- Buffett's big moves: Apple stake slash and record cash pile signal caution in the market.

- He prefers short-term bonds over stocks at current valuations, suggesting he expects a market correction.

- In this article, we will discuss how one can adapt his approach going forward.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

- Significant Apple Stake Reduction: Berkshire Hathaway significantly reduced its stake in Apple (NASDAQ:AAPL) by 13%, a move that could be interpreted as a broader signal of reduced enthusiasm for the U.S. stock market in general.

- Record Cash Holdings: Berkshire's cash hoard reached a staggering $189 billion, indicating a possible preparation for future market volatility or potential dip-buying opportunities.

- Increase the allocation of short-term bonds: Government bonds with short maturities (within 3 years) offer attractive yields in Europe as well.

- Rebalance portfolios: Regularly adjust your asset allocation to maintain your desired risk profile.

- Diversify: Since Buffett favors individual stocks, we can opt for broader diversification through global stock indices or by diversifying across regions (Asia, Europe, etc.).

Warren Buffett sent a clear message of caution at Berkshire Hathaway's (NYSE:BRKb) annual shareholders' meeting, held for the first time without his longtime partner Charlie Munger. Two key actions signaled a sentiment shift:

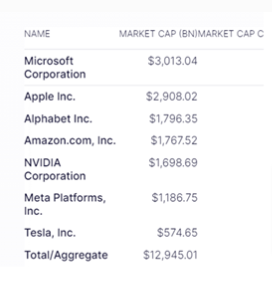

While the Apple stake reduction was attributed to "profit-taking," it's worth noting that Apple alone represents a significant portion (around $3 trillion) of the magnificent 7 companies with a combined market capitalization of approximately $13 trillion.

Apple's significant presence in stock indexes and ETFs globally, like the MSCI World (NYSE:URTH) where it carries a weight of 3-4%, underscores his point.

Buffett emphasizes that with current valuations, holding cash in short-term government bonds yielding over 5% is preferable to the stock market. In other words, he's waiting for a major market correction before resuming buying. This is evident in his current cash allocation of 33%, showcasing his cautiousness, even for someone widely considered the world's best investor.

Here's How You Can Adapt to Buffett's Approach

While we might not have Buffett's resources, we can still adopt his prudent approach in several ways. Here's what one could do:

Despite the recent correction in April, the last year of the presidential election cycle has been positive so far.

With inflation under control, rising earnings, and contained geopolitical tensions, the second half could be promising as well.

However, corrections are inevitable (around 5-10% at least once a year), and accepting them is part of being a wise investor.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.