This article was written exclusively for Investing.com

The Federal Reserve delivered an aggressive rate hike last week, bumping up overnight rates by 75bps just a few weeks after Chairman Powell had publicly stated that raising rates by 75bps at a time was “not something the Committee is actively considering”. Apparently, they were passively considering it.

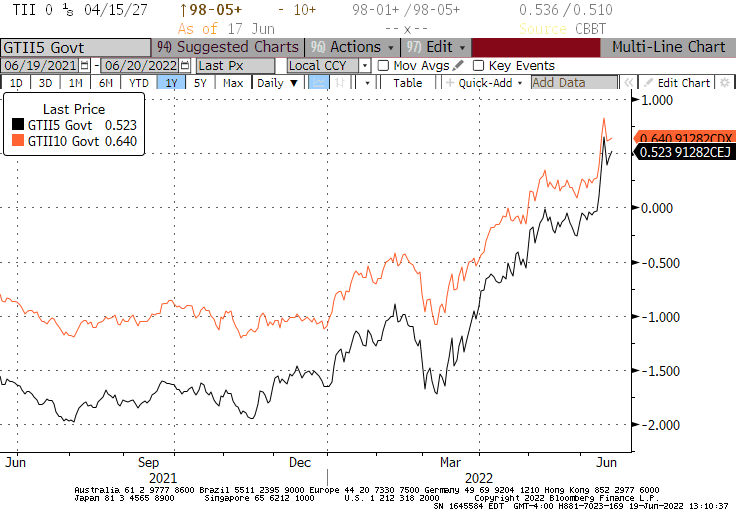

Real yields of 5-year TIPS rose 44bps on the week and 10-year real yields rose 28bps—most of that before the Fed meeting as word somehow ‘got around’ that the FOMC was actually going to raise the benchmark rate 75bps.

Since March, 5-year reals are up 220bps and 10-year real yields are +170bps (see chart). This has been rough for stocks, and is going to continue to be rough for stocks.

It has also been rough for bonds, of course. The classic 60-40 portfolio (60% stocks, 40% bonds) is down 18% since January. “Risk parity” portfolios are down more than that: the Toroso Risk Parity ETF (NYSE:RPAR) is down -20.6%.

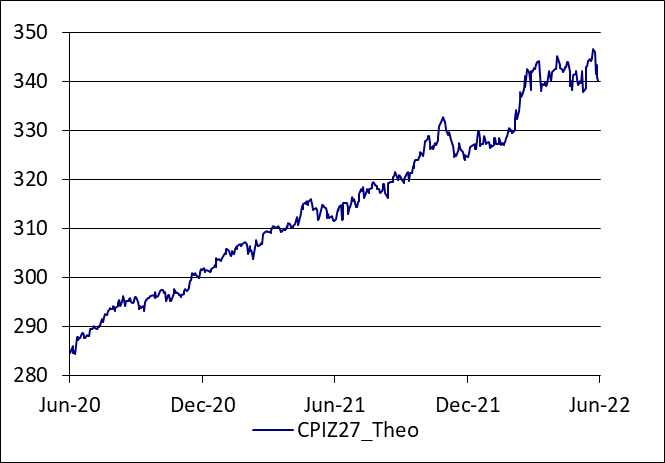

But help is on the way, right? 5Y and 10Y inflation swaps dropped 25bps and 20bps, respectively, this week, and are close to levels enjoyed back in February before the Ukraine invasion. The weekly change is clearly in reaction to the Fed, but as I’ve pointed out before a lot of the decline from local highs in April is due to carry—forward price level expectations haven’t in fact come down at all until this week (see the chart below showing the theoretical price of the December 2027 CPI futures if they existed).

Source: Enduring Investments

Still, the decline in market-based measures of inflation expectations this week could, and probably does, give the Fed some comfort that they are getting back ahead of the ‘unanchoring of inflation expectations,’ and are making strides in keeping this inflation problem from getting further out of hand.

Unfortunately, they may not be right on this. As I wrote in a column last week (“One Experiment Ends and Another Begins”), by jerking rates higher and ignoring reserves the Fed is only addressing the price of money and not the quantity of money…and we have never before deployed such a strategy to combat inflation.

Personally, I think the quantity is more important than the price, so I don’t think that their actions will have the dampening effect that we’re all being told to expect (to be sure, inflation will ebb at some point just on base effects, but we shouldn’t let them take a victory lap until y/y core CPI is back under 3%...and I’m not starting to shred any confetti yet).

Meanwhile, the Administration spent the week haranguing oil majors about their outlandish profits. In a letter to the big oil companies, President Biden stated that “refinery profit margins well above normal being passed directly onto American families are not acceptable.”[1]

While true, this state of affairs is largely the result of his own policies: the huge stimmy-induced demand putting an upward pressure on gasoline demand, while the release from the Strategic Petroleum Reserve put at least some downward pressure on crude prices.

The resulting expansion of the crack spread is exactly what you want, if you’re trying to induce oil companies to refine more. Is this incongruity accidental? Biden’s letter further threatened “I am prepared to use all tools at my disposal, as appropriate, to address barriers to providing Americans affordable, secure energy supply.” This follows a piece of legislation that passed the House in May which would give the President authority to declare an emergency and make it unlawful to increase gasoline or home energy fuel prices in an “excessive” manner. Can you say “price controls”?

Taking a Step Back…

On the one hand, it seems silly to waste time talking about price controls. They do not work in theory, and we have ample historical experience to know that they do not work in practice, either. Price controls set below the current price cause shortages, not to mention a contraction in government revenue as transactions move to the black market (maybe this is crypto’s salvation!). This is known.

It seems silly to even invite debate on this topic. The only thing price controls could do is to (temporarily) lower the measured inflation rate that gets reported…

Oh, I see it now.

It also seems silly to discuss a ‘windfall profits tax’ on oil companies, which the Administration and others accuse of worsening the current inflation crisis by “price gouging” (as if any company has enough power over a global market for a commodity product to be able to price gouge).

Again, it hasn’t worked when we have tried it before and theory is clear that such a tax should lead to less production: a company with 1 billion barrels in untapped reserves is more likely to take the risk of extracting those non-renewable reserves if profits are high, and more likely to let the reserves stay in the ground it they are punished for extracting them.

And with lower expected returns, exploration also will drop. Such a policy is likely to cause higher prices, and to cause prices to be higher for longer, rather than lower prices, while blaming oil companies and causing shortages for drivers of non-electric vehicles.

Oh, I see it now.

I said on a television program last week that it was sometimes hard to tell the difference between incompetence and malevolent intent. Personally, I like to believe that people generally have good intentions but poor execution.

The problem now is that it is getting increasingly difficult to believe in the colossal incompetence that would be required to pursue Modern Monetary Theory (MMT), price controls, and punitive taxes on producers. While I can believe for example that former Fed Chairman Bernanke didn’t see the housing bubble, as there was really nothing to be gained by not seeing it, the temptation to believe (or to pretend to believe) in MMT in late 2020 was very strong.

Here's the problem, and why it matters: unless we can believe the “incompetence” explanation, price controls will be implemented and a windfall profits tax will happen. They’re awful economic policies. But as politics? Some may see a winner.

In the medium-term, that means more inflation and not less, as neither policy addresses the causes of inflation, and indeed both price controls and punishing producers serve to worsen the imbalances.

So we are reduced to this: we are forced to hope that our policymakers are incompetent.

Michael Ashton, sometimes known as The Inflation Guy, is the Managing Principal of Enduring Investments, LLC. He's a pioneer in inflation markets with a specialty in defending wealth against the assaults of economic inflation, which he discusses on his Cents and Sensibility podcast.

[1] This follows his statement from the prior week that Exxon “made more money than God this year.” To be fair, judging from the rising tide of murders and suicides in the country maybe Exxon had a better year than God.