Worldwide PMI releases for May will be eagerly awaited with the turn of the month in the coming week. The first week of June also brings US labour market report on Friday. Meanwhile, the Bank of Canada convenes to update their monetary policy settings. In the data docket, a string of inflation updates will be anticipated from the eurozone, Germany and various Asian economies. GDP figures from Australia and India will also be in focus.

Market sentiment remained lacklustre this week amid indications of slowing growth from flash PMI readings for major developed economies and the May Fed minutes, which provided little fresh impetus for equities. Disappointing high frequency UK PMI data weighed on GBP/USD though sterling did manage to retrace losses into the latter half of the week as the greenback lost grounds. The euro meanwhile regained some strength after the eurozone PMI remained encouragingly resilient. More detailed global PMI data for May will therefore be eagerly watched for broader growth and inflation trends in other parts of the world, perhaps most notably mainland China.

Meanwhile, the May labour market report will be the key economic indicator to watch from amongst the upcoming US data releases. Another strong set of readings, including an expected 350k addition to non-farm payrolls, looks set to indicate a tight labour market. Such a positive trend had also been precluded by employment indicators from the May S&P Global Flash US Composite PMI. With that said, what may be of greater interest will be the wages and price picture, given the Fed's focus on inflation. The final PMI and ISM readings will therefore be assessed for the price indications and indications of supply conditions from key manufacturing hubs around the world.

Amongst central banks, the Bank of Canada is due to announce its monetary policy decision for June, with another rate hike following the March increase widely expected. Other items to watch include CPI numbers from the eurozone, Germany, South Korea, Indonesia and Thailand.

Manufacturing PMI surveys: what to watch

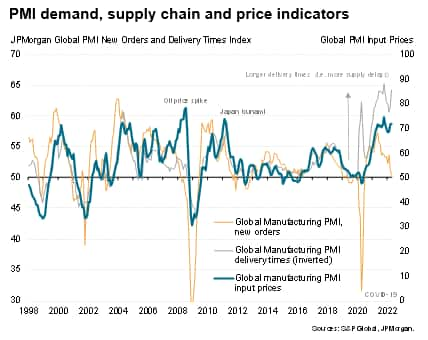

Upcoming PMIs due out in the coming week will provide an important steer to demand, supply and prices, and therefore also policymaking. While supply deteriorated in April to hand pricing power to sellers, as indicated by the global suppliers' delivery times index, the demand side of the inflation equation is more uncertain. Note that the April PMIs showed global manufacturing output falling globally amid a stalling in growth of new orders, the latter being the most up to date indicator of demand available.

The output and new orders indices from the global manufacturing PMIs will therefore need to be watched alongside the suppliers' delivery times index to get a comprehensive steer on the demand and supply fundamentals for commodity prices. Much will depend on the degree to which China's lockdowns persist, as these have muddied the global picture.

The degree to which the global expansion can be sustained will also be dependent on the extent to which demand from consumers can continue to recover after the current rebound, which has been fueled by economies reopening after the loosening of pandemic restrictions. The concern is that this rebound could fade quickly, especially if inflationary pressures remain elevated to add to the cost-of-living crisis.

It will also be important to watch the PMI backlogs of work indices, as these will give a guide as to whether current robust hiring will need to be sustained in the months ahead. The PMI future output expectations index will also give clues as to whether firms will remain keen on expanding capacity and additional hiring.

Key diary events

Monday 30 May

US Market Holiday

Thailand Manufacturing Production (Apr)

Eurozone Business Climate and Consumer Confidence (May)

Germany HICP Prelim (May)

Tuesday 31 May

South Korea Industrial Output (Apr)

Japan Unemployment Rate (Apr)

Japan Industrial Output, Retail Sales (Apr)

China (Mainland) NBS Manufacturing PMI (May)

United Kingdom Nationwide House Price (May)

Switzerland GDP (Q1)

Thailand Trade (Apr)

Germany Unemployment (May)

United Kingdom Mortgage Lending and Approvals (Apr)

Eurozone HICP (May, flash)

India GDP (Q4)

Canada GDP (Q1)

United States Consumer Confidence (May)

Wednesday 1 Jun

South Korea, Indonesia Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (May)

Australia GDP (Q1)

Indonesia Inflation (May)

Germany Retail Sales (Apr)

Eurozone Unemployment Rate (Apr)

United States ADP National Employment (May)

United States ISM Manufacturing PMI (May)

United States JOLTS Job Openings (Apr)

Canada BoC Meeting (1 Jun)

United States Fed Beige Book

Thursday 2 Jun

UK Market Holiday

Australia Trade Balance (Apr)

Switzerland CPI (May)

Eurozone Producer Prices (Apr)

United States Initial Jobless Claims

United States Factory Orders (Apr)

Friday 3 Jun

UK, China, Taiwan Market Holiday

Worldwide Services & Composite PMI* for US, Japan, India, Russia, Eurozone, Brazil, Singapore, UAE, S Africa (May)

South Korea CPI (May)

Germany Trade (Apr)

Eurozone Retail Sales (Apr)

United States Non-Farm Payrolls, Unemployment, Average Earnings (May)

United States ISM Non-manufacturing PMI (May)

* Press releases of indices produced by S&P Global and relevant sponsors

can be found here.

What to watch

Worldwide manufacturing and services PMIs for May

After flash May PMI data showed economic growth coming under pressure in major developed economies amid price pressures, detailed global PMI data for both manufacturing and many country's service sectors will be released in the coming week. The broader global PMI data are especially keenly awaited after economies such as the UK saw a significant surprise on the downside, with the flash PMI data showing inflationary pressures affecting economic conditions.

Refer to our PMI release calendar for the full schedule of monthly releases.

North America: May labour market report; BoC meeting

May's US labour market report will be released on Friday with Refinitiv consensus pointing to a 350k addition to non-farm payrolls, the unemployment rate to fall to 3.5% and average earnings growth to accelerate to 0.4% month-on-month, altogether reflecting tight labour market conditions and keeping the Fed's focus on targeting inflation.

Separately, the Bank of Canada is set to update their monetary policy. Following their March increase, another 50-basis point hike is expected according to our forecast for the BoC, which also sees their policy rate climb through the year.

Europe: Eurozone, Germany May inflation; unemployment rates

In the eurozone, May inflation and unemployment rates will be updated on Tuesday and Wednesday respectively. The S&P Global Flash Eurozone PMI reflected that price pressures eased from the April peak though remaining sharp by historical standards, while jobs growth surged, led by the region's rebounding services sector.

Asia-Pacific: Australia; India GDP; South Korea, Indonesia, Thailand CPI; Japan employment data

In APAC, a couple of tier-1 data releases will be anticipated in the week ahead including GDP figures across Australia and India while South Korea, Indonesia and Thailand will update May inflation figures. This will be alongside the series of PMI figures that will shed light on May supply and inflation conditions in the wider APAC region, and most notably reveal the latest situation in mainland China among the ongoing effort to control the Omicron wave.

***

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."