The US dollar rose against all the major and emerging market currencies over the past week, save the Russian ruble, which gained about 1.5%. Comments from several Fed officials, and most notably Yellen, drove home the message which arguably was diluted after the FOMC meeting: A rate hike this year is still the most likely scenario. This helped bolster the greenback.

On the other hand, ECB officials, including Draghi, underscored that the ECB is not yet ready to expand, extend, or alter the composition of its asset purchase scheme. And despite the core CPI in Japan falling back into deflation territory, the BOJ's Kuroda does not appear to be on the verge of increasing its aggressive asset purchase plan, though many expect him to do so at the end of next month.

The euro lost about 1% against the dollar last week and returned to the lower end of this month's range after setting the high the day after the FOMC meeting. The lower end of the range is found in the $1.1080-$1.1100 area. The technical indicators are soft, and the five-day average has slipped back below the 20-day average. Yet there is not strong momentum, and it looks like continued range-trading. Initially, the $1.1300-$1.1330 area may contain upticks.

The dollar has spent the month coiling in a triangle pattern against the yen. Ahead of the weekend, with Yellen's help, and rising stocks and US bond yields, the dollar broke higher. The JPY121.25 high was the greenbacks best since September 10. It is not uncommon to see false breaks from triangle patterns. The close was just below the top of the pattern. A convincing upside break would suggest a measuring objective near JPY122.50. The technical indicators are supportive, but between the Tankan and US jobs figures, there are plenty of potential fundamental drivers.

Sterling is a dog. It lost more than 2% against the US dollar over the past week. It has fallen five cents since the post-FOMC high near $1.5660. Before the weekend, sterling traded near $1.5150, which represents its lowest level since early May. The technical indicators are soft, and the five-day moving average has broken below the 20-day average. It spends the second half of last week below the 200-day moving average (~$1.5340). Additional support is seen near $1.5080, with the $1.50 area of greater psychological significance. Sterling is very streaky lately. Recall it had a nine-day losing streak in late-August into September. It then rallied but now has a new six-session losing streak.

The Australian dollar lost 2.5% against the US dollar last week. It was weighed down by the poor Caixin preliminary flash manufacturing PMI for China. Also, rate cut speculation is picking up again. After peaking post-Fed near $0.7280, the Aussie slumped to about $0.6940 on September 24 but reversed strongly and closed back above $0.7000. Follow-through buying before the weekend was limited, which suggests the downside pressure has not been alleviated. Stochastics and MACDs are still pointing lower, and the five-day moving average crossed below the 20-day at the end of last week. Nevertheless, we suspect the risk is to the upside ahead of US jobs data, with potential toward $0.7100-$0.7125.

The New Zealand dollar has been trading broadly sideways in its trough through September. It closed firmly ahead of the weekend, at its best level since September 9. Near-term potential extends toward $0.6450.

The US dollar recorded new multi-year highs against the Canadian dollar on September 24 just below CAD1.3420. The five-day moving average crossed back above the 20-day average. The technical indicators do not suggest the move is exhausted. A break of CAD1.3260 would signal a corrective phase. In the bigger picture, the next key technical objective is found near CAD1.40.

The November crude oil futures contract was little changed last week. The broad consolidation that has characterized this month’s activity has carved out a descending triangle. The down sloping line connecting the highs comes in $47.00-$46.30 over the course of next week. The horizontal line that marks the lower part of the triangle is found around $43.30. This is a bearish pattern, and a downside break should be respected.

US 10-Year Treasury yields largely moved sideways here in September. With just a one day exception (September 24), the yield has stayed above 2.10%. On the top side, the yield poked through 2.25% for three days in the middle of the month. Technical indicators are not generating strong signals, which warns of continued consolidation.

The S&P 500 reversed lower on September 17 after reaching a high of 2020. Follow through selling this past week took the index down to 1909, off which a hammer candlestick pattern was recorded on September 24. Buying before the weekend lifted the S&P 500 to almost 1953, which was just beyond the 38.2% retracement objective and just shy of the 20-day moving average (1956), but the close was poor and a retest on the 1900 area looks likely. A break would signal a return to the late August lows around 1865-1870.

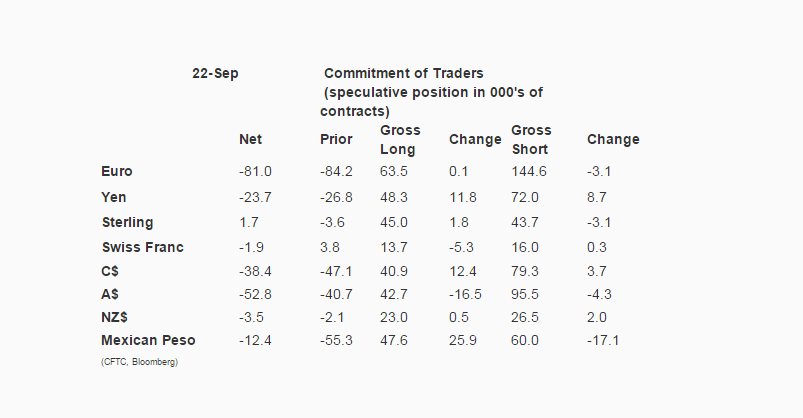

Observations from the speculative positioning in the futures market:

1. The first bucket we look at consists of the euro, Swiss franc, and sterling. These currencies saw only minor gross position adjustments. The 5.3k cut in gross long franc positions was the only gross position adjustment of more than 3.2k contracts. However, the minor adjustments were sufficient to swing the net sterling position long for the first time since the last week in August. After spending one-week net long, speculators swung back to hold a small net short position in francs.

2. The second bucket is the yen. Both bulls and bears were active. The gross long position rose 11.8k contracts to 48.3k. The gross short position grew by 8.7k contracts to 72/0.

3. The third bucket is the dollar bloc. There were two substantial (10k contracts or more) gross position adjustments. The bulls are picking a bottom by increasing their gross long position by 124k contracts to 40.9k. The bears are not convinced, and added 3.7k contracts to their gross short position, raising it to 79.3k. The Aussie bulls chopped their gross long position by 16.5k contracts to 42.7k. The gross short position was trimmed by 4.3k contracts.

4. The fourth bucket is the Mexican peso. Speculators began turning around their net short position. The gross long position more than doubled by jumping 25.9k contracts to 47.6k. A little more than 17k short contracts were covered, leaving 60k. The net short position fell to 12.4k from 55.3k contracts.

5. The net short 10-year US Treasury position was reduced to 8.5k contracts from 39.5k. This was the result of new speculative longs being established (33.7k contracts). Gross shorts were increased by 2.8k contracts.

6. The net long speculative light sweet crude oil futures position rose by 20k contacts to 259.4k. This was largely the result of 16.7k gross short contracts being bought back. The gross long position rose by 3.4k contracts (to 229.8k)