Utilico Emerging Markets Trust’s (UEM’s) managers Charles Jillings and Jacqueline Broers remain very upbeat about the long-term prospects for emerging market equities. They consider that, in aggregate, corporates are continuing to deliver robust earnings growth despite an uncertain macroeconomic environment. The nature of the trust’s investments in well-managed, cash-generative infrastructure and utility assets means that UEM’s portfolio should be relatively resilient during periods of economic or stock market weakness. Since its inception in 2005 until the end of December 2024, the trust’s NAV total return has compounded at 8.9% per year.

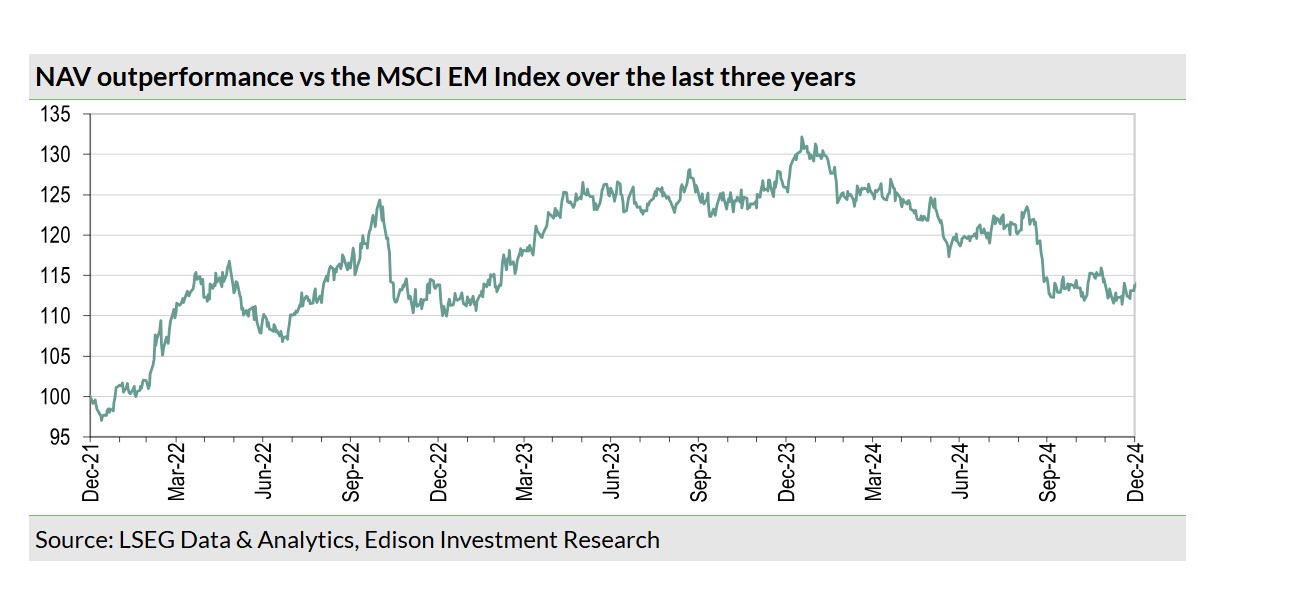

NAV outperformance Vs. the MSCI EM Index over the last three years

|

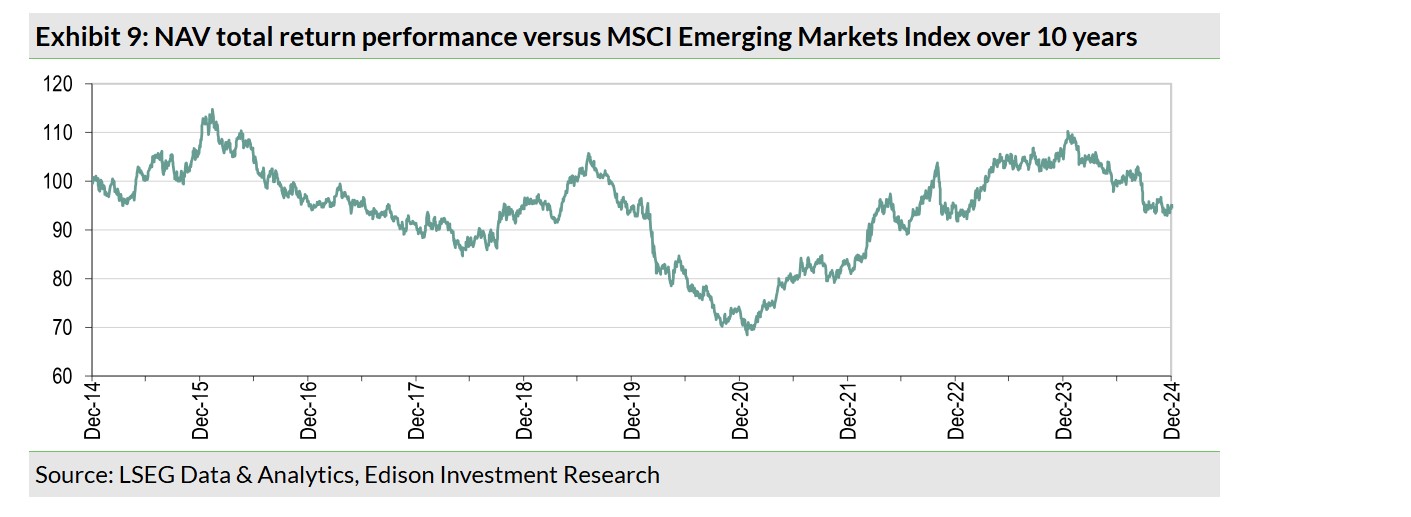

Why consider UEM?Although the MSCI Emerging Markets Index is used as a reference, its composition is very different from UEM’s unique collection of high-quality emerging market infrastructure and utility assets. The trust’s largest country exposures are Brazil and China including Hong Kong, while its largest industry exposures are electricity and ports. The managers and their team are very experienced in their field and travel extensively to fully understand current and potential portfolio companies and the industries and countries in which they operate. Each of the trust’s holdings is classified under one of four megatrends that the managers have identified as a driver of emerging market growth: social infrastructure (infra), digital infra, energy growth & transition and global trade. UEM’s portfolio is fully invested, and the managers have a long-term horizon, allowing value to accrue over time, while not being distracted by short-term stock market noise. However, the fund is actively managed; positions are sold when there is a change in the investment thesis, maybe due to an unforeseen development in the regulatory environment or when a business becomes fully valued. UEM’s last announced quarterly dividend of 2.325p per share was a step up from the prior eight quarters of 2.15p per share and the annual distribution is fully covered. In line with other investment companies, in an environment of above-average risk aversion, UEM’s discount is wider than its three-, five- and 10-year historical averages. Coupled with its defensive portfolio (beta of c 0.8) and 4%+ dividend yield, it now looks like an interesting opportunity for both new and existing shareholders. When sentiment shifts, there is scope for UEM to trade on a much narrower discount. UEM: Outperformance from emerging market specialistUEM is a unique fund, specialising in emerging markets infrastructure and utility companies, most of which are asset backed and more than 95% are operational. Due to the nature of the assets held, the portfolio has a low beta (c 0.8). More than 80% of the trust’s portfolio companies pay dividends, which supports UEM’s progressive dividend policy. The trust has a long-term record of outperformance. Since inception in July 2005 until 31 December 2024, UEM’s +8.9% annual NAV (+424.3% absolute) total return was meaningfully ahead of the MSCI Emerging Markets Index’s +7.4% annual (+304.2% absolute) total return. On 2 January 2025, UEM’s board announced the appointment of Jacqueline Broers as joint portfolio manager alongside Jillings with immediate effect. Broers has been involved with the management of UEM since joining specialist asset manager ICM in 2010 and was appointed as the trust’s deputy portfolio manager in 2021. The case for emerging marketsJillings and Broers are very positive on the long-term prospects for emerging markets based on structural growth drivers, global infra megatrends and attractive valuations. Structural growth drivers in emerging markets include: positive demographics as young and growing populations move up the education curve; ongoing urbanisation leading to increased demand for infrastructure assets; a rising middle class with increasing levels of disposable income; and strong GDP growth, which is supported by government investment in infrastructure projects. The four global growth megatrends on which the managers and their team focus are: social infra, which includes social infrastructure such as sanitation, water supply and transportation networks; energy growth & transition such as investment in energy infrastructure including wind, solar and hydroelectric, which is required to support economic growth and increase energy security; digital infra as digital connectivity investment is occurring very rapidly and hence is driving strong demand for data centres; and global trade, where the shift in supply chains is expected to continue regardless of US President Trump’s trade policies. The managers believe that these four megatrends will be a huge tailwind for UEM’s portfolio for at least the next decade and beyond. Emerging market equities look inexpensive in both absolute and relative terms. On a cyclically adjusted P/E multiple basis, emerging markets are trading around 13x, which is in line with their long-term average, while the US S&P 500 is trading on 34x versus its c 27x long-term average. Highlights from H125 (ending 30 September 2024)

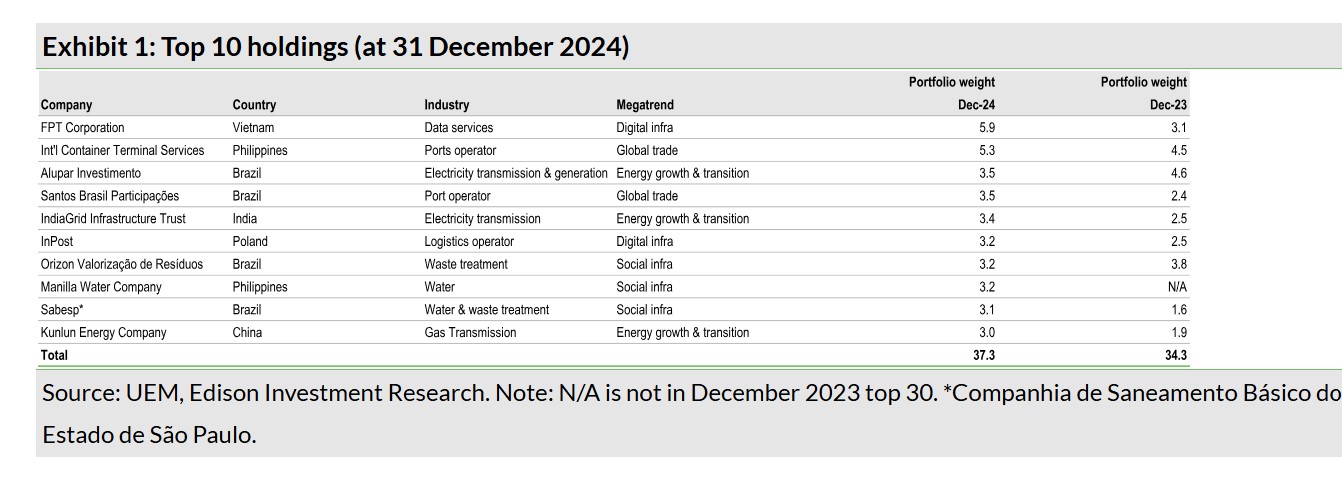

Performance: NAV and share price total returns of -1.4% and +0.1% respectively trailed the MSCI Emerging Markets Index’s +7.5% total return. With UEM’s largest exposure to Brazil, performance was negatively affected by the 13.4% depreciation of the Brazilian real versus sterling over the six-month period. There was also a negative revaluation of the holding in Petalite. Unlisted investments: during H125, the carrying value of Petalite was reduced by 58.1% to reflect a challenging electric vehicle market. In aggregate, UEM’s unlisted investments were 3.2% of the portfolio at 30 September 2024 versus 4.5% at 31 March 2024. Revenue and dividends: revenue per share was 6.54p versus 5.95p in H123, an increase of 9.9%. So far in respect of FY25, two fully covered dividends have been declared: 2.15p per share and a higher 2.325p per share, representing a 4.1% increase in the H1 year-on-year distribution. The board is anticipating that the higher rate will continue for the rest of FY25, which would equate to an increase of 6.1% in the total annual dividend. At the end of H125, UEM had revenue reserves of 7.64p per share, which is c 0.9x the last annual dividend payment. Share repurchases: with industry discounts remaining stubbornly high, the board has continued to buy back UEM’s shares. During H125, approximately 2.9m shares were repurchased, which added 0.3% to the trust’s NAV total return. The board: Chairman John Rennocks retired on 31 December 2024 and was replaced by former senior independent director Mark Bridgeman. Isabel Liu is now the senior independent director. On 1 September 2024, Nadya Wells joined the board as an independent non-executive director. She has more than 25 years of emerging markets investment experience, having spent 13 years with Capital Group as a portfolio manager and formerly as a portfolio manager at Invesco Asset Management investing in Eastern Europe. Portfolio breakdownUEM’s portfolio has around 70 holdings and its annual turnover is 25%. At the end of December 2024, UEM’s top 10 positions made up 37.3% of the portfolio, which was a higher concentration versus 34.3% a year earlier.

All four of the growth megatrends were represented in the trust’s largest holdings. Below we highlight the total fund breakdown at the end of December 2024, along with an example of a current portfolio holding:

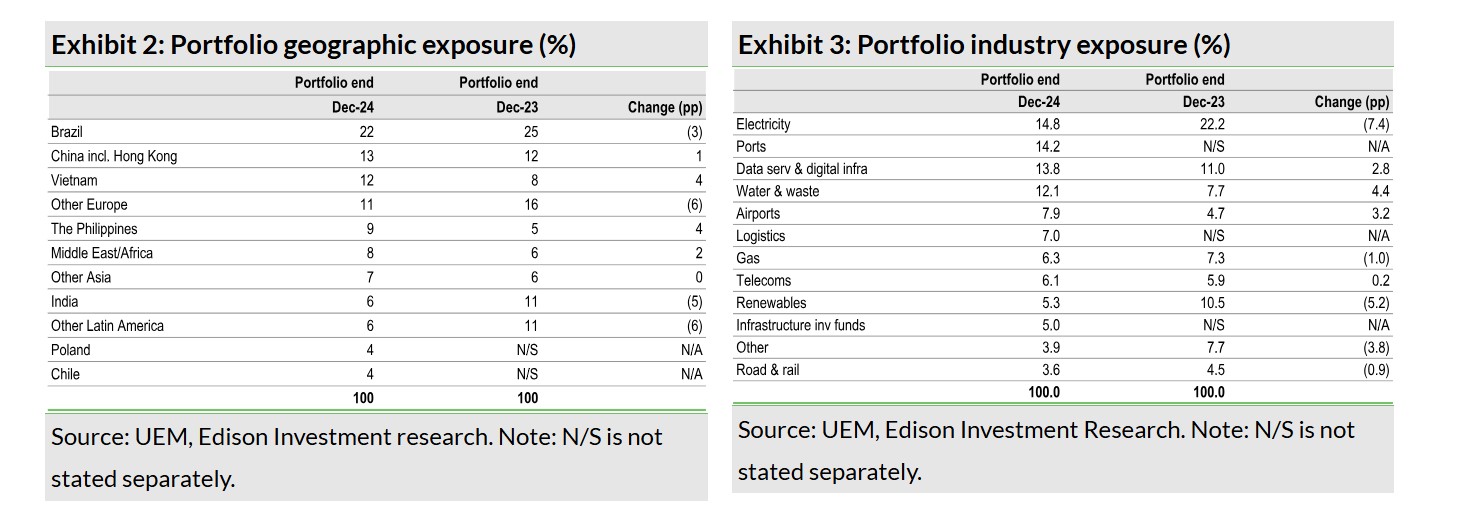

UEM’s portfolio breakdowns by geography and sector at the end of December 2024 are shown in Exhibits 2 and 3. It should be remembered that given the trust’s specialist mandate and active bottom-up stock selection, its exposures are very different to those in the MSCI Emerging Markets Index. For example, the trust has a relatively low exposure to China and a very high utility allocation. Jillings and Broers reiterate that one of the primary stock section criteria is stable, long-term cash flow generation. A year-on-year comparison is not straightforward because some elements are not stated separately. As an example in December 2023, ports and logistics were combined but now have individual classifications. Where numbers are comparable in the 12 months to the end of December 2024, there are notably lower weightings in electricity (-7.4pp) and renewables (-5.2pp) with a higher allocation to water & waste (+4.4pp).

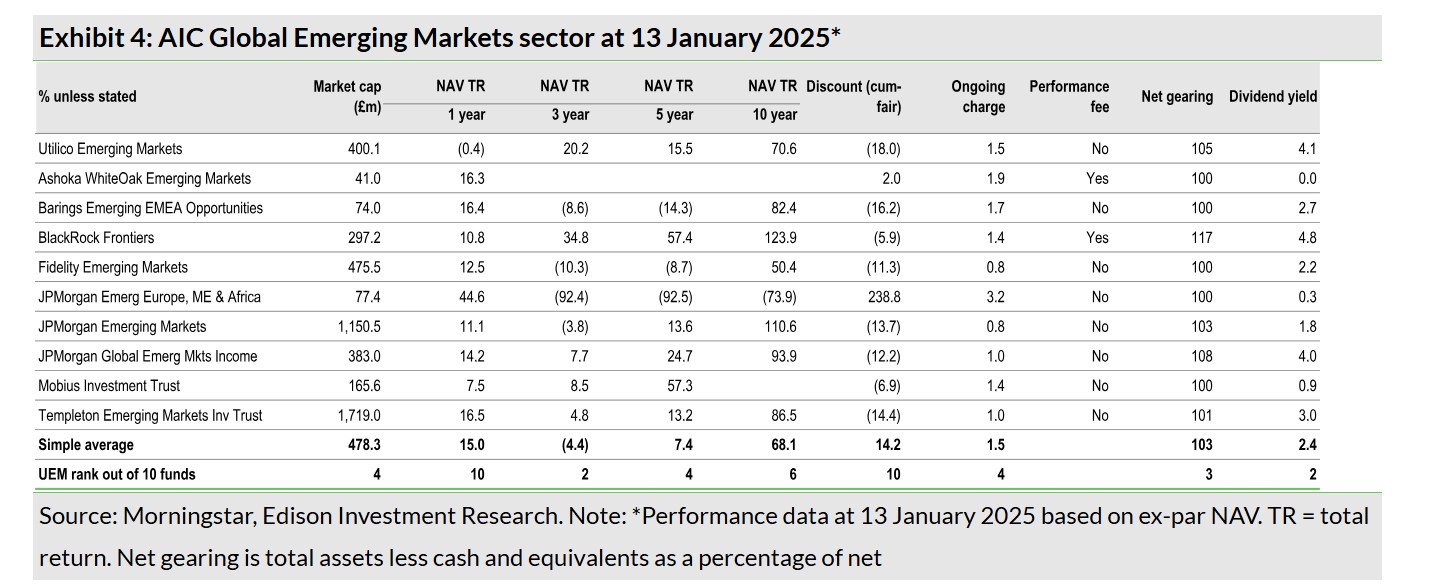

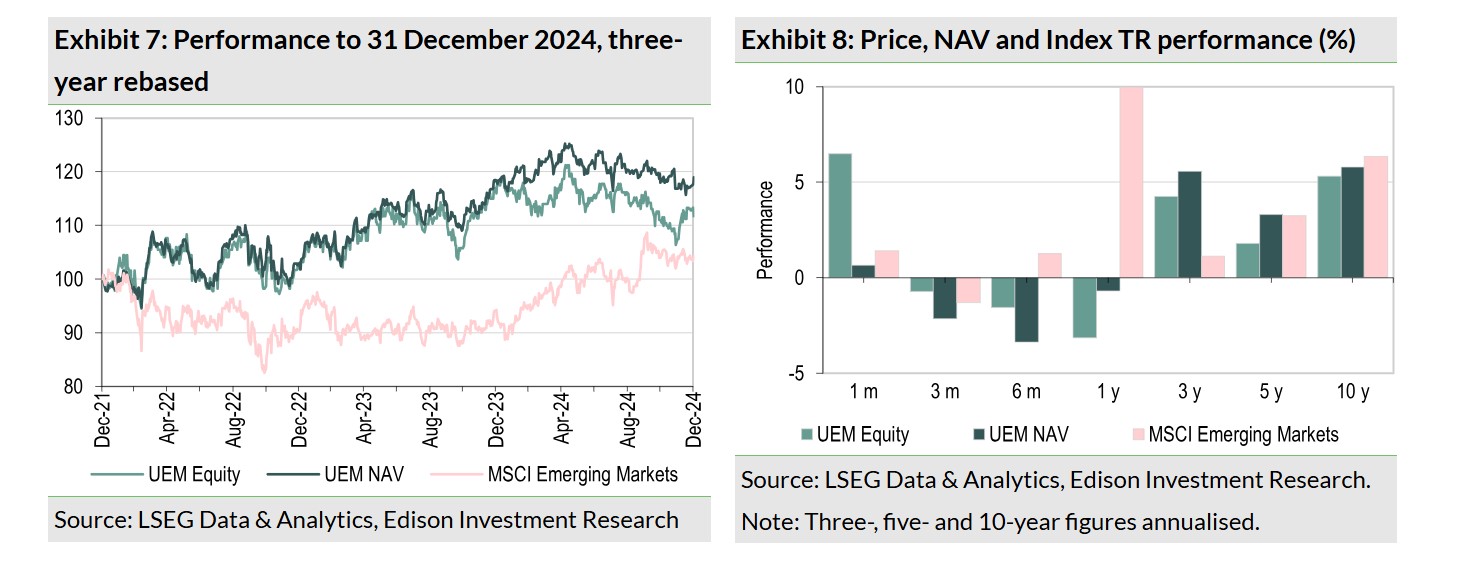

The managers highlight the resilience of UEM’s portfolio of essential infrastructure and utility assets. While inflation has been challenging in recent years, utility contracts generally have price escalation clauses. Also, emerging market countries are used to dealing with inflation pressures, while their balance sheets are in better shape than they were in the past, helped by lower debt levels and borrowing in local currencies rather than incurring foreign exchange risk by borrowing in US dollars. Some of UEM’s investee companies operate monopolistic businesses, such as Brazilian railroad operator Rumo which, as the sole operator on some of its routes, is benefiting from pricing flexibility as well as volume growth. Jillings and Broers believe that emerging market corporates can continue to deliver strong earnings growth despite an uncertain macroeconomic environment, where issues include US President Trump’s trade policies, elevated geopolitical tensions and Chinese economic weakness. More importantly, the managers believe that UEM’s portfolio should not be unduly disrupted given investee companies’ robust cash flow generation and strong management teams that can generate above-average growth and returns. Performance: Ahead of the reference index over three yearsThere are 10 funds in the AIC Global Emerging Markets sector, which include those with generalist and those with a more specialised mandate, such as UEM. The trust’s NAV total returns are above average over the last three, five and 10 years, ranking second out of nine, fourth out of nine and six out of eight funds, respectively. UEM’s performance does not take the dilutive effect of its historical subscription shares before February 2018 into account. The trust currently has the widest discount, an ongoing charge that is in line with the mean and is one of five funds that is geared. UEM has an attractive dividend yield, ranking second and 1.7pp above the sector average.

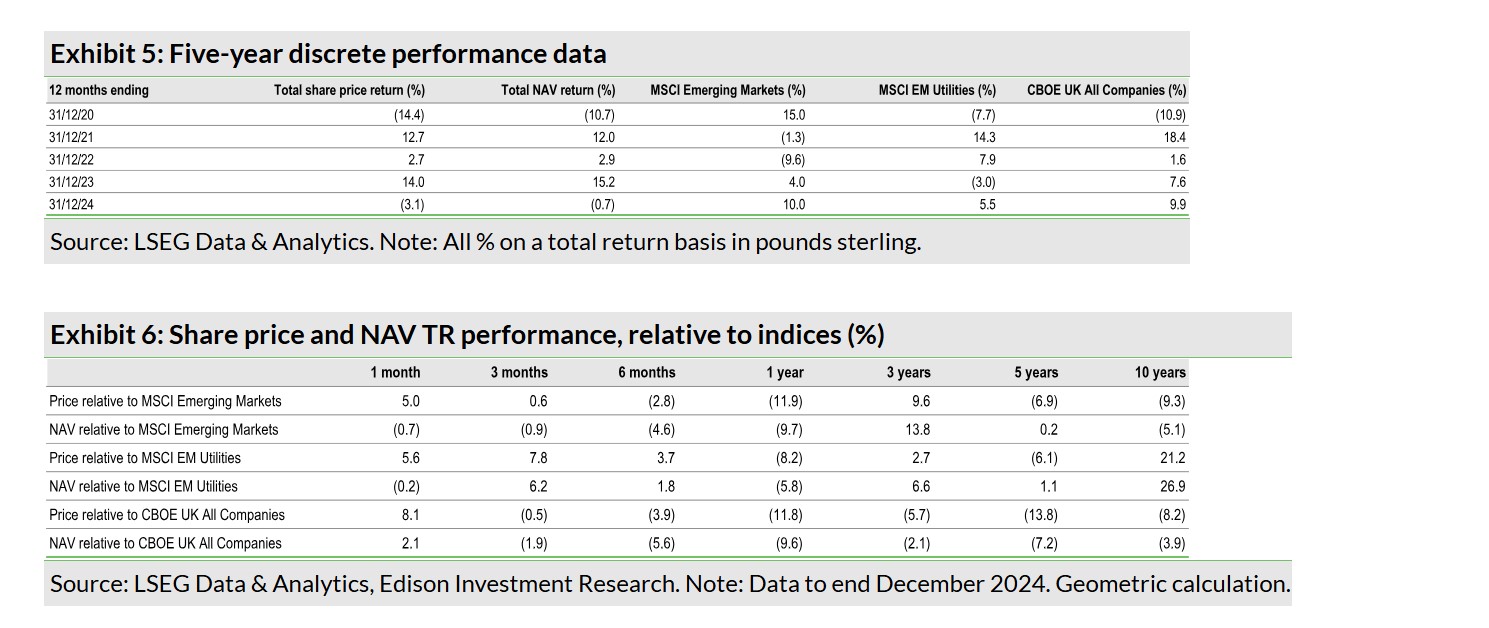

Exhibit 6 shows UEM’s relative performance. Its NAV is meaningfully ahead of the MSCI Emerging Markets reference index over the last three years, and modestly ahead over the last five years.

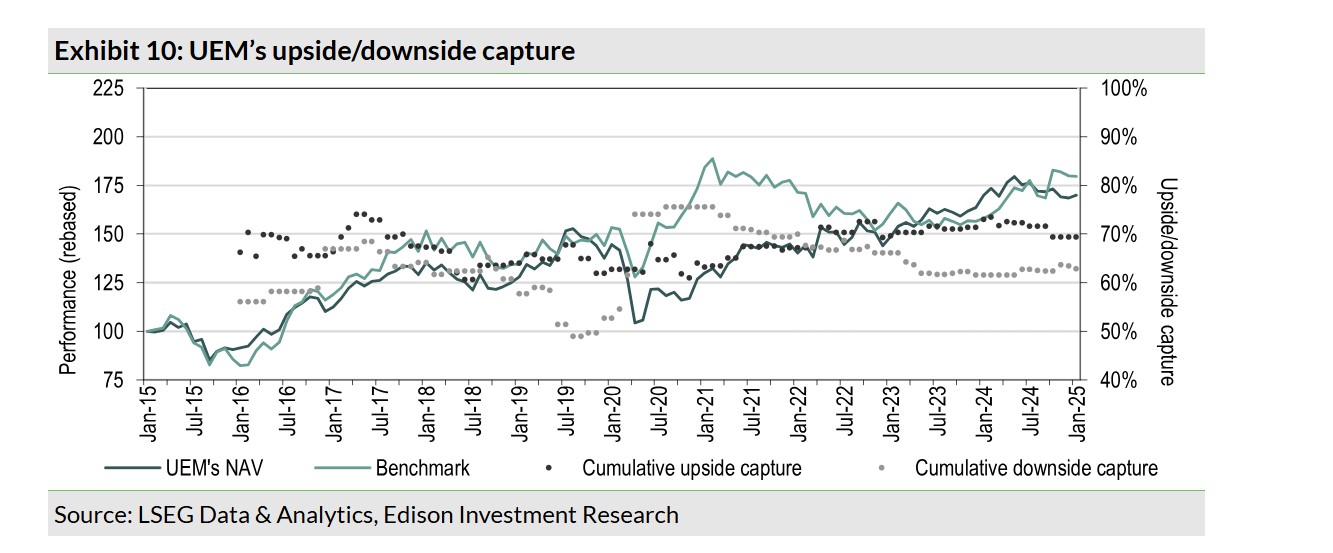

UEM’s upside/downside analysisUEM offers a specialised yet defensive exposure to emerging markets. In Exhibit 10, we show the trust’s upside/downside capture over the last decade. In months when emerging market stocks rose, on average, UEM captured 69% of the upside, whereas in months when emerging markets declined, the trust captured just 63% of the downside.

|