Failure to hit the 121.50 caused a bearish wave yesterday that took the USD/JPY pair below 121.00 once again.

These bearish corrective movements contradict with stability above moving averages.

The correction has produced unclear signs on technical indicators and thus, we will be neutral over intraday basis, waiting for convenient signs to follow.

Support: 120.30-120.00–119.60.

Resistance: 121.05-121.50-121.80

Direction: Sideways

USD/CHF stabilizes above 61.8% along with consecutive bullish tendencies, as seen on the provided daily chart.

Currently, a re-test process is seen for the broken resistance line and we aim to see the USD/CHF pair reaching 0.9880.

A break above 0.9880 will open the door up towards 1.0000 psychological this time.

Technical indicators remain positive and that’s why we will be bullish.

Support: 0.9680-0.9650- 0.9630

Resistance: 0.9760-0.9780-0.9805

Direction: Bullish

Euro has moved slightly upwards, but the bullish tendencies remain weak to relieve momentum indicator. Trading below 1.1105 keeps the bearishness available and coming below 1.1050 again will confirm.

Anyway, we remain bearish based on the negativity on moving averages.

Support: 1.1050 – 1.0995 – 1.0910

Resistance: 1.1105 –1.1145 – 1.1190

Direction: Bearish

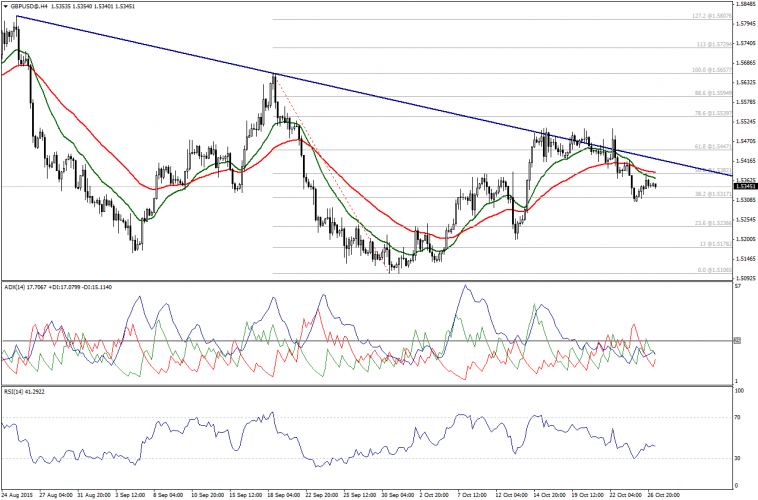

Stability below moving averages continues to add bearish pressure on GBP/USD.

Trading below 1.5385 keeps the bearishness valid over intraday basis and a break below 1.5315 will affirm and will extend the downside wave.

Support: 1.5315 – 1.5275 – 1.5235

Resistance: 1.5380 – 1.5400 – 1.5445

Direction: Bearish