- Reports FY Q4 2022 results on Thursday, Feb. 17, before the open

- Revenue expectation: $151.74 billion

- EPS expectation: $1.49

Investors have several reasons to remain excited about mega-retailer Walmart (NYSE:WMT) ahead of its FY 2022 Q4 earnings release tomorrow morning. Despite the challenging retail environment, the company has maintained a strong sales outlook while coping with supply-chain disruptions quite well.

A positive report should also instill some life in the company’s shares.

The Bentonville, Arkansas-based discount retailer's stock hardly budged in 2021 even as competitors Target (NYSE:TGT) and Costco (NASDAQ:COST) saw their stocks surging to record highs. WMT shares closed on Tuesday at $134.37, down almost 6% for the year.

The primary reason behind WMT’s underperformance appears to be a $6 billion insider stock sale by the company’s largest stakeholder last year, namely the Walton family. At the time, Walmart said that those sales were partly motivated by the founder's family’s desire to keep their ownership percentage unchanged amid the company’s massive buyback program.

In its last earnings report in November, the world’s largest retailer raised forward guidance, forecasting a $6.40 profit per share for the year ahead, compared with a previous prediction of no more than $6.35. Moreover, comparable sales excluding fuel in Walmart’s US stores were predicted to grow more than 6% in the fiscal year that ended on Jan. 31.

This strong outlook comes in an environment when retailers are navigating multiple challenges posed by global supply-chain disruptions, a labor squeeze and rising fuel costs—all of which are contributing to the fastest jump in consumer prices in four decades.

These pressures, however, provide Walmart a competitive edge to attract more cost-conscious customers. According to chief executive Doug McMillon, Walmart is in a strong position to win over more consumers, helped by its omnichannel focus which is pushing digital penetration to record levels. He told Bloomberg in an interview that fighting inflation is in the company’s DNA.

If all goes as anticipated, Walmart should post the 25th consecutive quarter of positive traffic at its US stores. Online sales, which are becoming a more significant contributor to reported same-store sales growth, have expanded 87% during the past two years.

Share Gains

Now that insider sales are out of the way, many analysts believe the robust sales outlook should propel WMT stock higher.

The company has repeatedly shown that it is on the right track to counter online retailers like Amazon (NASDAQ:AMZN), by successfully executing its own e-commerce strategy. That, coupled with its massive brick-and-mortar presence, offers a great long-term value to investors looking to include a solid defensive stock in their portfolios.

Bank of America, while reiterating its buy rating, said it sees several positive catalysts heading into the company’s earnings and investor meeting later this month. UBS, in a similar note, reiterated Walmart as a buy, adding:

“WMT should show strong results to close out the year. We think WMT’s 4Q results will point to further share gains and a successful holiday season.”

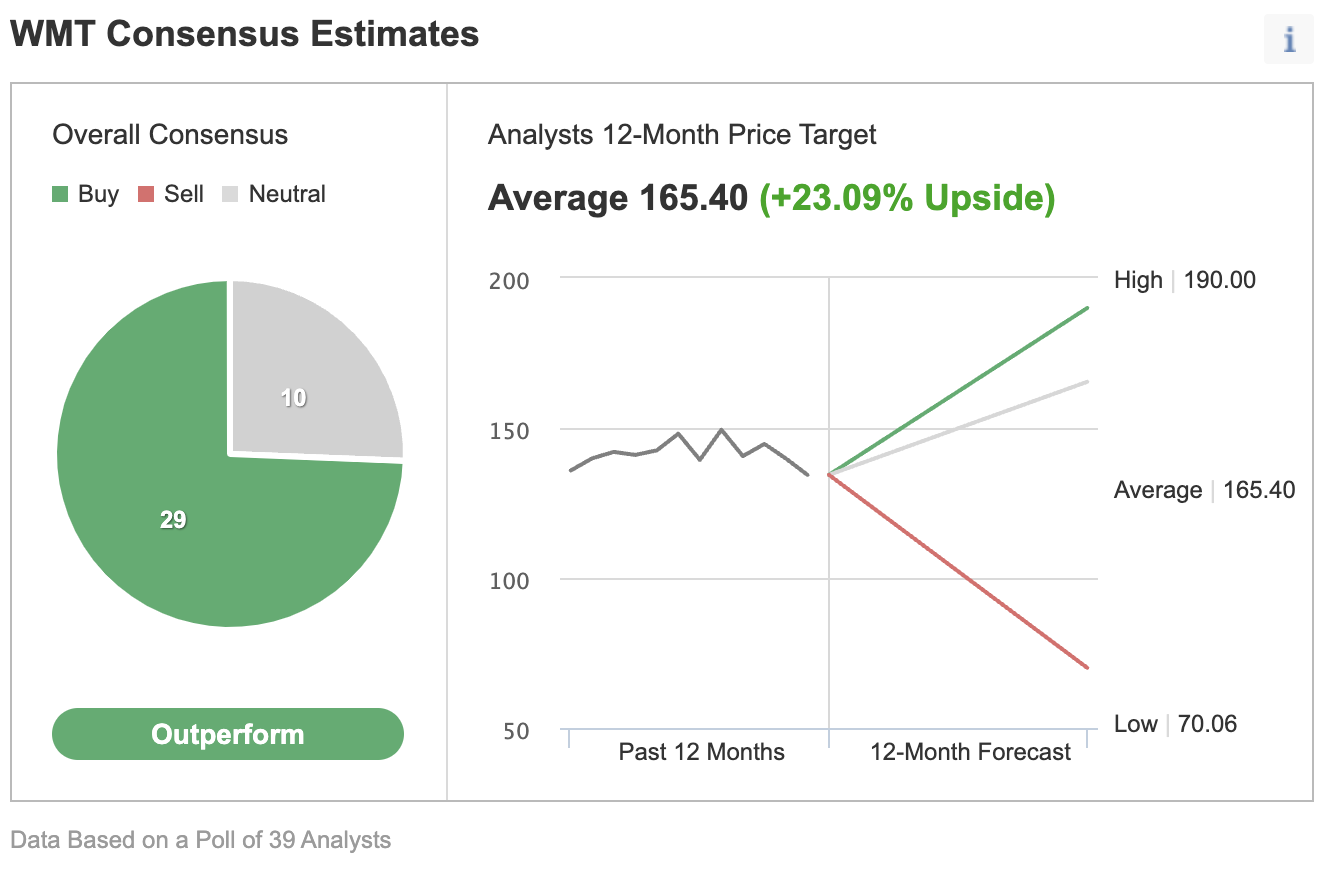

In a poll of 39 analysts conducted by Investing.com, 29 gave the stock an "outperform" rating with a consensus 12-month price target of $165.40, implying a 23.09% upside potential from the current market price.

Source: Investing.com

Bottom Line

Backed by its e-commerce momentum and substantial core brick-and-mortar operations, WMT should post yet another strong earnings report tomorrow.

The improving outlook combined with the falling stock price means Walmart’s stock has become much more attractive than it was last year.