While it will likely be a relatively quieter week so far as macro data is concerned, North American markets re-open today after a long weekend, and with China also back this week, markets should turn a bit livelier after a quiet period.

In the FX space, the USD/CAD will be among the busier of major currency pairs, as we will have Canadian CPI, the FOMC’s last meeting minutes, and global PMI data, all to come this week.

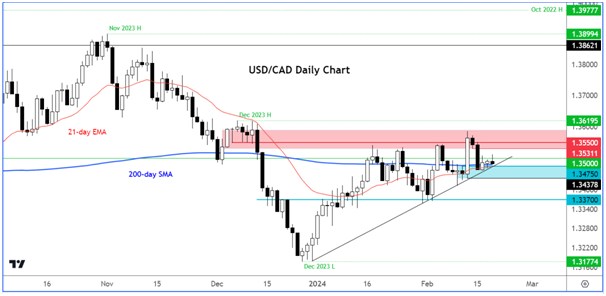

The USD/CAD was steady after holding above a key support area around 1.3450 to 1.3475 on Monday, ahead of these macro events.

Will we see a breakout or a breakdown this week?

Will the CAD Succumb to USD’s Bullish Trend?

The USD/CAD has been edging higher since the turn of the year, thanks to a strong performance from the US dollar. But the ongoing rally in equity markets has kept the USD/CAD’s upside limited, with the risk-sensitive Canadian dollar also rising against some of the weaker currencies.

Inflation in the US has remained hotter than expected, which has discouraged the USD bears from showing up aggressively, although the Dollar Index (DXY) did close lower in the last three days of last week and has started this week on the back-foot. Still, the DXY has been finding support on any short-term dips so far in 2024 and will be looking to extend those gains unless something changes fundamentally.

Following a hot CPI print of 3.1% y/y or +0.3% month-on-month as was reported last Tuesday, PPI was equally strong on Friday, printing +0.3% m/m against expectations of 0.1%, while core PPI rose 0.5% on the month, easily beating expectations of 0.1%.

The PPI gains were fuelled by a sharp rise in costs of services, highlighting concerns about the sticky nature of inflation. We also saw an uptick in the UoM consumer sentiment and inflation expectations survey, with the latter rising to 3% from 2.9%. The market was therefore once again reminded that the Federal Reserve will be in no rush to cut interest rates. Yet the USD/CAD failed to find any significant support on the day.

But as the dollar continues to find macro reasons to push higher, this could see the USD/CAD exchange rate break higher, Canadian data permitting.

Canadian CPI, FOMC Minutes and global PMIs All Coming Up

The USD/CAD could move sharply this week depending on the outcome of incoming data. Up first on the economic data calendar is Canadian CPI data today. In December, Canada's annual inflation rose to 3.4% from 3.1%, meeting expectations. This aligns with the Bank of Canada's projection of sustained elevated inflation around 3.5% for a lengthy period, potentially keeping rate cuts off the table for a long time. The increase was driven by higher gasoline costs, leading to rebounds in transportation and shelter prices, including rents and mortgage rates. Passenger vehicle prices also rose. With US inflation falling less than expected, will we also see a positive surprise for Canada’s CPI? Well, it is expected to have eased to 3.2% from 3.4%

On Wednesday, we will have the FOMC’s last meeting minutes that took place in January, when the Fed kept rates steady at 5.25%-5.5%. Powell and his FOMC colleagues emphasized a reluctance to lower rates until confident about reaching 2% inflation sustainably. The Fed chair hinted at possible rate reductions later in the year but expressed skepticism about a March cut. The Fed omitted further rate hike references, noting improved risk balance but remained prepared to adjust policy if necessary due to persistently high inflation. Let’s see if the meeting minutes will convey any notable surprises that we don’t already know about. If so, this could move the USD/CAD in the direction of the surprise.

This week’s other important macro highlight includes Thursday’s release of global manufacturing and services PMIs. Among them will be those from the US, which should impact the dollar in the direction of the surprise.

USD/CAD Analysis: Technical Levels to Watch

Source: TradingView.com

The USD/CAD has been able to hold its own above the bullish trend line, which is keeping the bears at bay for now. The trend line converges with the point of origin of last Tuesday’s rally and 200-day moving average, all around the key 1.3450 to 1.3475 area.

So, in terms of support and resistance levels to watch, the 1.3450 to 1.3475 area is key on the downside. It is therefore possible that dip-buyers might step in here to defend their ground. If we see evidence of buying pressure here, then the next upside target would be around 1.3530 to 1.3550. Above here, the next target would be the December high at 1.3620.

However, if the sellers manage to push rates lower and break the abovementioned support area between 1.3450 to 1.3475 decisively, then this could give rise to further follow-up technical selling towards 1.3370, and possibly lower over time.

Conservative bearish traders may therefore wish to wait for the potential break of the trend line before looking for bearish setups. Otherwise, the bulls will feel happy to look for dip-buying opportunities until the charts tell us otherwise.

Read my articles at City Index

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.