In our last update on Bitcoin, where we presented a forecast for 2024, we found that based on historical evidence,

“BTC moved late November/early December from the Early-Bull phase into its Mid-Bull phase, which will end in late 2024, each time this phase transition happened, BTC struggled for a few months: topped around January +/-1 month, bottomed around February +/- 1 month with an average loss of around 20 +/- 5%, and then rallied into July +/- 1 month. Thus, we should expect Q1 to be “soft”, and Q2 to be strong. From an EWP perspective, our primary expectation is for BTC to be in the green W-2 of red W-iii, which matches the four-year cycles. See Figure [1] below.”

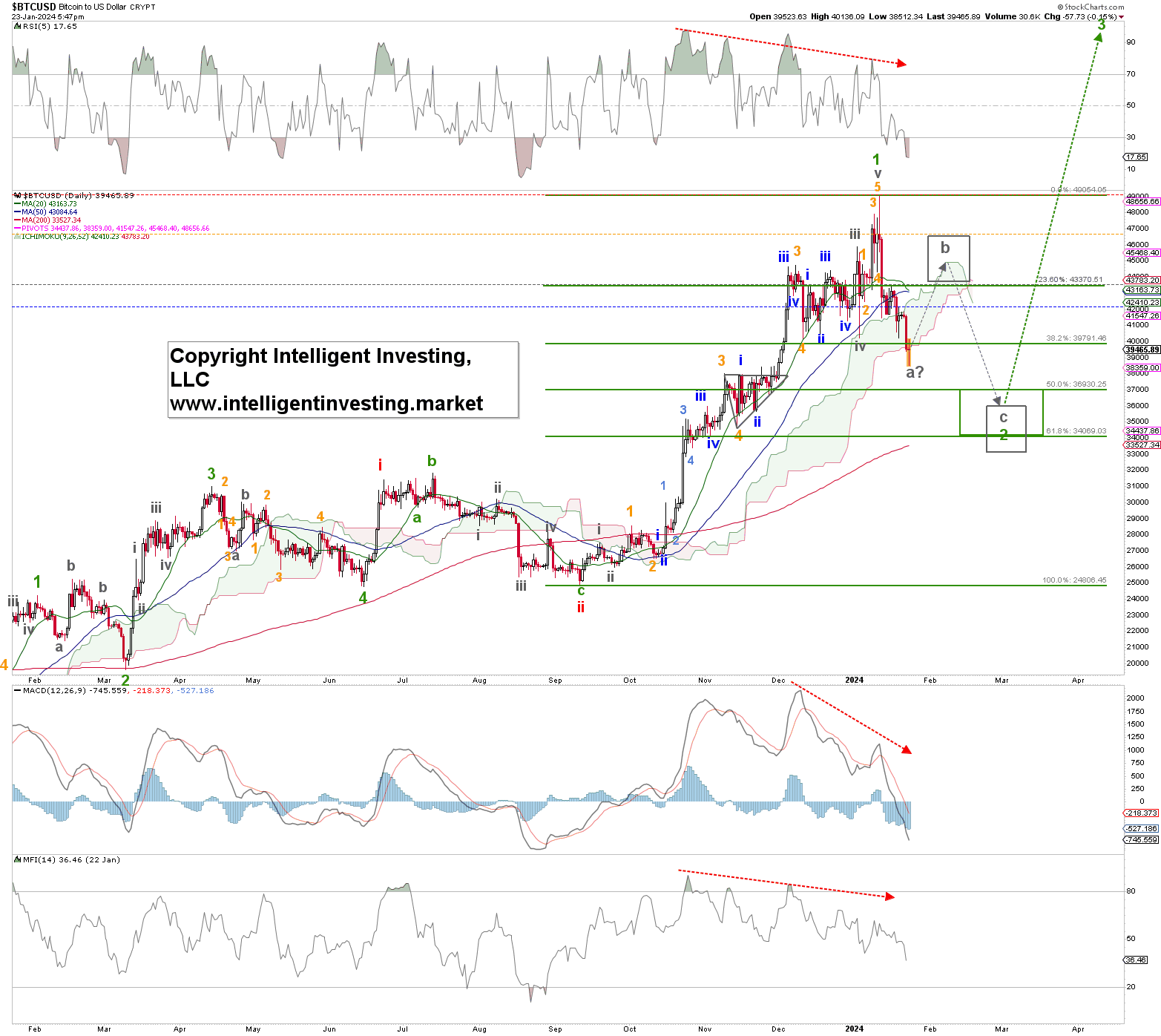

Fast-forward to January 11. BTC peaked at $49054 and has since experienced an 18% pullback. It is the largest since the rally from the September 2023 low started, strongly suggesting the green W-2 to ideally $37+/-2.5K is underway. Indeed, Q1 is weak so far, as all gains made since December 4 have now been erased. Besides, we have refined our Elliott Wave Principle (EWP) count to account for all waves since that low.

Figure 1. The daily chart of BTC with technical indicators and detailed EWP count. Since 2nd waves are corrections, which always move in three waves and are labeled as “a-b-c,” BTC should now be in (grey) W-a of green W-2. See Figure 1 above. Typically, a correction’s first leg (W-a) reaches around the 38.20% retracement of the previous same-degree impulsive advance. In this case, that is all the green W-1; 38.2% is at $39790, and currently, BTC’s price is right about there. Meanwhile, several technical indicators like the RSI5 and MACD are oversold. Thus, we should expect a “dead cat bounce,” the grey W-b, which typically retraces 50-76.40% of the W-a. Sometimes more, sometimes less. In this case, that would mean $45.0 +/- 1.5K. Once (grey) W-b is complete, the third and final leg, W-c, should materialize. C-waves are often fast and furious and relate to the previous W-a as 1x a to 1.618x a. Again, sometimes more, sometimes less. But we can only work with what we know. These typical Fibonacci-based relationships thus target $35+/-1K, which matches the aforementioned W-2 target zone of $37.5+/-2.5K.

Since 2nd waves are corrections, which always move in three waves and are labeled as “a-b-c,” BTC should now be in (grey) W-a of green W-2. See Figure 1 above. Typically, a correction’s first leg (W-a) reaches around the 38.20% retracement of the previous same-degree impulsive advance. In this case, that is all the green W-1; 38.2% is at $39790, and currently, BTC’s price is right about there. Meanwhile, several technical indicators like the RSI5 and MACD are oversold. Thus, we should expect a “dead cat bounce,” the grey W-b, which typically retraces 50-76.40% of the W-a. Sometimes more, sometimes less. In this case, that would mean $45.0 +/- 1.5K. Once (grey) W-b is complete, the third and final leg, W-c, should materialize. C-waves are often fast and furious and relate to the previous W-a as 1x a to 1.618x a. Again, sometimes more, sometimes less. But we can only work with what we know. These typical Fibonacci-based relationships thus target $35+/-1K, which matches the aforementioned W-2 target zone of $37.5+/-2.5K.

The dotted horizontal lines on the chart in Figure 1 show what we call “warning levels” for, in this case, the Bears. Above the blue dotted line at $42,140 is the first signal that grey W-b is underway. The grey line at $43525 is the second signal, etc. Each higher level/signal increases the odds that W-b is underway. If BTC’s price moves above the red dotted line, the January 11 high, it tells us that the W-3 is likely already underway.

Assuming W-2 bottoms at around $34K while knowing W-1 was $24K ($25->$49K), we can calculate W-3 to reach ideally: $34K + 1.618 x $24K = $72.8K. Thus, as stated in many prior articles:

“We have been Bullish on BTC for quite some time. However, our Bullish scenario is entirely invalidated below $25K. Only when that happens will we change our overall, longer-term Bullish POV, which BTC is proving more correct for each update we provide in that, based on BTC’s past cycles, made up of four more minor phases, it is currently in the “Mid Bull” phase and thus close to the next Bull run, which can target $100-200+K by the end of 2025.”