- The US dollar demonstrated strength at the beginning of the year as it surged to reach the 103 level.

- This surge was propelled by positive US economic data, hawkish signals from the Fed, and an uptick in US Treasury yields.

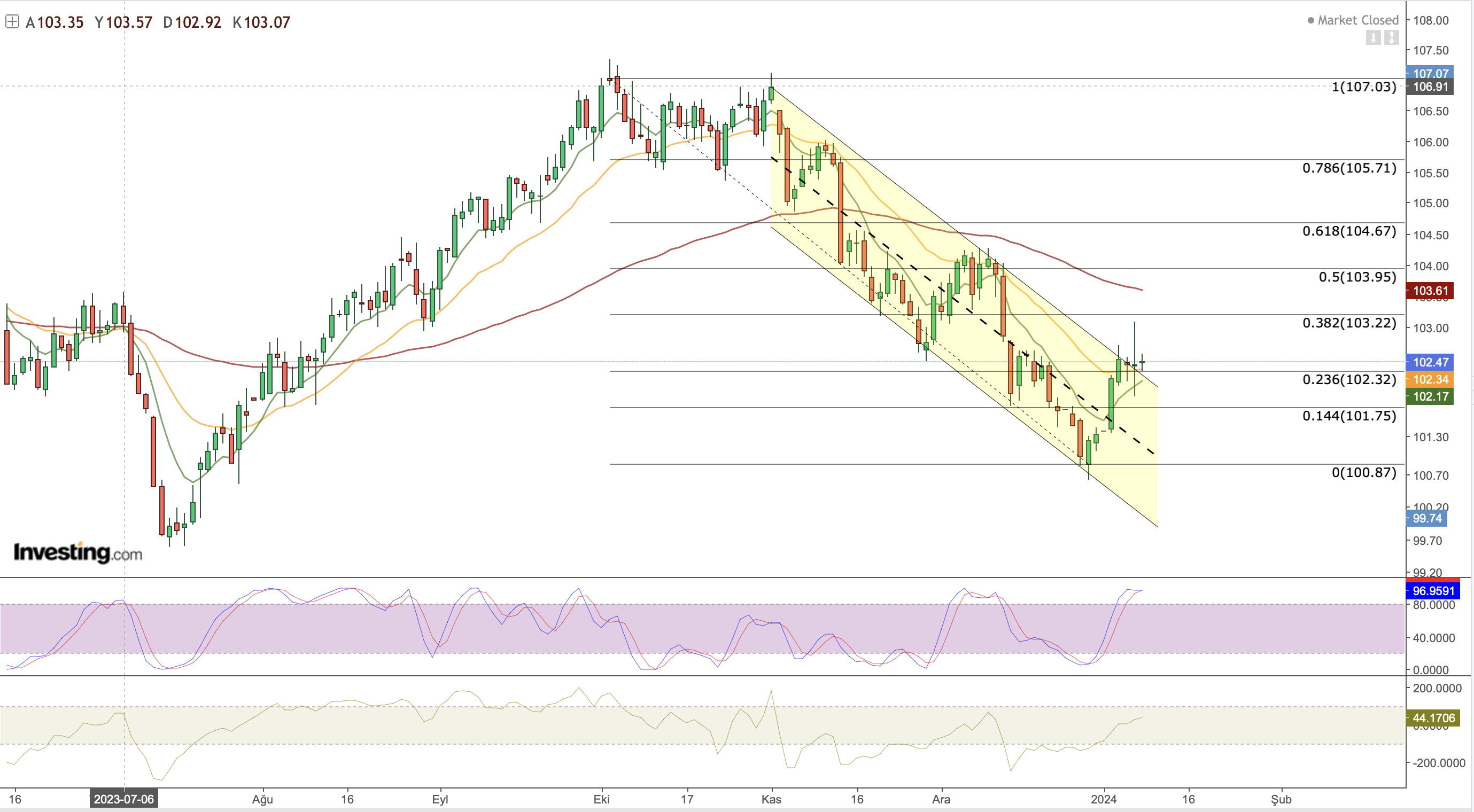

- There is potential support at 102.3 and resistance at 103.2 - 103.6, making the upcoming US CPI release a decisive factor for market direction.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

The new year witnessed a robust performance by the US dollar, as evidenced by the Dollar Index's 1% gain, reaching the 103 level tested the previous week.

This surge stands out as a strong signal of recovery from the downward trend that began in late October, with support stemming from the latest US economic data.

The Federal Reserve's indication of a prolonged period of higher interest rates this year, coupled with hawkish rhetoric from the Fed, contributed to the dollar's rise against six major currencies.

Furthermore, the uptick in US Treasury yields played a pivotal role in bolstering the greenback's position.

This week, inflation data, which is closely monitored by the Fed, will be in focus. While the markets remained calm before the US CPI report, the dollar started the week by maintaining its positive outlook.

According to the Employment data and unemployment rate, it was seen that there was more employment than expected in December, while the increase in wages also stood out.

The data thus made the inflation data to be announced on Thursday more important. Another detail about the US economy was the results of the US non-manufacturing PMI that revealed that the service sector slowed down considerably in the last month of 2023 and employment declined to the level of 3.5 years ago.

While these survey results and the published employment data contrasted, dollar index remained stable at 102.4 after some volatility on the same day.

Despite the increase in US employment, the relative slowdown in the US labor market also strengthened the views that there may be a loosening in the labor market in the coming months.

Against this mixed backdrop, the Fed will be looking for confirmation that inflation remains within its 2% target. This makes Thursday's CPI release all the more important for the market trend direction.

However, the market has lowered its expectation that the Fed will cut interest in March to 64%.

Considering that the probability was 90% in the last week of 2023, it can be said that the risk appetite in the market has decreased in direct proportion.

This expectation also emerges as important data explaining the increase in demand for the dollar.

US Dollar: Technical View

Technically speaking, the DXY broke the falling channel originating from October to the upside as of last week's close. However, there are technically critical levels ahead for the DXY to continue its recovery momentum.

First of all, we can focus on the 102.3 - 102.5 level, which is not yet off the radar.

During last week, the DXY struggled to exceed the Fib 0.236 value according to the Fibonacci measure calculated based on the last downward momentum. This week, there is a view that this area around 102.3 has turned into support.

A test of this region may be seen throughout the week. The position of the Stochastic RSI on the daily chart can also be closely monitored for possible pullbacks.

If the indicator sags below 80, it will indicate that the selling pressure on the dollar is increasing and may signal that the retreat may move toward the 101 level.

If the DXY continues its upward movement, the 103.2 - 103.6 level will become important for the continuation of the trend.

It is also possible that this region will be tested this week, and the fact that the short-term EMA values have turned upwards again and are about to produce a possible positive crossover signal supports this movement.

However, if the inflation data meets expectations, there may be relief in the market and the dollar may ease from the nearest resistance level of the index.

If the CPI comes in above expectations, it will be interpreted as a pressure factor on the Fed on interest rates, and this time we can see that the DXY can move quickly towards 104.6 - 105.7.

As a result, the US CPI data to be announced this week is likely to be decisive on the new direction of the dollar, which currently maintains its positive outlook.

Considering that the DXY will maintain its positive outlook as long as it remains above the average support of 102.3, it can be said that risky markets may also move bearishly as long as the index remains above this level.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Want to start using InvestingPro? Here is a small gift from us! Enjoy an extra 10% discount on the 1 or 2 year plans. Hurry up not to miss the New Year’s sale! You can save almost 60%!

Follow this link for the 1-year plan with your personal discount, or click here for the full 2-year plan with 60% off!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.