and to date (by 14% in the seven weeks to 14 October). Notwithstanding seasonality, accentuated by the staycation boon, management expects leisure demand to remain buoyant, with tradespeople business resilient and office-based custom recovering, thereby a potential return of UK like-for-like RevPAR to pre-pandemic levels ‘at some point in 2022’. Robust, asset-backed finances (£2.1bn liquidity) give ample scope to capitalise on structural opportunities, enhanced by COVID-19 fallout, in the highest growth segment of the hotel market, both domestically and in Germany, where management is confident of replicating its UK success.

Share price graph

Business description

Whitbread owns and operates Premier Inn, one of the largest budget branded hotel chains in the world. It is a clear leader in the UK with c 81,000 rooms and has a growing presence in Germany (c 5,000 rooms). Its restaurant brands, primarily on joint sites with Premier Inn, include Beefeater and Brewers Fayre.

Bull

- Strong position in a long-term growth market (budget hotels) with significant opportunity to repeat UK success in Germany.

- Benign environment post COVID-19: pent-up demand, reduced competition and enhanced availability of sites at lower prices and on more flexible terms.

- Robust, asset-backed balance sheet (available liquidity of c £2.1bn at August 2021).

Bear

- Threat of continuing COVID-19 restrictions.

- Macroeconomic uncertainties and operating challenges, mitigated by retention of good liquidity, new three-year £100m efficiency programme and scale (eg buying power and staff career opportunities).

- Execution risk in terms of planned expansion.

H1: Post-lockdown surprise

As only essential business was allowed up to 17 May (the bulk of Whitbread’s Q1), the pace of recovery to end August from almost a standing start is impressive, with Q2 UK accommodation sales (London apart) matching those of the same period of 2019 despite continued COVID-19 restrictions. While the staycation boon and VAT reduction were exceptional factors, Premier Inn’s brand strength, scale, distribution and value offering allowed double-digit pp outperformance of the midscale and economy sector in Q2. Central London was subdued, given weak international demand, but accounts for only 7% of rooms. In Germany (2% of H122 sales), severe restrictions throughout H1 (occupancy 32%) preclude detailed assessment other than recognition of a recovering market (60%+ occupancy in August).

Germany: Aiming to be number one

Whitbread confirms good progress in its goal to be the leading budget operator in Germany, a market potentially even more attractive than the UK as 40% larger, with greater regional spread and highly fragmented (independents 72% share vs 48% in the UK). Its open and committed pipeline of c 14,000 rooms, largely accrued during the pandemic, is already over half that of leader Ibis and on track for 60,000 rooms, which may understate as it’only 6% market share (Premier Inn has 11% in the UK).

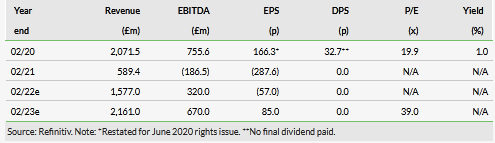

Valuation: Attractive

With FY22 disrupted by COVID-19, pre-pandemic FY20 and pre-IFRS 16 numbers give a better guide to a likely valuation. £567m EBITDA on net cash of £60m (August 2021; excluding leases) suggests an EV/EBITDA of 11.6x, reflecting Whitbread’s clear long-term growth potential (average of 9.3x for European peers on similar basis).