February flash PMIs, RBNZ, BoK meetings, GDP readings

IHS Markit flash PMIs for February, released across major developed economies, will be in focus in the coming week. Central bank meetings in New Zealand and South Korea will also unfold, while a series of GDP updates for the US, Germany, Taiwan and Thailand are anticipated. Consumer confidence across the US and eurozone will also be updated.

The global market had been caught between the crosswinds of geopolitics risks and inflation concerns in the past week, with the latter accompanied by increasingly hawkish central bank expectations. Flash PMIs will be unveiled for February in the coming week across major developed economies for a check on the Omicron variant's disruptions towards economic conditions and, more crucially, the supply chain and inflation situation. This comes amid reinforcements of an anticipated March FOMC rate hike based on recent Fed comments, though uncertainty continues to surround the likelihood of a more aggressive 50 basis points hike at the next meeting.

Meanwhile after the Bank of England hiked interest rates to tackle inflation and amid tight labour market conditions, across the globe in New Zealand, the RBNZ is expected to raise interest rates again after the labour market continued its record trend into Q4. The Bank of Korea is, however, expected to stay put.

Separately, February consumer confidence data across the US and eurozone will also closely watched for any indications of a turnaround after consumer services activity led the global economic slowdown in January.

Flash PMIs and Omicron impact

Flash PMI surveys for February will provide key insights into economic trends in the first quarter for the US, Eurozone, Japan, Australia and the UK. The data follow January's surveys showing global economic growth slowing to the weakest for one and a half years amid disruptions form the Omicron wave, with consumer services especially hard hit.

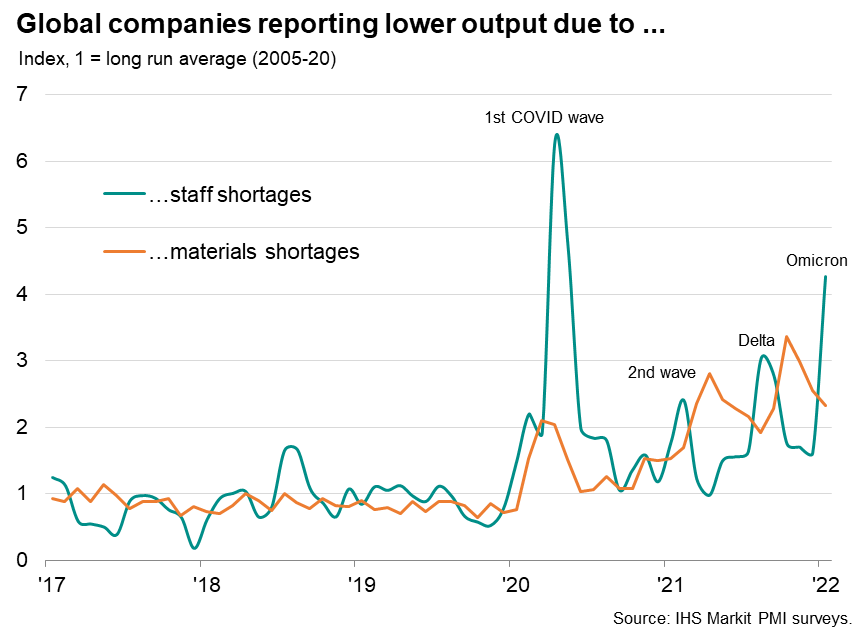

While tighter virus containment measures contributed to the weaker PMI growth picture in January, companies also reported output to have been constrained by staff shortages to an extent exceeded only by that seen during the first wave of the pandemic in early-2020. Labour shortages were exacerbated in January by staff illness and absenteeism due to self-isolation rules.

More encouragingly, the incidence of output being constrained by materials shortages continued to fall from a pandemic-peak recorded last October. However, the concern - illustrated by our chart below - is that output constraints due to staff shortages have been followed by periods of worsening materials shortages, reflecting the lagged impact from the lost production of inputs and other raw materials arising from the labour shortages.

Some of the important trends to watch in the flash PMI numbers will therefore be the extent to which both manufacturing output and supplier delivery times have been affected by the Omicron wave, and the extent to which this has fed through to producer input and output prices. However, the data will also be watched for signs that the worst of the Omicron impact on consumer services may be over, at least in the US and Europe, which should help offset any supply chain damage to growth. That said, any combination of recovering demand and supply constraints bodes ill for inflation. Meanwhile also keep an eye on the future output expectations indices, as this is where any geopolitical concerns emanating from Ukraine will be most visible.

Key diary events

Monday 21 Feb

US, Canada Market Holiday

Australia IHS Markit Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK CIPS/IHS Markit Flash PMI, Manufacturing & Services*

Germany IHS Markit Flash PMI, Manufacturing & Services*

France IHS Markit Flash PMI, Manufacturing & Services*

Eurozone IHS Markit Flash PMI, Manufacturing & Services*

New Zealand Trade Balance (Jan)

Thailand GDP Growth (Q4)

Philippines Core CPI (Jan)

Germany Producer Prices (Jan)

Taiwan Export Orders (Jan)

Tuesday 22 Feb

US IHS Markit Flash PMI, Manufacturing & Services*

Germany Ifo Business Climate New (Feb)

United States Consumer Confidence (Feb)

Wednesday 23 Feb

Japan Market Holiday

Australia Wage Price Index (Q4)

New Zealand Cash Rate (23 Feb)

Thailand Customs-Based Trade Data (Jan)

Thailand Manufacturing Production (Jan)

Singapore Consumer Price Index (Jan)

Germany GfK Consumer Sentiment (Mar)

Taiwan Industrial Output (Jan)

Eurozone HICP (Jan, final)

Thursday 24 Feb

South Korea Bank of Korea Base Rate (Feb)

Taiwan GDP (Q4, revised)

United States GDP (Q4, 2nd estimate)

United States Initial Jobless Claims

United States New Home Sales (Jan)

Friday 25 Feb

Philippines Market Holiday

New Zealand Retail Sales (Q4)

United Kingdom GfK Consumer Confidence (Feb)

Singapore Manufacturing Output (Jan)

Germany GDP Detailed (Q4)

Germany Import Prices (Jan)

Eurozone Business Climate (Feb)

Eurozone Consumer Confidence (Feb, final)

United States Personal Income and Consumption (Jan)

United States Core PCE Price Index (Jan)

United States Durable Goods (Jan)

United States UoM Sentiment (Feb, final)

*Press releases of indices produced by IHS Markit and relevant sponsors can be found here.

What to watch

February IHS Markit flash PMIs

February's flash PMIs will be released across the US, UK, eurozone and APAC economies including Japan and Australia. January's figures told of slowing growth and persistent price pressures for the global economy. Amid the varying trajectory of the COVID-19 Omicron variant's spread across the different developed countries, February's PMI readings will keenly watched. Specifically, consumer services' performance will be observed after having been hard hit by the deterioration in COVID-19 conditions brought about by the spread of the more infectious variant. The trends with price pressures attributed to disruptions towards materials and staff will also be in focus, particularly given the focus on monetary policy tightening.

Recap January's PMI developments with ourMonthly PMI Bulletinor refer to ourrelease calendarfor a full schedule of upcoming PMI updates.

North America: US Q4 GDP (2nd estimate), consumer confidence, core PCE readings

A holiday-shortened week ahead for the US finds the release of the second Q4 GDP estimate, January core PCE and February consumer confidence data. While a slight upward revision for Q4 GDP is expected, the attention may well be on the January core PCE reading following a 40-year high CPI update. February consumer confidence is meanwhile expected to soften, according to consensus. Also watch out for US durable goods orders and new homes sales.

Europe: Eurozone HICP, consumer confidence, German Q4 GDP, Ifo business climate

Final January HICP is expected out of the eurozone alongside February consumer confidence data. Meanwhile Germany releases detailed Q4 GDP data, producer price numbers and February's Ifo business climate readings.

Asia-Pacific: RBNZ, BoK meetings, Taiwan and Thailand Q4 GDP

The Reserve Bank of New Zealand and Bank of Korea meet in the coming week with the RBNZ expected to hike another 25 basis points amid a tightening labour market situation.

"Disclaimer: The intellectual property rights to these data provided herein are owned by or licensed to Markit Economics Limited. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without Markit’s prior consent. Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon.

In no event shall Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing Managers' Index™ and PMI™ are either registered trademarks of Markit Economics Limited or licensed to Markit Economics Limited. Markit is a registered trade mark of Markit Group Limited."