It will be a holiday-shortened trading week, with Monday being a half day, while the market will be closed on Tuesday. This will be a hectic week with a lot of data. Starting Monday with the ISM data for June and finishing the week with the Jobs report.

Barring a disaster from this data point, I think the Fed will raise rates again in July. Fed Fund Futures are pricing an 81% chance of a July hike, and the United States 2-year rate has broken out and moved beyond some key resistance levels.

Many people believe the market no longer cares about the Fed or rate hikes, which I’m afraid I have to disagree with. The equity market has not responded more negatively to Fed rate hikes because the bond yields have been relatively range bound, with the 10-year trading between roughly 3.3% to 4%.

This is because the bond market thought that the bank problem would cause a Fed pivot and rate-cutting cycle, but so far, that turned out to be wrong. Now rates are on the verge of correcting for that mistake and moving higher.

What causes the equity market to respond is not always the actual rate but the rate of change. In this case, a move higher on the 10-Year beyond 4% would likely get the equity market's attention and cause the equity market to respond.

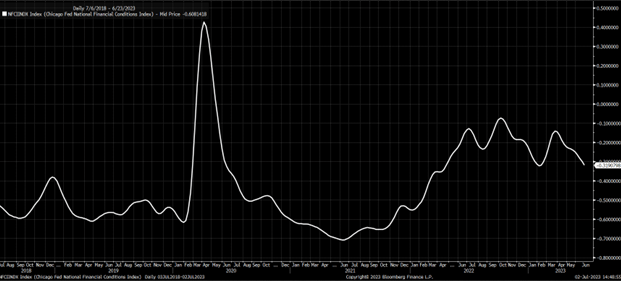

But with rates range bound, spreads have narrowed, implied volatility has fallen, and the dollar has been stuck, which has allowed financial conditions to ease and the equity market to rise. But again, I think this is ending because, as I have been talking about for some time, the economy remains more robust than expected, and inflation is stickier than expected. This means rates on the curve’s long end are probably way too low.

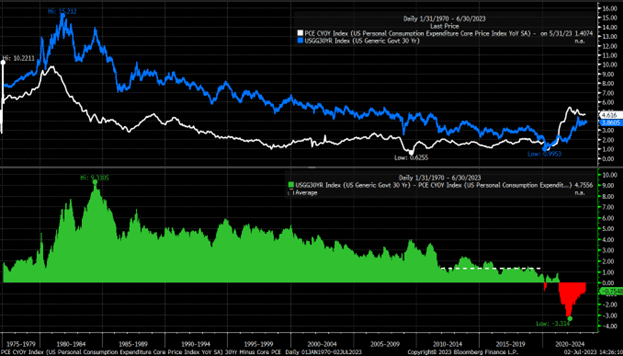

This period has been the first time since 1975 that the 30-year rate has traded below core PCE, and that tells you almost how much rates need to rise from here, given the more robust economy, which is probably another 75 to 100 bps.

The 30-year appears to have a cup-and-handle pattern present, and I think that is a bullish setup for the 30-year rate to move back to its October highs and possibly well beyond those October highs.

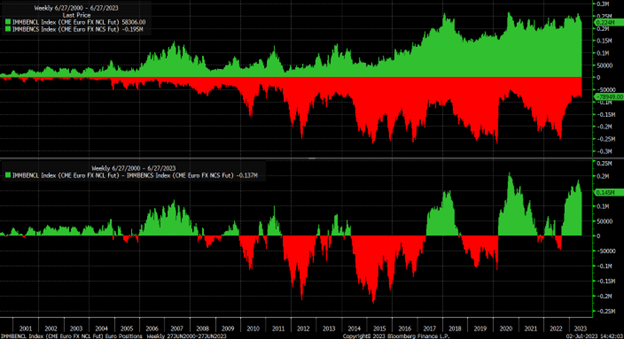

If the data continues to support a strong US economy and rates go higher, the dollar could see a sharp rise, especially against the euro. Positioning for non-commercials is very net long, and overall, the euro futures contracts, and if the dollar starts to strengthen, those long positions would need to unwind.

The euro appears to be forming head and shoulders, and if the euro drops below 1.05, then the dollar could see a significant move higher and the euro back to parity.

Why Do Rates and U.S. Dollar Matter?

If the period of rate and dollar stagnation is coming to an end, then the period of easing financial conditions is coming to an end, and so too is implied volatility declines, and the equities market rise. On top of this, we see liquidity leaving the system as the Treasury general account is refilled and reserve balances have dropped to around $3 trillion.

If the S&P 500 were to stop at its current level, it wouldn’t be surprising, and it would be easy to explain as it would be a 100% extension off of the closing low on October 12, the February 2 high, and March 13 low. It also hits a trend line off the October 13 intraday lows.

Again, where stocks go from here will be determined by where rates and the dollar go. It will be a significant headwind if they rise above their prevailing range since mid-October and financial conditions begin to tighten again. Also, notice that the index made a new high on Friday, but the RSI did not; that is the first sign of a potential bearish divergence.

The Nasdaq 100 did not make a new high on Friday and stayed below the June 16 highs and the 1.618% extension.

Also, notice that the Biotech sector has been left out of this rally entirely, which I think is odd because if rates truly didn’t matter, then the S&P Biotech ETF (NYSE:XBI), I would think, wouldn’t be performing much better than it has.

This week’s stories for subscribers of Reading The Markets: