- Another BOJ meeting is behind us with markets perceiving the central bank's tone as dovish.

- Meanwhile, the USD/JPY pair has seen a sharp selloff near 160, indicating possible BOJ intervention.

- Eyes are on the Fed for a possible hawkish surprise, possibly strengthening the US dollar and weakening the yen further.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

The forex market started the week in a relatively calm fashion, except for significant volatility in Japanese yen currency pairs.

This escalation began last week after the Bank of Japan meeting failed to deliver any concrete statements on potential monetary tightening, despite their earlier landmark interest rate hike.

The market interpreted the meeting's tone as dovish, leading to a sharp sell-off of the yen, pushing the USD/JPY pair towards the 160 level. This could have triggered a suspected intervention from the Central Bank to halt the yen's depreciation, prompting the Yen to bounce off the all-important support.

Looking ahead for this week, key events include US labor market data and the Federal Reserve meeting. While a change in interest rates is unlikely, a clear hawkish stance from the Fed could further strengthen the USD/JPY pair.

BOJ's Dovish Stance Fuels Yen Weakness

The recent yen weakness stems primarily from the market's renewed expectations that the BOJ will remain dovish and refrain from further monetary tightening.

The Bank's latest communique not only lacked specifics on future rate hikes but also included Governor Kazuo Ueda's statement downplaying the impact of a weak yen on core inflation.

Additionally, the BOJ emphasized that its policy doesn't directly target the exchange rate.

This combination of factors triggered a surge in the USD/JPY pair, which only slowed down near the 160 level, the highest since the early 1990s.

While the sharp decline suggests potential Central Bank intervention in the forex market, no official confirmation exists.

However, if the significant policy divergence between the BOJ and the US Fed persists, such interventions may only provide temporary relief.

Focus Shifts to US Labor Market and Fed Meeting

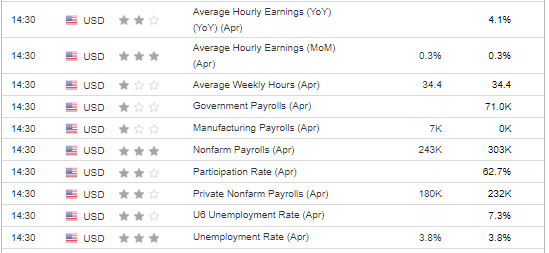

Despite the low probability of a significant Fed policy shift (though hawkish surprises are always possible), this week's focus may shift to US labor market data, with the following key forecasts:

While forecasts suggest continued strength, strong data without negative surprises would likely favor the US dollar. Revisions to previous months' data, which often impact market perception, will also be crucial.

USD/JPY: 160 Remains Key Resistance

The recent sharp correction in the USD/JPY pair near 160 yen suggests potential central bank intervention. If sellers push the price lower, the key support level lies around 152 yen, previously a broken resistance point.

However, if the BOJ's stance widens the disparity between Japanese and US monetary policy, it will likely push the USD/JPY pair back above 160 yen in the long run.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $10 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.