Gold prices set for weekly gains on dovish Fed outlook; silver near record high

WANdisco's (LON:WAND) deal flow trend is looking increasingly encouraging. The latest deal announced, worth c $1.65m and with a major US investment bank, was signed through the company’s partnership with IBM (NYSE:IBM). Management expects the deal to take FY21 revenue past market estimates (Edison and pre-announcement consensus of $6m). This trend needs to continue to validate WANdisco’s financial model, but we understand the near-term pipeline remains healthy. The diversity of partners through which deals are being signed (Google (NASDAQ:GOOGL), AWS and IBM in the last month) and the use cases for which Live Data Migrator is being deployed still point to significant market potential if sales execution can be sustained.

WANdisco has announced a deal via its partnership with IBM, for the migration of on-premise data with a major US investment bank. The three-year licensing deal is worth $3.3m in licensing to IBM and WANdisco should receive 50% of this, so c $1.65m. This amount should have scope to expand materially if the customer opts to use Live Data Migrator for cloud-based use cases in the future.

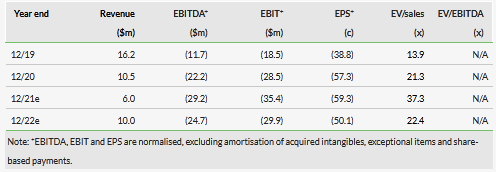

As a result of the win, management expects FY21 revenues to be meaningfully ahead of market expectations. IBM is WANdisco’s longest-standing partnership and because this is a licensing deal, revenues will be recognised largely up front. We forecast $6m of revenue for 2021 with $12m of RPO (in line with previous guidance of $18m revenue + RPO). We leave our estimates unchanged for the time being, pending more information on the full run-up to the year end.

Deal flow towards the end of FY21 has come through a diverse range of partners, use cases and industries. The latest deal follows a $6m contract win with a European automotive components manufacturer to migrate data to Google Cloud and another for an unannounced amount with a top five UK bank to migrate data to AWS. These deals are important because they add customer/use case referenceability for other potential clients. The diversity is also an encouraging indicator of the broad applicability of WANdisco’s technology and potentially its strategic importance in the cloud data supply chain. We still need to see deals being signed more consistently to prove WANDisco’s economic model and we understand the CEO is again leading business development to try to ensure that this will happen.

Share price performance

Business description

WANdisco’s proprietary replication technology enables its customers to solve critical data-management challenges created by the shift to cloud computing. It has established partner relationships with leading players in the cloud ecosystem including Amazon (NASDAQ:AMZN), IBM and Microsoft (NASDAQ:MSFT).