Central bank meetings will dominate headlines this week with the Reserve Bank of Australia (RBA), European Central Bank (ECB) and the Bank of Canada (BoC) all set to assemble. S&P Global services and construction PMIs will meanwhile add to last week's manufacturing PMIs which indicated a general slowdown and even contractions in activity. Elsewhere Q2 GDP updates for Japan, Eurozone and Canada will be eyed by markets while inflation figures for mainland China are also released.

Inflation data across the globe has confirmed worryingly persistent price pressures. Central banks have employed hawkish monetary policies amid efforts to cool growth and curb price rises, and this week sees the ECB, BoC and RBA likely to step hard on the brakes again. In all cases, rate hikes are on the table. Canada is dubbed to hold the strictest stance though it remains to be seen whether a 50-, 75- or 100-point hike is implemented. RBA is set to continue its 50 basis-points hike trend. However, it's likely that the ECB will garner the most market interest, with an unprecedented hike of 75 basis points now priced in. Q2 GDP updates for the Eurozone will also be released and add colour on economic performance.

The central bank meetings come in a week in which services PMIs are updated. After manufacturing PMIs showed a broad-based slowdown and easing price pressures, the focus will shift to the resilience of consumer spending on services amid the rising cost of living and high interest rates. The surveys will also provide an insight into the pass through of higher energy costs and wages to selling prices.

In Asia, a plethora of inflation data will be released, most notably for mainland China, Thailand and Taiwan. Mainland China's inflation rates are set to grow, but still remain weaker than those seen across the globe. Elsewhere, in Japan and Australia Q2 GDP growth rates will provide an indication into second quarter performance.

Finally, a relatively quiet week in terms of economic data for the US, whereas Canada sees a wealth of releases. Employment, inflation and GDP updates will be released for the latter, in addition to the central bank meeting.

Manufacturing under pressure as global trade shrinks

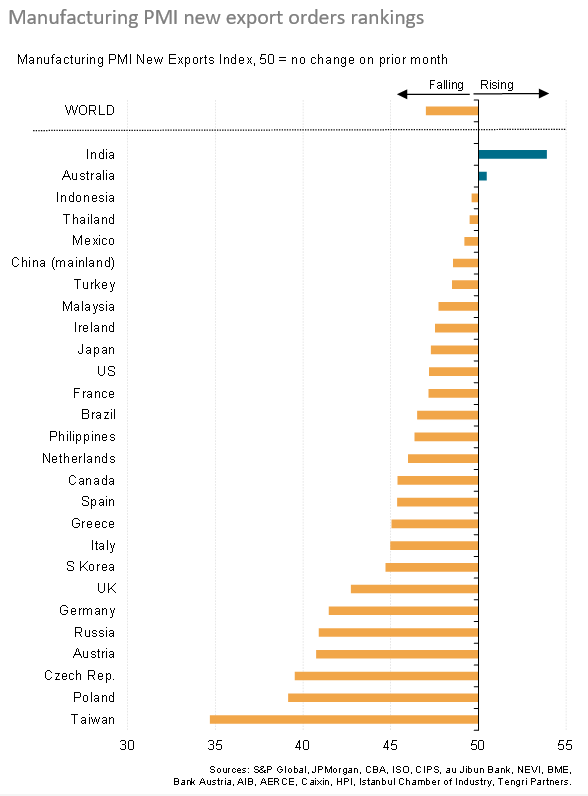

Worldwide services PMIs are released in the coming week, coming on the heels of the manufacturing PMIs. The factory gauges were disappointing (see special report), with global output in decline amid the rising cost of living and an accelerating downturn in global trade flows. In fact, only India reported any material growth of goods exports in August, with Australia registering only a marginal decline and all other economies suffering falling exports. Perhaps most disconcerting was the extent of the decline in Taiwan, often seen as a bellwether of near-term global trade flows, where the decline was by far the steepest of all economies surveyed.

Key diary events

Monday 5 September

US Market Holiday

S&P Global Worldwide manufacturing PMIs*

Australian Retail Sales (Jul)

Thailand Core Inflation (Aug)

Singapore Retail Sales (Jul)

Switzerland GDP (Q2)

Eurozone Retail Sales (Jul)

Tuesday 6 September

S&P Global Construction PMIs*

United Kingdom BRC Retail Sales Monitor (Aug)

Japan Household Spending (Jul)

Philippines Inflation Rate (Aug)

Australia RBA Interest Rate Decision

Netherlands Inflation rate (Aug)

Germany Factory Orders (Jul)

Taiwan Inflation Rate (Aug)

Spain Consumer Confidence (Aug)

Wednesday 7 September

Australia GDP Growth Rate (Q2)

China Balance of Trade (Aug)

Japan Coincident Index Prel (JUL)

Germany Industrial Production (Jul)

United Kingdom Halifax House Price Index (Aug), BBA Mortgage Rate (Aug)

Italy Retail Sales (Jul)

Eurozone GDP (Q2)

United States MBA Mortgage Applications (02/SEP), Balance of Trade (Jul), Fed Beige Book

Canada Balance of Trade (Jul), BoC Interest Rate decision

Poland Interest Rate decision

Thursday 8 September

Japan GDP (Q2), Eco Watchers Survey (Aug)

Australia RBA Gov Lowe Speech, Balance of Trade (Jul)

Philippines Unemployment Rate (Jul)

France Non-Farm Payrolls (Q2), Balance of Trade (Jul)

Mexico Inflation Rate (Aug)

Switzerland Unemployment Rate (Aug)

Eurozone ECB Interest Rate Decision, ECB Press Conference

United States Jobless Claims (Sep), Consumer Credit (Jul)

New Zealand Electronic Retail Card Spending (Aug)

Friday 9 September

China Inflation Rate (Aug)

Netherlands Manufacturing Production (Jul)

France Industrial Production (Jul)

Brazil Inflation Rate (Aug)

Canada Employment Change (Aug)

United States Wholesale Inventories (Jul)

Russia GDP (Q2), Inflation Rate (Aug)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

S&P Global worldwide services PMIs

Following last week's manufacturing data - which revealed contractions in private sector activity across the UK, Eurozone, Japan, France, Germany and US - services PMI data will provide further insight into macroeconomic conditions. Flash data pointed to a general slowdown in activity, with some regions also registering outright declines. While the service PMIs will be watched with particular interest on Tuesday, also watch out for the construction and other detailed sector PMI releases mid-week.

Americas: Canada Q2 GDP, BoC interest rate decision, US mortgage applications and US balance of trade

This week sees a wealth of economic data and events for Canada with the BoC Interest Rate Decision arguably the most significant. A rate hike is certainly on the table, though it remains unclear on whether it'll be a 50-, 75- or even a 100-basis point hike after the previous meeting's 100bp shock. Q2 GDP updates will accompany the bank's decision.

Elsewhere balance of trade data for the US are forecasted to come in around the -$72.3bn mark (down from -$79.6bn). US mortgage application data will also be eyed by markets.

Europe: Eurozone Q2 GDP and ECB Interest Rate Decision

The ECB is set to unveil its latest interest rate decision on Thursday, and is sure to dominate headlines. After rising to a record 9.1% in August, CPI price pressures have showed no sings of easing. ECB officials warn a sacrifice is needed to tame surging inflation which will no doubt come in the form of another rate hike. A 75-basis point hike is now widely expected. The third Q2 eurozone GDP estimate will meanwhile reveal performance with annual growth forecast to moderate to 3.9%.

Asia-Pacific: RBA Interest Rate Decision, Japan Q2 GDP, China Inflation

Price pressures in Australia have not displayed any sigh of relief with the latest CPI at 6.1%. Reserve Bank meeting minutes pointed to further steps taken to normalise monetary conditions. Three consecutive 50.0 basis point hikes suggest a fourth is highly likely.

Elsewhere in Asia, China inflation figures will be highly anticipated by markets and Japan will release Q2 GDP updates.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."