- It remains impossible to tell whether we are witnessing a bear market rally or the return of a sustained bull market

- Tech may reclaim market leadership if the Fed pivots to a more dovish stance

- Financials would benefit from a prolonged tightening cycle

- Low inflation and growth (best-case scenario)

- Low inflation and recession (intermediate scenario)

- High inflation and growth (intermediate scenario)

- High inflation and recession (worst-case scenario)

It seems like just yesterday, commodities and energy stocks were the only positive investments of the year, while all other sectors or asset classes essentially showed double-digit declines. Then, from mid-June, the (short-term) bottom and the subsequent rebound.

While it remains impossible to tell if this is just a dead-cat bounce within a broader bear market or a return to a sustained bull market, we can plan for the possible scenarios. This involves building strategies based on what may occur between now and the end of the year.

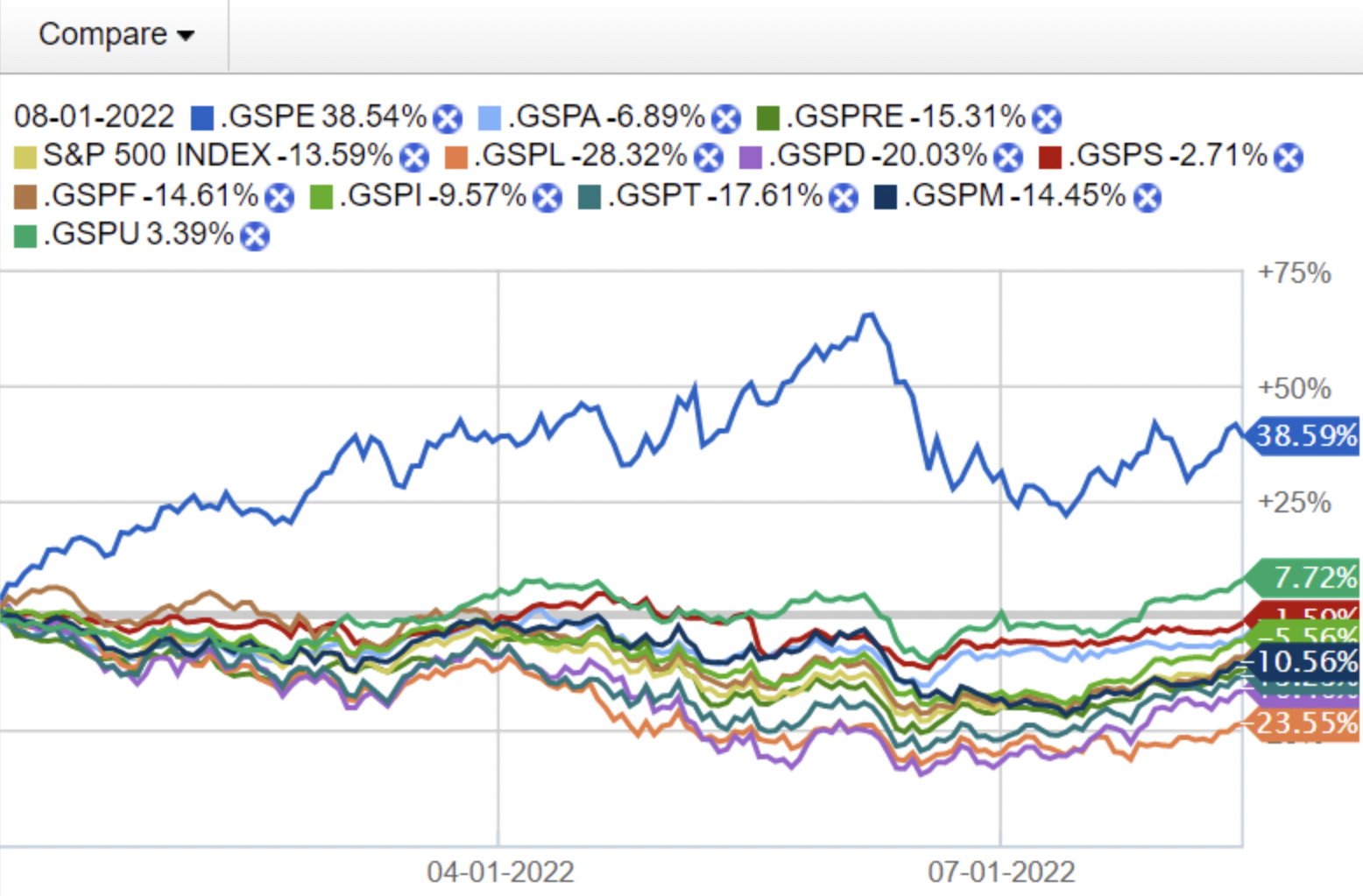

Let's start with a general overview from the beginning of the year. In the chart below, we can see how, among the various sectors, energy remains the year-to-date market leader (blue line at +38.59%). Next comes the utilities sector (green line), considered more defensive and, therefore, more effective during the H1 2022 decline. On the bottom (orange line), we see communication services, with an average -23.5% performance for the year.

Source: Fidelity research

How To Prepare For The Rest Of The Year?

To better gauge the likely scenarios for the rest of the year, we must first consider two key variables: inflation (and thus interest rates) and economic growth, analyzing how they add up to different macroeconomic environments.

The combinations could be:

Based on these four possibilities, we can distinguish which sectors might perform better than others in each scenario.

The first two combinations would likely favor tech stocks. That is because we know that many tech companies live on cash flows and time-dilated earnings expectations. Therefore, if inflation starts showing signs of subsiding, interest rates would likely follow, meaning that the discount rate for these companies (which is based on Central Bank rates) would also turn lower.

A persistent recession with low inflation could also force the Fed to pivot to rate cuts sooner than expected, thus providing some tailwinds for such companies.

However, if the economy starts growing again (first and third scenarios), the Fed would be able to maintain tight monetary conditions for longer, ensuring that inflation subsides in the long run.

In such a case, financials could come out on top. That is because banking stocks would increase lending margins with higher rates. In such a case, however, you should opt for solid banks that, in addition to benefiting from higher interest margins, have good coverage on impaired loans--as customers could have trouble repaying their debts due to higher rates.

Finally, in the worst-case scenario of a recession combined with high inflation (stagflation), consumer staples could benefit from investment inflows on a defensive basis while still maintaining a greater margin to pass on the prices of goods and services to the final consumer.

In such a scenario, the risk of any investment grows much higher, and even though consumer staples are defensive and more suitable for a recession, with higher rates, many companies would suffer from being highly indebted, particularly in the telecommunication industry.

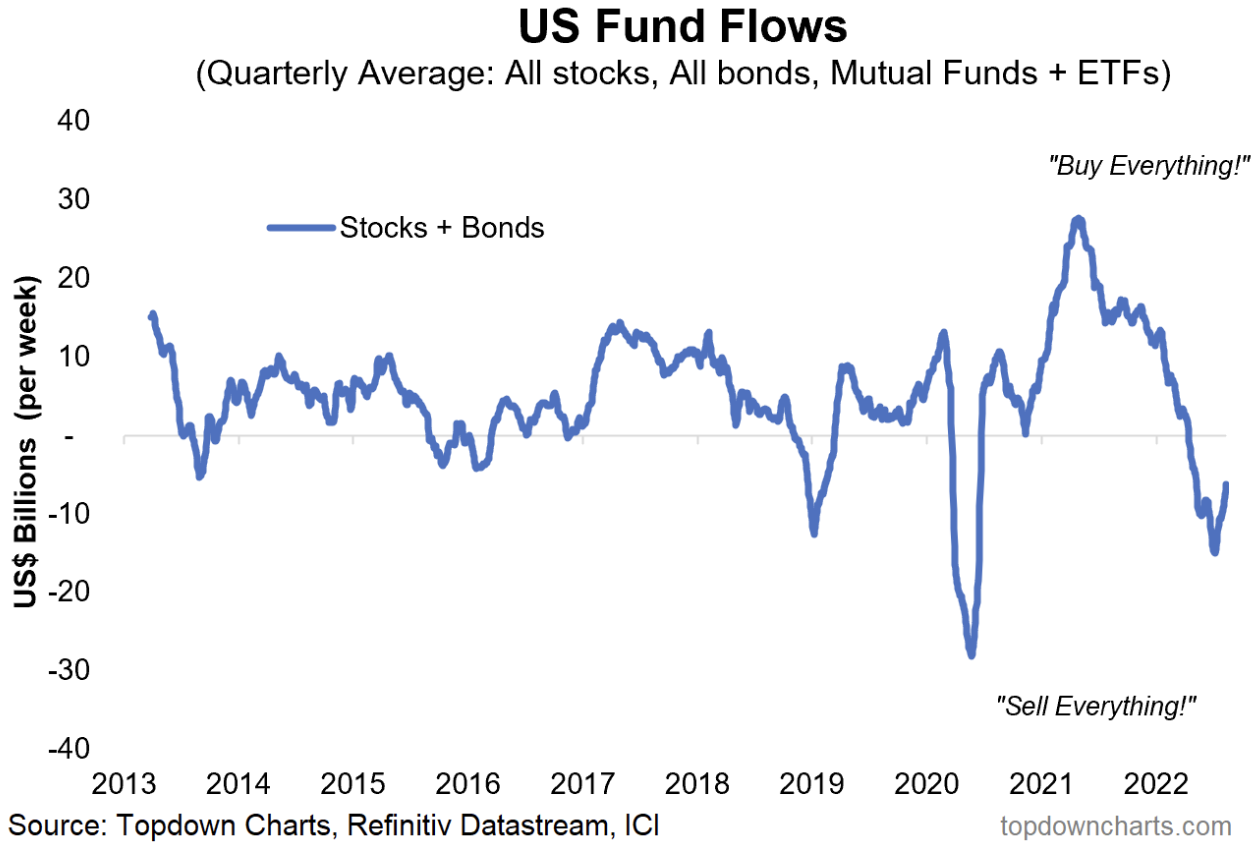

I close by pointing out that only a few investors have benefited from the broad market rebound since mid-June. The chart below shows how, during that period, market flows were unusually low (classic human behavior).

Source: Refinitiv, Top Down Charts

On the positive side, along with the rebound, we have witnessed a resumption of share buybacks and M&A activity, which should benefit many companies in the long run.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI