Wandisco (LON:WAND), a company that replicates petabyte scale data to the cloud, last week announced the general availability of its LiveData Migrator on Azure (LDMA). While this could be a significant catalyst for WAND, increased future deal flow will be the evidence by which successful execution could be measured, especially in light of management recently significantly lowering FY21 revenue guidance. The company’s growth drivers still look intact, the migration of data to the cloud is a significant structural trend and WAND has partnerships with the key players in this space. If good evidence comes through that the pipeline is converting, then the promise of scalable growth could become a reality again, opening up the potential for a share price recovery.

Share price performance

Business description

WANdisco’s proprietary replication technology enables its customers to solve critical data-management challenges created by the shift to cloud computing. It has established partner relationships with leading players in the cloud ecosystem including Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT).

General availability for LiveData Migrator on Azure

On 18 October, WAND announced the general availability (GA) of its LDMA, which is designed to allow customers to accelerate their migration of on-premises data lakes to the cloud without operational downtime or business risk. LDMA is designed to ensure that customers can maintain business continuity while their data are transmitted securely to Azure Data Lake Storage. The general availability of LDMA also makes the feature available to Azure consultants and system integrators for use in the clients they serve.

FY21: Guidance and forecasts significantly reduced

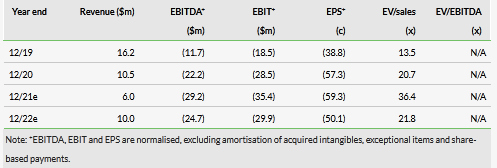

In September, WAND reported disappointing H121 results amid Azure delays, with sales down 7.5% y-o-y and only at 10% of prior guidance for all of FY21. As a result, WAND lowered its guidance to a composite of revenue and RPO (remaining performance obligation) of at least $18m for FY21, versus prior guidance of $35m in revenue alone. We downgrade our revenue forecasts from $37m and $60m to $6m and $10m in FY21 and FY22 respectively, to reflect the reduced guidance. However, the GA of LDMA could be a significant catalyst for WAND and a key trigger for more deals coming down the line.

Execution remains key to multiple expansion

WAND’s shares are down 30% year to date. The group operates in a rapidly growing market, and its technology and model have considerable potential. The parts appear to be in place to realise their value but what has been missing is successful execution of its growth strategy. The company’s KPIs need to demonstrate that WAND can generate steady, repeatable, committed revenue in order to justify multiple expansion and a re-rating. If good evidence comes through that the pipeline is converting, then the promise of scalable growth could become a reality again, opening up the potential for a share price recovery.

Click on the PDF below to read the full report: