By Blake Heimann

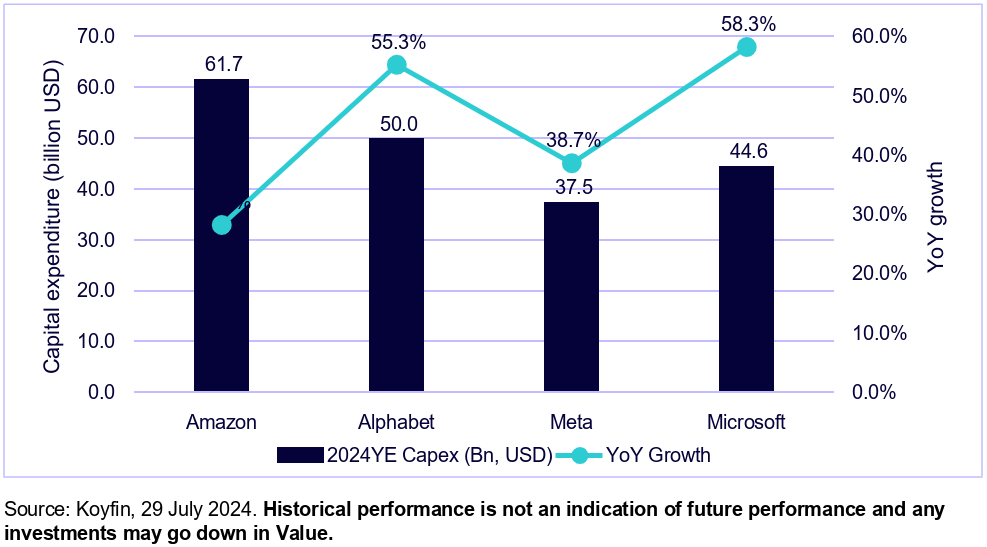

Since the release of ChatGPT, mega cap technology companies poised to profit from AI-enhanced software tools or cloud AI-model training capabilities have seen a surge in their stock prices. Yet, many are yet to realise significant AI-driven revenue growth, let alone a substantial impact on their bottom lines. This has formed the basis for what Sequoia Capital calls AI’s $600B question – whether today’s capital expenditure (capex) levels can offer an estimated $600B in revenue generated from AI software and services to provide positive return on investment (ROI), given the industry’s heavy investment in hardware infrastructure.

The obvious beneficiaries of this investment so far have been Nvidia (NASDAQ:NVDA) and its semiconductor peers, experiencing exponential revenue growth due to high demand for AI training chips. With significant capital expenditures being made to purchase these chips and build the next wave of AI data centres, several critical questions arise: Will end users and enterprises see enough value to justify these costs? Will current investments in AI infrastructure deliver positive returns? And, most importantly, are these firms fairly valued?

In this blog, we will focus on valuation, examining whether the current stock prices of these tech giants are justified given the modest impact of AI on their revenues so far.

Valuation trends and market sentiment

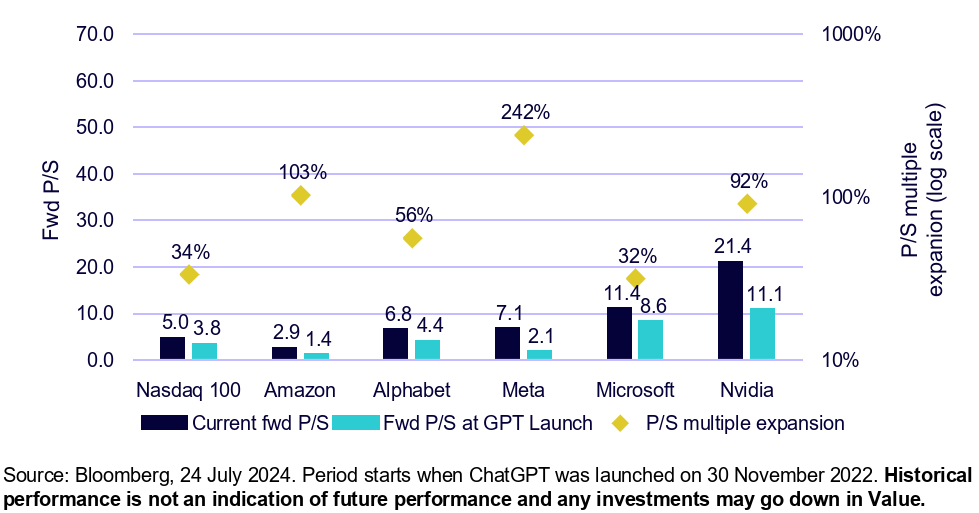

The narrative has always positioned AI as a software revolution. While semiconductors serve as essential tools, software will be the key differentiator as users seek the most advanced, intelligent platforms. Consequently, mega cap tech companies have seen significant stock price appreciation since ChatGPT's launch, driven by investor optimism about AI's potential future earnings being concentrated amongst these prominent players. However, this enthusiasm has led to valuation multiple expansions, which many believe may indicate a bubble.

Examining the period since ChatGPT's launch, Figure 2 shows that the Nasdaq forward price-to-sales (P/S) ratio expanded from 3.8 to 5.0, a moderate 34% increase. However, Amazon (NASDAQ:AMZN), Google, Meta, and Nvidia all saw over 50% expansions, with some exceeding 100%. This could imply that these stocks are overvalued or that the market considers them fairly valued, given the expectations of substantial future AI revenues and earnings potential beyond current forward sales estimates.

More recently, Wall Street's sentiment towards these firms has shifted from positive to negative as investors question the potential ROI from large capital expenditures and the timeline for realising these returns. Last week's earnings reports from major tech companies revealed mixed results.

Amazon's stock declined due to a cautious revenue outlook and disappointing sales, compounded by rising costs to expand Amazon Web Services. Microsoft (NASDAQ:MSFT) reported slowing growth in its Azure cloud-computing arm and plans to continue substantial investments in data centers. In contrast, Meta posted strong earnings, appeasing investors and buying time for its AI investments to bear fruit. Meanwhile, Alphabet (NASDAQ:GOOGL)'s shares fell after the company surprised Wall Street with sharply higher costs, overshadowing its better-than-expected sales. The impact of a weaker-than-expected jobs report at the end of the week further exacerbated declines in these stocks, prompting investors to reassess their positions amid a slowing economy. As a result, there have been significant multiple contractions as investors sell shares and reposition themselves. The valuation premium previously afforded to these stocks has diminished, as concerns grow that the AI hype may not meet expectations.

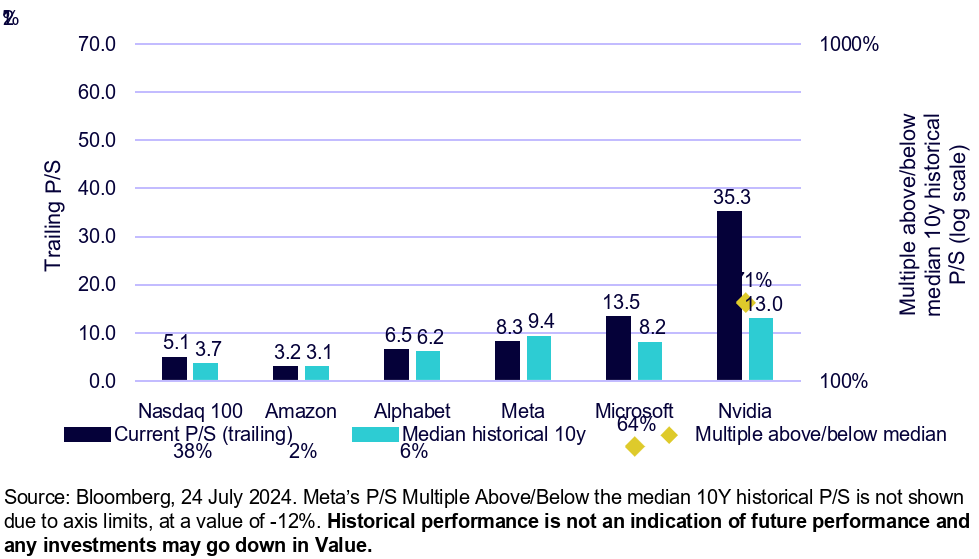

Examining current P/S ratios in the context of historical trends can provide valuable insights into whether valuations have become stretched compared to the past. Figure 3 sheds light on whether the recent pullbacks in stock prices are justified.

Nvidia and Microsoft stand out as notable outliers, with current P/S ratios significantly higher than their historical 10-year medians. This could suggest that the market expects fair value for extremely strong growth ahead, or it could indicate overvaluation. By piecing together forward and historical ratios, we see that Amazon, Google, and Meta have recovered from relatively low valuation ratios recently. With significant multiple expansions post-ChatGPT launch, they have returned to valuations in line with their historical numbers. However, the story may be different for Microsoft and Nvidia, as both have experienced significant multiple expansions beyond what is seen in the broader Nasdaq index, materially exceeding historical norms.

AI's potential as a game-changer for mega cap tech companies might justify higher valuations now and into the future. Historically, investing in these firms five or more years ago would have been highly profitable, regardless of valuation. However, current valuations of some indicate a significant 'valuation premium' compared to the past, which likely explains why investors are now more cautious. This caution has contributed to recent price pullbacks, even amidst positive earnings reports.

Historical perspectives on valuations

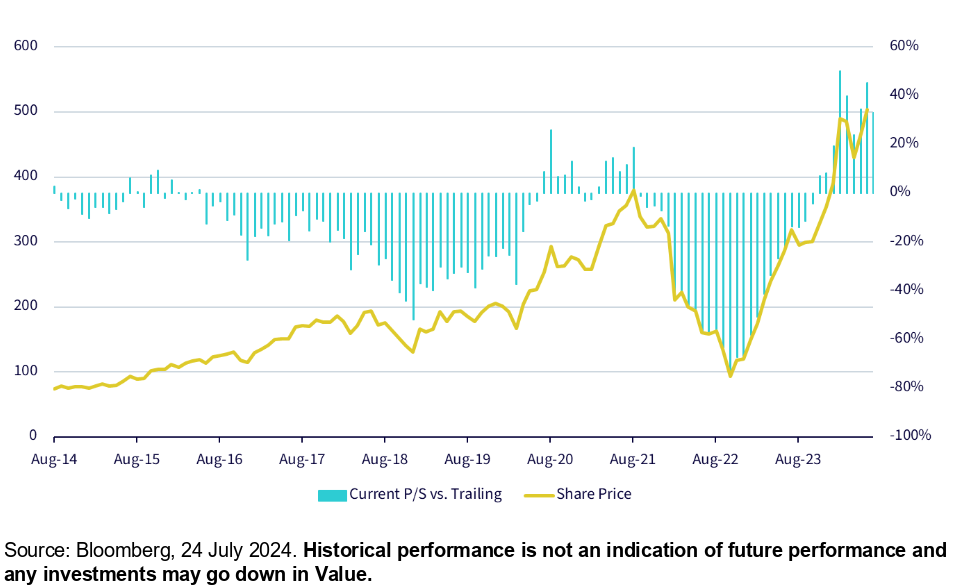

Investing in exponential technologies like AI can benefit portfolios, but it is essential to manage concentration risk and market timing. By being aware of valuation trends, investors can strategically trim positions when overvalued and add when undervalued – following the classic ‘buy low, sell high’ adage. A 10-year chart of Meta illustrates how trimming positions during overvaluation periods and accumulating during undervaluation relative to historical norms could have been beneficial.

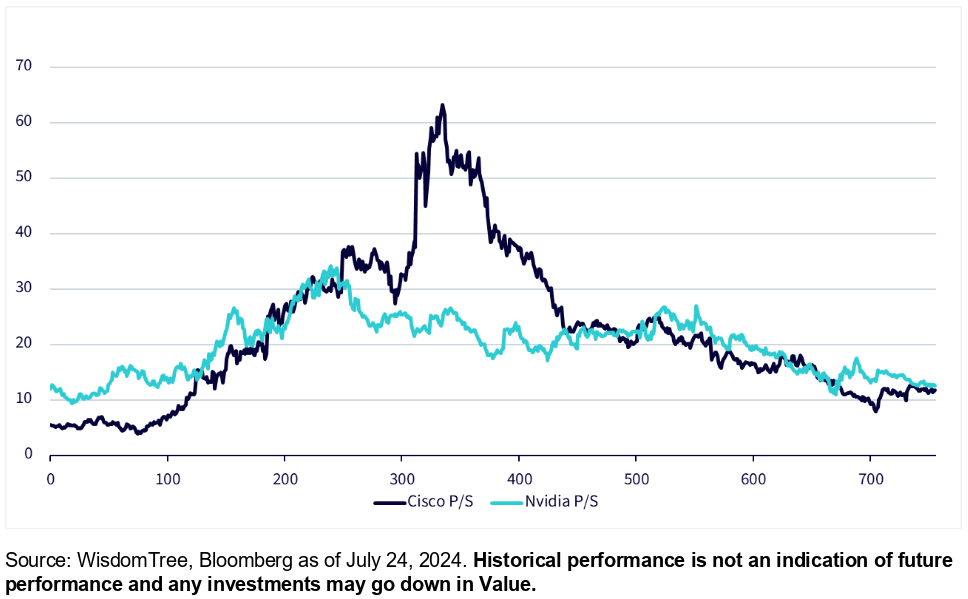

Reflecting on past market bubbles, such as Cisco (NASDAQ:CSCO) during the dot-com era, can provide valuable context for remaining valuation-sensitive when investing in technology equities. Cisco's P/S ratio soared to 60 before the stock price collapsed by over 80% in the early 2000s. Comparatively, Nvidia’s current P/S of approximately 35 is not at dot-com bubble levels, indicating a less extreme valuation.

This historical perspective helps address the question, ‘How far is too far?’ when valuations seem stretched. While mega cap tech firm P/S ratios have expanded significantly since the onset of the AI wave, it remains well below the extremes seen during the dot-com bubble. This suggests that although valuation multiples have increased since ChatGPT's launch, we are not witnessing a bubble akin to the early 2000’s.

Conclusion

While investing in AI and exponential technologies is exciting, a valuation-aware approach is crucial. Rather than avoiding these investments entirely, investors should adjust their exposure as valuations fluctuate, ensuring they avoid over-concentration at peak valuations and maintain a diversified portfolio.

At WisdomTree, we seek to take this approach in our WisdomTree Artificial Intelligence UCITS ETF, which offers a systematic approach to capture the potential gains in the AI segment through the AI value chain, including engagers, enablers and enhancers. With the exposure engagers – software companies that are directly involved in AI and running an AI business, enablers – hardware companies that provide the infrastructure for AI to run; and enhancers – tech giants who are prominent in AI but the relevant industry is not a core part of their revenue, the fund remains diversified through taking a modified equal weighting approach, with the flexibility to rebalance allocations, giving investors the benefit of flexibility within a highly dynamic market environment.

________________________

IMPORTANT INFORMATION

Marketing communications issued in the European Economic Area (“EEA”): This document has been issued and approved by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Marketing communications issued in jurisdictions outside of the EEA: This document has been issued and approved by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

WisdomTree Ireland Limited and WisdomTree UK Limited are each referred to as “WisdomTree” (as applicable). Our Conflicts of Interest Policy and Inventory are available on request.

For professional clients only. Past performance is not a reliable indicator of future performance. Any historical performance included in this document may be based on back testing. Back testing is the process of evaluating an investment strategy by applying it to historical data to simulate what the performance of such strategy would have been. Back tested performance is purely hypothetical and is provided in this document solely for informational purposes. Back tested data does not represent actual performance and should not be interpreted as an indication of actual or future performance. The value of any investment may be affected by exchange rate movements. Any decision to invest should be based on the information contained in the appropriate prospectus and after seeking independent investment, tax and legal advice. These products may not be available in your market or suitable for you. The content of this document does not constitute investment advice nor an offer for sale nor a solicitation of an offer to buy any product or make any investment.

An investment in exchange-traded products (“ETPs”) is dependent on the performance of the underlying index, less costs, but it is not expected to match that performance precisely. ETPs involve numerous risks including among others, general market risks relating to the relevant underlying index, credit risks on the provider of index swaps utilised in the ETP, exchange rate risks, interest rate risks, inflationary risks, liquidity risks and legal and regulatory risks.

The information contained in this document is not, and under no circumstances is to be construed as, an advertisement or any other step in furtherance of a public offering of shares in the United States or any province or territory thereof, where none of the issuers or their products are authorised or registered for distribution and where no prospectus of any of the issuers has been filed with any securities commission or regulatory authority. No document or information in this document should be taken, transmitted or distributed (directly or indirectly) into the United States. None of the issuers, nor any securities issued by them, have been or will be registered under the United States Securities Act of 1933 or the Investment Company Act of 1940 or qualified under any applicable state securities statutes.

This document may contain independent market commentary prepared by WisdomTree based on publicly available information. Although WisdomTree endeavours to ensure the accuracy of the content in this document, WisdomTree does not warrant or guarantee its accuracy or correctness. Any third party data providers used to source the information in this document make no warranties or representation of any kind relating to such data. Where WisdomTree has expressed its own opinions related to product or market activity, these views may change. Neither WisdomTree, nor any affiliate, nor any of their respective officers, directors, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this document or its contents.

This document may contain forward looking statements including statements regarding our belief or current expectations with regards to the performance of certain assets classes and/or sectors. Forward looking statements are subject to certain risks, uncertainties and assumptions. There can be no assurance that such statements will be accurate and actual results could differ materially from those anticipated in such statements. WisdomTree strongly recommends that you do not place undue reliance on these forward-looking statements.

WisdomTree Issuer ICAV

The products discussed in this document are issued by WisdomTree Issuer ICAV (“WT Issuer”). WT Issuer is an umbrella investment company with variable capital having segregated liability between its funds organised under the laws of Ireland as an Irish Collective Asset-management Vehicle and authorised by the Central Bank of Ireland (“CBI”). WT Issuer is organised as an Undertaking for Collective Investment in Transferable Securities (“UCITS”) under the laws of Ireland and shall issue a separate class of shares ("Shares”) representing each fund. Investors should read the prospectus of WT Issuer (“WT Prospectus”) before investing and should refer to the section of the WT Prospectus entitled ‘Risk Factors’ for further details of risks associated with an investment in the Shares.

WisdomTree Artificial Intelligence UCITS ETF

Nasdaq® and the Nasdaq CTA Artificial intelligence Index are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by WisdomTree Management Limited. The WisdomTree Artificial Intelligence UCITS ETF (the “Fund”) has not been passed on by the Corporations as to its legality or suitability. Shares in the Fund are not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND.

Notice to Investors in Switzerland – Qualified Investors

This document constitutes an advertisement of the financial product(s) mentioned herein.

The prospectus and the key investor information documents (KIID) are available from WisdomTree’s website: https://www.wisdomtree.eu/en-ch/resource-library/prospectus-and-regulatory-reports

Some of the sub-funds referred to in this document may not have been registered with the Swiss Financial Market Supervisory Authority (“FINMA”). In Switzerland, such sub-funds that have not been registered with FINMA shall be distributed exclusively to qualified investors, as defined in the Swiss Federal Act on Collective Investment Schemes or its implementing ordinance (each, as amended from time to time). The representative and paying agent of the sub-funds in Switzerland is Société Générale Paris, Zurich Branch, Talacker 50, PO Box 5070, 8021 Zurich, Switzerland. The prospectus, the key investor information documents (KIID), the articles of association and the annual and semi-annual reports of the sub-funds are available free of charge from the representative and paying agent. As regards distribution in Switzerland, the place of jurisdiction and performance is at the registered seat of the representative and paying agent.

For Investors in France:

The information in this document is intended exclusively for professional investors (as defined under the MiFID) investing for their own account and this material may not in any way be distributed to the public. The distribution of the Prospectus and the offering, sale and delivery of Shares in other jurisdictions may be restricted by law. WT Issuer is a UCITS governed by Irish legislation, and approved by the Financial Regulatory as UCITS compliant with European regulations although may not have to comply with the same rules as those applicable to a similar product approved in France. The Fund has been registered for marketing in France by the Financial Markets Authority (Autorité des Marchés Financiers) and may be distributed to investors in France. Copies of all documents (i.e. the Prospectus, the Key Investor Information Document, any supplements or addenda thereto, the latest annual reports and the memorandum of incorporation and articles of association) are available in France, free of charge at the French centralizing agent, Societe Generale (EPA:SOGN) at 29, Boulevard Haussmann, 75009, Paris, France. Any subscription for Shares of the Fund will be made on the basis of the terms of the prospectus and any supplements or addenda thereto.

For Investors in Malta: This document does not constitute or form part of any offer or invitation to the public to subscribe for or purchase shares in the Fund and shall not be construed as such and no person other than the person to whom this document has been addressed or delivered shall be eligible to subscribe for or purchase shares in the Fund. Shares in the Fund will not in any event be marketed to the public in Malta without the prior authorisation of the Maltese Financial Services Authority.

For Investors in Monaco: This communication is only intended for duly registered banks and/or licensed portfolio management companies in Monaco. This communication must not be sent to the public in Monaco.