This article was written exclusively for Investing.com

- Lumber's wild ride in 2021

- Price remains higher than highest level before 2017

- Weyerhaeuser: REIT with a call option on lumber

- Leader in sustainability, a “woke company”

- Insider buying, an attractive dividend, and capital appreciation

Lumber is a highly volatile agricultural commodity and trades within an illiquid futures market. In 2021, the price of lumber has traded as low as $448 and as high as $1711.20 per 1,000 board feet.

Lumber futures experience low volume and open interest levels, making the raw material virtually untradeable. As well, Illiquid markets suffer from price vacuums, making the execution of buy or sell orders challenging when opening or closing long or short risk positions.

I have been trading commodities for four decades and have traded most raw materials on the US and European exchanges. However, I have never bought or sold one lumber contract. I wouldn't ever dip a toe in the lumber arena unless the volume and open interest levels increase to a point that would allow for buying and selling on tight bid/offer spreads in all market conditions.

Meanwhile, I watch lumber prices like a hawk since wood is a leading raw material that has implications for housing prices and construction activity. Weyerhaeuser Company (NYSE:WY), the Seattle-based manufacturer of wood products as well as one of the world's largest owners of private timberlands, tends to move higher and lower with lumber prices. In addition, it's far more liquid than the commodity's futures contracts.

I often use WY as a proxy for the wood market, but the company also offers a compelling long-term investment case.

Lumber's wild ride in 2021

Lumber futures have been particularly illiquid and highly volatile during 2020 and 2021.

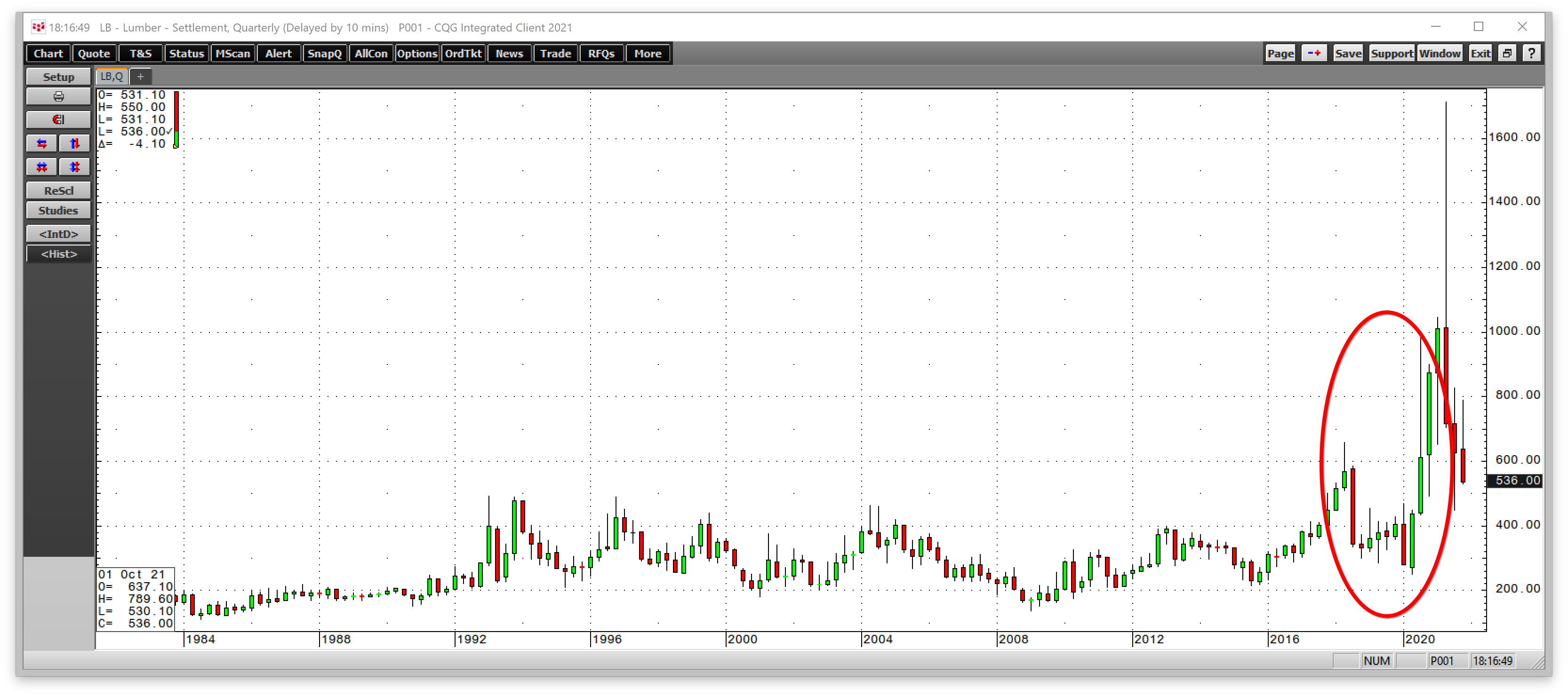

Source: CQG

The weekly chart of lumber futures, above, illustrates the rally that took wood’s price from a low of $251.50 in March/April 2020 to a high of $1711.20 per 1,000 board feet in May 2021.

That parabolic rally imploded in mid-August, pushing the price to a low of $448 before it started recovering.

Source: CQG

The daily chart of active month January lumber futures shows that the price peaked at $1275 per 1,000 board feet in May. The $436.20 backwardation, where nearby prices were higher than deferred prices, was a result of the pandemic-triggered supply shortages caused by bottlenecks at lumber mills.

As the demand for new homes exploded, lumber supplies became scarce, pushing nearby prices higher. The cure for high prices in the world of commodities is high prices. The backwardation in the forward lumber curve reflected that producers would increase output, pushing prices to one-third the level of the May record peak.

Price remains higher than highest level before 2017

As of Nov. 15, the nearby January lumber futures price was sitting at $637 per 1,000 board feet. Expiring November futures, which are essentially cash prices, were lower at the $530 level.

Source: CQG

The quarterly chart shows that before 2017 lumber’s all-time high was in 1993 at $493.50 per 1,000 board feet. Even though the price imploded, it remains above the pre-2017 record peak in November 2021.

Weyerhaeuser: REIT with a call option on lumber

Weyerhaeuser is unique. It operates as a real estate investment trust (REIT) with a portfolio of timberland property. WY is also one of the largest manufacturers of wood products.

While lumber is an illiquid futures market, WY is a highly liquid stock, with a $27.662 billion market cap at $37.41 per share. The average daily volume exceeds 3.74 million shares.

Weyerhaueuser shares are essentially an industrial real estate investment product with a lumber call option with no expiration date. Since WY produces lumber, its earnings reflect wood’s price, making it a proxy that follows the futures market.

However, the high liquidity level causes the stock to underperform during rallies and outperform during corrections.

Leader in sustainability, a 'woke company'

Addressing climate change is a social imperative. The investment community has embraced companies that have followed the shifting political and social agenda. Trees are good for the environment, and WY takes its position as a leading timberland company seriously regarding environmental concerns.

Weyerhaeuser manages forests for a myriad of benefits. The company has more than 1,000 oil and gas producing wells on the land they own or lease in the US. While WY’s exploration projects include oil and gas, coalbed methane, geothermal, and wind power, their sustainably managed forests provide wood fiber used as a renewable energy source that reduces the consumption of fossil fuels, addressing climate change.

Insider buying, attractive dividend, capital appreciation

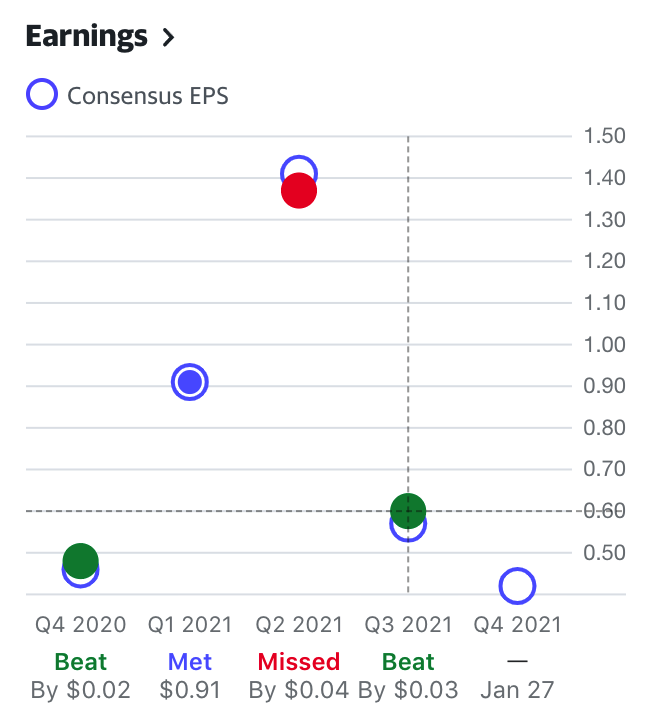

One of the most bullish signs for a company is when insiders buy the stock. Last year, insiders were buying WY shares with one, the CFO, increasing holdings by 46%. Over the past four quarters, the company’s earnings have mostly met or exceeded analysts’ forecasts.

Source: Yahoo Finance

A survey of nine analysts on Investing.com has an average 12-month price target of $41.78 for WY shares, an 11.68% upside, with forecasts ranging from $38 to $45, above the current share price.

In addition, as a unique REIT, Weyerhaeuser pays shareholders a $0.68 annual dividend, which translates to a 1.82% yield at the current $37.41 share price.

Since the 2020 low, lumber futures prices have rallied by 6.8 times and fell to one-third the price of the May 2021 high.

Source: Barchart

The chart above shows the bullish trend of mostly higher lows and higher highs in WY shares since the March 2020 low. On Mar. 23, 2020, WY hit rock bottom at $13.10 and rallied to a high of $41.68 in May 2021 when lumber futures peaked.

The shares fell to a low of $32.65 during lumber’s correction as they underperformed the percentage gain in the futures market on the upside and outperformed on the downside.

With lumber prices still above the highest pre-2017 price in November 2021, WY earnings should continue to support a higher price for the stock.

US infrastructure rebuilding, addressing climate change, and the growing demand for new homes are bullish for Weyerhaeuser, a stock that should continue to appreciate. At the same time, it pays its shareholders an attractive dividend.