WANdisco's (LON:WAND) Q122 trading update demonstrated that the momentum we reported on earlier this year has continued, with bookings and remaining performance obligations (RPO) up significantly to $5.8m (+427% y-o-y) and $14m (+233% y-o-y), respectively. Deals were won across a range of industries and use cases, with computer hardware, telecoms, insurance, and IoT and multi-cloud being key. The company’s momentum is in line with our expectation that as WAND continues its transition to a consumption-based model, it should generate more predictable revenues. This is shown by the recent growth in RPO (up 49% from Q421’s $9.4m), which measures deferred revenue plus unbilled committed contractual revenues. Our estimates for FY22 may be conservative, especially if WAND continues to build on its momentum, but we leave our forecasts unchanged pending the FY21 results announcement.

Share price performance

Business description

WANdisco’s proprietary replication technology enables its customers to solve critical data-management challenges created by the shift to cloud computing. It has established partner relationships with leading players in the cloud ecosystem including Oracle (NYSE:ORCL), Amazon (NASDAQ:AMZN), IBM (NYSE:IBM) and Microsoft (NASDAQ:MSFT).

In line with the growth in bookings and RPOs, management expects the end-Q122 cash position to be $21.3m, down from $27.8m in Q421. However, with the anticipated cash infusions from the new contracts described above, we are less concerned that the company will be required to raise additional capital in H222.

While the general availability of LiveData Migrator (LDM) was essential in Q122’s business acceleration, we believe other factors are at play, such as a growing roster of reference customers across use cases and accelerating investment by customers into multi-cloud strategies, IoT and cloud analytics. WAND is well embedded in the cloud analytics ecosystem, as deals for its LDM solution were won through key cloud partners IBM, Azure and AWS (and post-Q122, through its restructured partnership with Oracle) as well as its analytics partners Databricks and Snowflake, and directly, where its ability to facilitate multi-cloud strategies (moving data from one cloud provider to another) is driving sales.

Importantly, WAND’s continued momentum this quarter did not depend on one large deal but was from a number of sizeable contract wins, renewals and expanded use cases. These included contracts for migrating data to the cloud for IoT service providers, a data migration in February for a major client of Microsoft’s Azure cloud and a $1.5m commit-to-consume win with a top 10 global telco. Notably, WAND entered into a significant follow-on deal with the latter customer that was worth $1.2m.

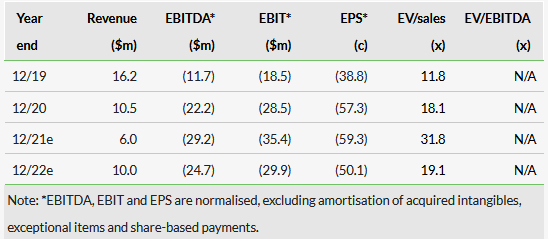

Our estimates for FY22 may be conservative, especially if WAND can continue building on its momentum. However, we await the reporting of FY21 audited financials before re-assessing our forecasts.